Today is Thursday, December 21, 2023.

The Early Bird Index today is 63.60.

New to this newsletter? Sign up here

Hey Early Birds,

Just a quick heads up – we're taking a short breather between Christmas and New Year's to recharge our investment mojo and come back swinging in 2024!

🗓️ Break Dates: December 25th, 2023 - January 1st, 2024

We'll be back in your inbox right after New Year's, ready to kick off another exciting year of investing insights.

Wishing you a fantastic holiday season and a prosperous New Year!

Cheers,

Steven and The Early Bird Team 🐦🚀

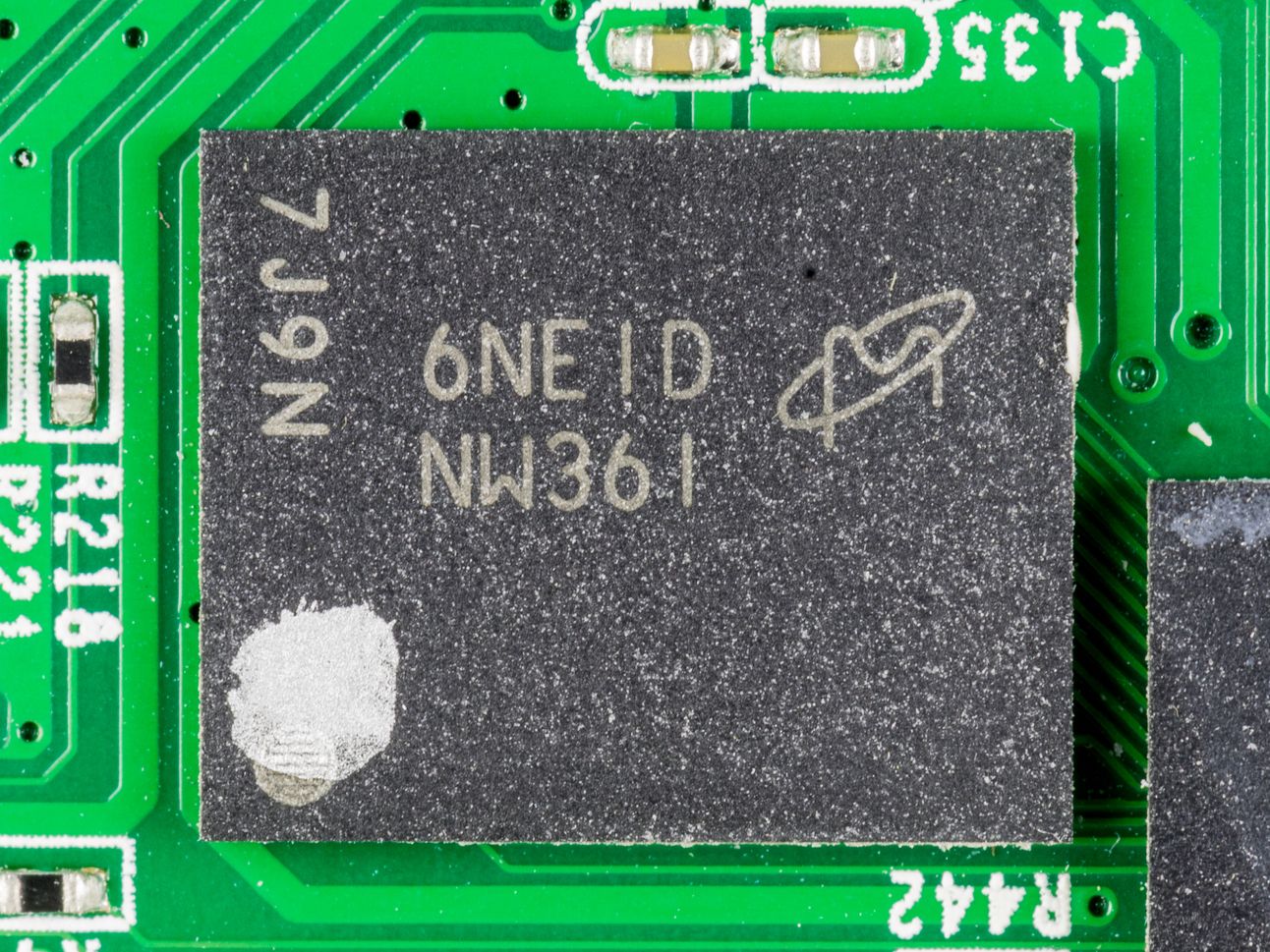

Micron’s Very Strong Execution

Semiconductor maker Micron Technology (Nasdaq: MU) produced good financial results on Wednesday and the stock price increased by 4.84% in after-hours trading.

