Photo by Mohammad Shahhosseini / Unsplash

Today is Tuesday, September 27, 2021.

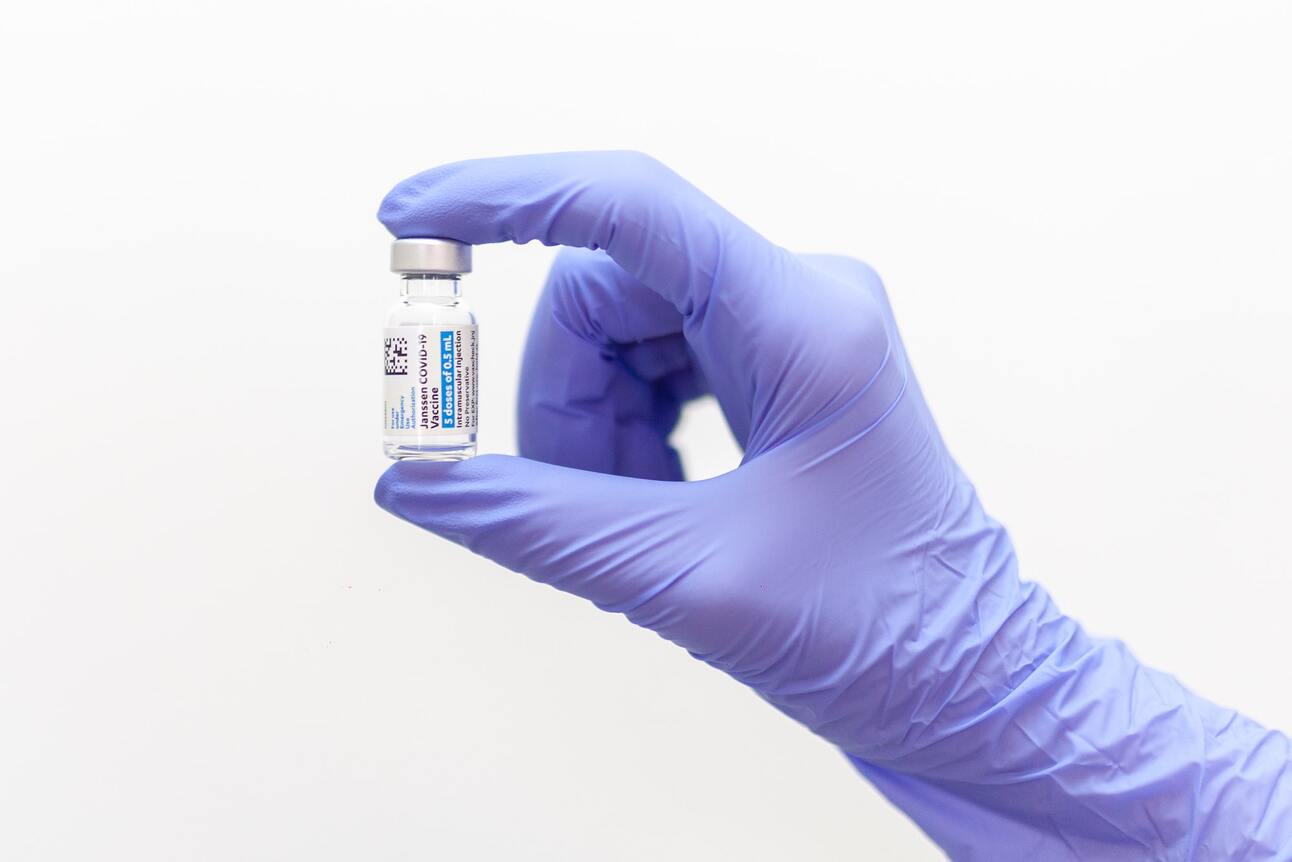

The Vaccine Boom is Over As Stocks Slide

Shares of the major pharmaceutical companies behind the Covid-19 vaccines decreased Monday due to a variety of pressure points.

