Today is Friday, March 8, 2024.

The Early Bird Index today is 73.44.

New to this newsletter? Sign up here

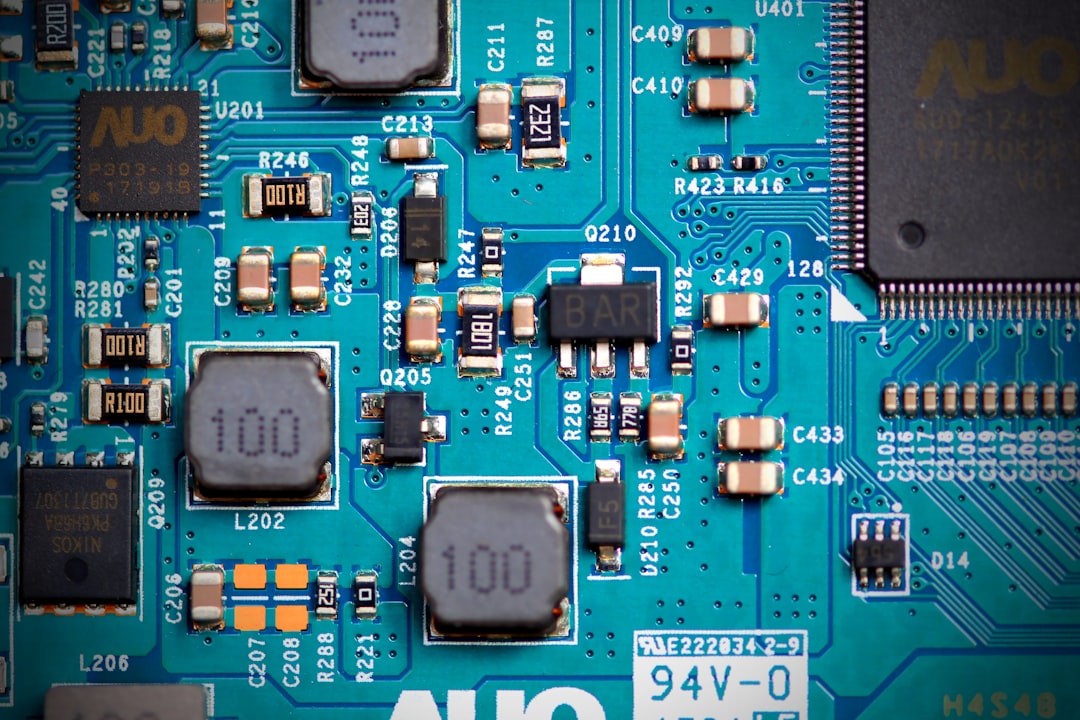

Broadcom's AI Boom Slips

Expectations were simply too high for Broadcom (Nasdaq: AVGO), which reported financial results on Thursday and slipped by 3.27% in after-hours trading.

Financials: Broadcom reported earnings of $10.99 per share in the past quarter and revenue of $11.96 billion; both were better than expected.

Powering the Story: While the company said it was “pleased” with the results, investors wanted more. Broadcom expects revenue of $50 billion in the fiscal year, but the reaction from investors was lukewarm at best.

Stock Price: Broadcom is up 122% in the past year thanks to its artificial intelligence chips business booming.

Final Thoughts: The outlook from Broadcom did not satisfy investors. Even though Broadcom’s AI business surged, the company’s exposure to other parts of the market was not as strong.

Sponsored

Ticker Tea

Delivering daily updates on the news that matters: financial markets.

Notables

Notable Earnings Today: Algonquin Power & Utilities (NYSE: AQN), America's Car-Mart (Nasdaq: CRMT), Genesco (NYSE: GCO), Bio-Path Holdings (Nasdaq: BPTH).

Notable IPOs Today: N/A.

Notable Equity Crowdfunding Campaigns Ending Today: Staymenity (Netcapital), Sholder (Wefunder), Japa Health (Netcapital), Fierce & Kind (Netcapital), Chef Red's Catering (Honeycomb), Hank's - Garage and Grill (Mainvest).

Notable Economic Events Today: Unemployment Rate (8:30 a.m. ET), Nonfarm Payrolls (8:30 a.m. ET), Average Hourly Earnings (8:30 a.m. ET), Private Nonfarm Payrolls (8:30 a.m. ET), Labor Force Participation Rate (8:30 a.m. ET), WASDE Report (12:00 p.m. ET).

Marvell Forecasts Soft Demand

Semiconductor company Marvell Technology (Nasdaq: MRVL) fell by 7.74% in after-hours trading on Thursday after reporting mixed financial results.

Financials: Marvell reported earnings of 46 cents per share in the past quarter, which was in line. Revenue reached $1.42 billion, which was better than expected.

Details: The company issued a $3 billion stock buyback on Thursday to help drive the stock price up.

Powering: Marvell’s problem is the outlook. CEO Matt Murphy said that the company is “forecasting soft demand impacting consumer, carrier infrastructure, and enterprise networking in the near term.” The company only expects sales to be $1.15 billion in the current quarter.

Stock Price: Similar to Broadcom, Marvell is up 97% in the last year due to the AI boom.

Final Thoughts: Another AI-related stock could not live up to the expectations. Lower enterprise demand dragged the outlook for the quarter down.

Costco’s Disappointing Holiday Sales

A mixed financial report sent shares of Costco (Nasdaq: COST) down by 4.06% in after-hours trading on Thursday.

Financials: Costco reported earnings of $3.71 per share in the past quarter, which was better than expected. But revenue came in at $58.44 billion; which was lower than expected.

Powering the Story: While Costco’s e-commerce business grew revenue by 18.4% in the past quarter (which was the holiday shopping season), overall company sales still fell short.

Final Thoughts: Costco is up 61% in the last year. It is concerning that overall sales during the holidays lagged. It is a setback, but growth in the digital business is promising.

Trends to Watch

Happy Holidays: Gap shares pop as company’s holiday earnings blow past estimates, Old Navy returns to growth (CNBC)

Grooming for an IPO: Razor maker Harry's files for IPO, sources say (Reuters)

Surging: Solana tops $150 amid Pantera Capital bid, surge in memecoin and DApp activity (Cointelegraph)

Tired of Aircraft Problems: United Airlines plane loses tire, lands safely at LAX after being diverted from San Francisco (CBS News)

Finally Making Investors Happy: Rivian surprise announces the R3 hatchback, and it’s cute as hell (TechCrunch)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents from Early Bird are for informational and entertainment purposes only and do not constitute financial or legal advice.