Financials: Micron reported a loss of 95 cents per share in the past quarter and revenue of $4.73 billion; both were better than expected.

Quote: “Micron’s strong execution and pricing drove better-than-anticipated first quarter financial results.” - CEO Sanjay Mehrotra.

Final Thoughts: Micron, up 56% this year, also predicts that revenue will exceed $5 billion in the current quarter because of the rise of AI.

Hal9 (Sponsored)

Chat with your enterprise databases using secure generative AI and empower business users in your team to do their own data analyses in seconds.

Notables

Notable Earnings Today: Nike (NYSE: NKE), Carnival (NYSE: CCL), Cintas (Nasdaq: CTAS), AAR Corp (NYSE: AIR), CarMax (NYSE: KMX), Paychex (Nasdaq: PAYX), Mission Produce (Nasdaq: AVO), Apogee Enterprises (Nasdaq: APOG), Cemtrex (Nasdaq: CETX), Limoneira (Nasdaq: LMNR).

Notable IPOs Today: VictoryShares Small Cap Free Cash Flow ETF (Nasdaq: SLFO), Texas Capital Texas Small Cap Equity Index ETF (Nasdaq: TXSS).

Notable Equity Crowdfunding Campaigns Ending Today: Frost Brewhouse (Honeycomb), Pitsa (SMBX), Combs’ Coffee (Honeycomb).

Notable Economic Events Today: Jobless Claims (8:30 a.m. ET), GDP (8:30 a.m. ET), Philadelphia Fed Manufacturing Index (8:30 a.m. ET), Philly Fed Employment (8:30 a.m. ET), U.S. Leading Economic Indicators Index (10:00 a.m. ET), Fed's Balance Sheet (4:30 p.m. ET).

Blackberry Expects Sales Drop

Blackberry (NYSE: BB) fell by 4.63% in after-hours trading on Wednesday due to mixed financial results.

Financials: Blackberry reported earnings of 1 cent per share, which was better than expected. But revenue fell below estimates at $175 million.

Final Thoughts: Blackberry anticipates that sales will decline in the current quarter. The stock is up 23% this year.

Worst Stocks and Sectors of 2023

While most stocks performed well in 2023, a few stocks and sectors struggled to gain traction this year and saw massive price declines.

Bad Medicine: The pandemic is over and several of the pharmaceutical stocks that gained during the pandemic came crashing back down in 2023. Johnson & Johnson (NYSE: JNJ) is down 12%, Pfizer (NYSE: PFE) is down 45%, and Moderna (Nasdaq: MRNA) is down 50%.

Lack of Energy: Lower energy prices might be good for consumers, but it’s bad for shareholders in energy companies. Traditional oil companies had a bad year, including Chevron (NYSE: CVX), which dropped 12%. In alternative energy, Enphase Energy (Nasdaq: ENPH) dropped by 46% and Plug Power (Nasdaq: PLUG) plunged by 63%.

Stale Consumer Goods: Investors who expected a recession bet big on consumer staples, and boy were they wrong. Procter & Gamble (NYSE: PG), PepsiCo (Nasdaq: PEP), and Coca-Cola (NYSE: KO) were all in the red this year.

Don’t Buy: It was a weak year for some retail stores. Dollar General (NYSE; DG) dropped 47% this year. Walgreens Boots Alliance (Nasdaq: WBA) is down 30%.

Meme No More: How many times can we say that the meme stock trade is over? Seriously, it’s not 2021 anymore. AMC Entertainment (NYSE: AMC) plummeted by 77% this year.

Final Thoughts: Just because these stocks had a terrible 2023 doesn’t mean that they are destined for a bad 2024. In the new year, these stocks could potentially turn things around.

Trends to Watch

Media Consolidation: Warner Bros. Discovery in talks to merge with Paramount Global (Axios)

IPO Watch: Chair of powerful House committee pushes Shein about data protections, China relationship (CNBC)

Glitch: Toyota recalls 1 million Toyota and Lexus vehicles because air bag may not deploy properly (CBS News)

Out of Business: Bird Electric Scooter Company Files for Bankruptcy After 2021 SPAC (Wall Street Journal)

A Safer Internet: FTC proposes strengthening children’s online privacy rules to address tracking, push notifications (The Hill)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.