Together With

Today is Thursday, March 21, 2024.

The Early Bird Index today is 73.55.

New to this newsletter? Sign up here

PRESENTED BY AQUIPOR

Porous Concrete and The Green Street Revolution

Concrete production is responsible for 8% of global CO2 emissions, and while cities cover huge areas with it, rainwater flows over it, bypassing natural watersheds, creating stormwater deluges that push pollution and garbage into our lakes, rivers, and oceans.

But that could stop with AquiPor’s revolutionary new porous concrete. Using a fraction of the energy regular concrete uses to make, AquiPor’s concrete is porous, allowing water to pass through while filtering out the pollution and particulate matter on the surface, allowing for freshwater to return to the ground naturally and cities the ability to manage stormwater flooding and pollution.

What can you do? AquiPor launched an equity crowdfunding campaign for investors to take this technology to the world. You could join the cause for a greener and cleaner future for cities.

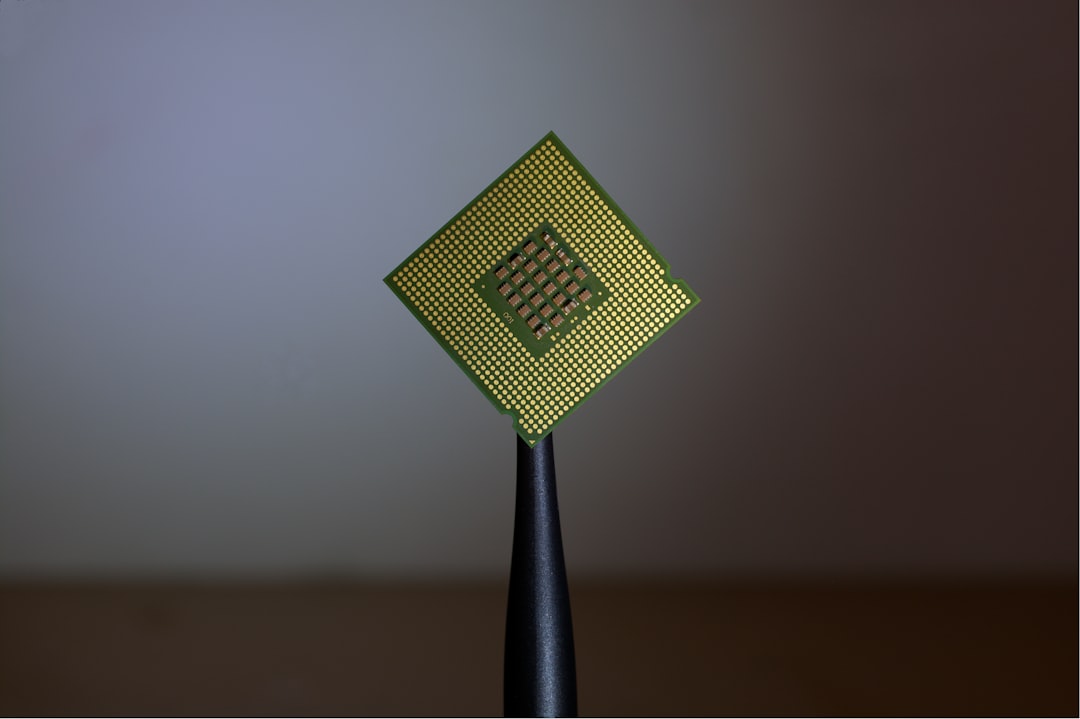

Micron’s Winning AI Strategy

Shares of Micron Technology (Nasdaq: MU) continued its impressive year with an 18.18% surge in after-hours trading on Wednesday following the company’s strong financial results.

Financials: Micron reported earnings of 42 cents per share in the past quarter and revenue of $5.82 billion; both were better than expected.

Powering the Story: The semiconductor manufacturing company attributed its strong results to artificial intelligence demand and a tight supply of chips.

Outlook: Micron expects revenue in the current quarter to be around $6.6 billion, which is also better than expected.