Numbers: The declines on Monday included: 0.72% for Johnson & Johnson (NYSE: JNJ), 0.86% for Pfizer (NYSE: PFE), 2.70% for AstraZeneca (Nasdaq: AZN), 4.95% for Moderna (Nasdaq: MRN), 6.90% for Novavax (Nasdaq: NVAX), and 7.91% for BioNTech (Nasdaq: BNTZ).

Bigger Picture: The likely culprit for Monday’s decline was due to Singapore reporting its highest Covid-19 cases since last April. Most of the population is vaccinated, so there may not be as many hospitalizations. The country uses the same vaccines that are available in the U.S.

Potential Factor: On Sunday, the CEO of Pfizer said on ABC News that “normal life” will return in a year. This may have prompted some profit-taking from investors who fear that the vaccine stocks won’t be growing in the future.

Final Thoughts: Most of the vaccine stocks have performed well in 2021. If you are bullish on the vaccine stocks, Monday’s pullback is an opportunity to buy.

Notables

Notable Earnings Today: Micron Technology (MU) Cal-Maine Foods (CALM), Factset (FDS), IHS Markit (INFO), Thor Industries (THO), United Natural Foods (UNFI).

Notable IPOs Today: Amplitude, Inc. Class A Common Stock (Nasdaq: AMPL), Semler Scientific, Inc. Common Stock (Nasdaq: SMLR), Riverview Acquisition Corp. Class A Common Stock (Nasdaq: RVAC).

Notable Equity Crowdfunding Campaigns Ending Today: Marek Landscaping (Honeycomb), Acrospire Brewing (Honeycomb), Mangled Mascots (Netcapital).

Notable Economic Events Today: Goods Trade Balance (8:30 a.m. ET), Consumer confidence index (10:00 a.m. ET).

Invesco to Develop Crypto ETFs With Galaxy

Investors may soon get access to new physically-backed, U.S.-listed cryptocurrency exchange-traded funds (ETFs) via a partnership between asset management firm Invesco (NYSE: IVZ) and digital assets company Galaxy Digital (TSX: GLXY) announced Monday.

Quote: “Our partnership with Invesco, a longstanding ETF innovator, will bring the same thoughtful approach to educating investors about digital assets as Invesco has brought to the ETF industry itself.” - Steve Kurz, head of asset management at Galaxy Digital.

Numbers: Invesco has about $1.5 trillion assets under management. Galaxy Digital has about $2.1 billion.

Background: Although many companies have applied to have a crypto ETF, the U.S. Securities and Exchange Commission has yet to approve any of them. Analysts believe that a Bitcoin Futures ETF would likely be among the first to get approved.

Final Thoughts: Not only would a crypto ETF provide a new opportunity for investors, but the approval would add more legitimacy to cryptocurrency.

Electric Vehicle Companies on Equity Crowdfunding Platforms

Investors who are interested in getting exposure to an electric vehicle company can now look beyond the public market, as equity crowdfunding platforms offer several EV startups for investing.

History: Uniti, a Swedish EV company that was called the “Tesla for megacities,” raised £1.1M on Crowdcube in 2018.

History, Repeated: Carverter, a hybrid and electric car company in the U.K., raised £2.32 on Seedrs in a campaign that closed in early 2021.

On Their Own: Atlis Motor Vehicles launched an equity crowdfunding campaign in August to raise $5 million on their own website.

Back Again: Eli Electric, which raised $1.4M in equity crowdfunding in July, recently launched a second equity crowdfunding campaign on StartEngine in September.

Final Thoughts: As with any startup, early private market investing carries a mixture of high risk and high reward.

Trends to Watch

Golden News: Kirkland Lake Gold shares up over 8% on M&A rumor (Mining.com)

Oil Be There For You: Oil up on tight supply, Brent crude nears $80 a barrel (Reuters)

Be Direct: Coinbase will let you direct-deposit your paycheck and convert it to crypto (Insider)

A Literal Best Buy: Piper Sandler is bullish on Best Buy’s new membership program, sees over 40% upside for stock (CNBC)

Stepping Down: Kaplan Steps Down as Dallas Fed Chief, Hours After Rosengren (Bloomberg)

Thank you for reading! Please any send feedback to [email protected].