Stock Price: Micron is up 64% in the past 12 months, including an 18% gain in the last 30 days before these results.

Final Thoughts: As long as the AI boom continues, Micron stands to benefit.

Notables

Notable Earnings Today: FedEx (NYSE: FDX), Nike (NYSE: NKE), Accenture (NYSE: ACN), Lululemon Athletica (Nasdaq: LULU), Academy Sports + Outdoors (Nasdaq: ASO), Darden Restaurants (NYSE: DRI), AAR Corp (NYSE: AIR), Winnebago (NYSE: WGO), FactSet (NYSE: FDS), Asensus Surgical (NYSE American: ASXC), Baozun (Nasdaq: BZUN), Designer Brands (NYSE: DBI), Direct Digital Holdings (Nasdaq: DRCT), Exscientia (Nasdaq: EXAI), HireQuest (Nasdaq: HQI), Hyperfine (Nasdaq: HYPR), Intuitive Machines (Nasdaq: LUNR), Mink Therapeutics (Nasdaq: INKT), Lufax (NYSE: LU), Shoe Carnival (Nasdaq: SCVL), SNDL (Nasdaq: SNDL), TELA Bio (Nasdaq: TELA), Titan Machinery (Nasdaq: TITN), Vitru (Nasdaq: VTRU).

Notable IPOs Today: Reddit (NYSE: RDDT), LOBO EV TECHNOLOGIES LTD. Ordinary shares (Nasdaq: LOBO), Avantis Emerging Markets ex-China Equity ETF (Nasdaq: AVXC).

Notable Equity Crowdfunding Campaigns Ending Today: Botanery Barn Distilling (StartEngine).

Notable Economic Events Today: Jobless Claims (8:30 a.m. ET), Philadelphia Fed Manufacturing Index (8:30 a.m. ET), Philly Fed Employment (8:30 a.m. ET), S&P Global US Manufacturing PMI (9:45 a.m. ET), S&P Global Services PMI (9:45 a.m. ET), S&P Global Composite PMI (9:45 a.m. ET), Existing Home Sales (10:00 a.m. ET), US Leading Index (10:00 a.m. ET), Fed's Balance Sheet (4:30 p.m. ET).

Five Below's "Shrink Headwinds"

Gif by FiveBelow on Giphy

Discount retailer Five Below (Nasdaq: FIVE) sank by 12.68% in after-hours trading on Wednesday after posting disappointing financial results.

Financials: Five Below reported earnings of $3.65 per share in the past quarter and revenue of $1.34 billion; both were lower than expected.

Quote: “The benefit of strong sales performance to our profitability was offset by higher than anticipated shrink headwinds, resulting in earnings at the low end of our guidance range.” - CEO Joel Anderson.

Final Thoughts: Five Below was down 3% in 2024 before these results. Retailers are struggling all year. The “shrink headwinds” comment is a problem.

KB Home Sees Improved Market Conditions

KB Home (NYSE: KBH) ticked up 0.73% in after-hours trading on Wednesday after posting better-than-expected earnings and revenue results for the past quarter.

Quote: “Market conditions have improved since the end of our 2023 fiscal year, contributing to the significant year‐over‐year increase in our net orders for the quarter.”- CEO Jeffrey Mezger.

Final Thoughts: KB Home is up 12% this year and is growing despite a troubled housing market.

Trends to Watch

A ‘Ruff’ Business: Write a pun about this: Chewy says pet business is ‘recession resilient,’ but offers this warning (MarketWatch)

Guess What: Guess Prepares to Build With Rag & Bone as Earnings Top Estimates (Women’s Wear Daily)

Wednesday in Crypto: Bitcoin Tops $67K on Dovish Fed Remarks; Ether Rebounds From SEC Fears, DOGE Soars (CoinDesk)

Upvote: Reddit Prices I.P.O. at $34 a Share, in a Positive Sign for Tech (New York Times)

An Electric Future: Biden administration unveils strictest ever US car emission limits to boost EVs (BBC)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.