Early Bird Prime for December 15, 2024

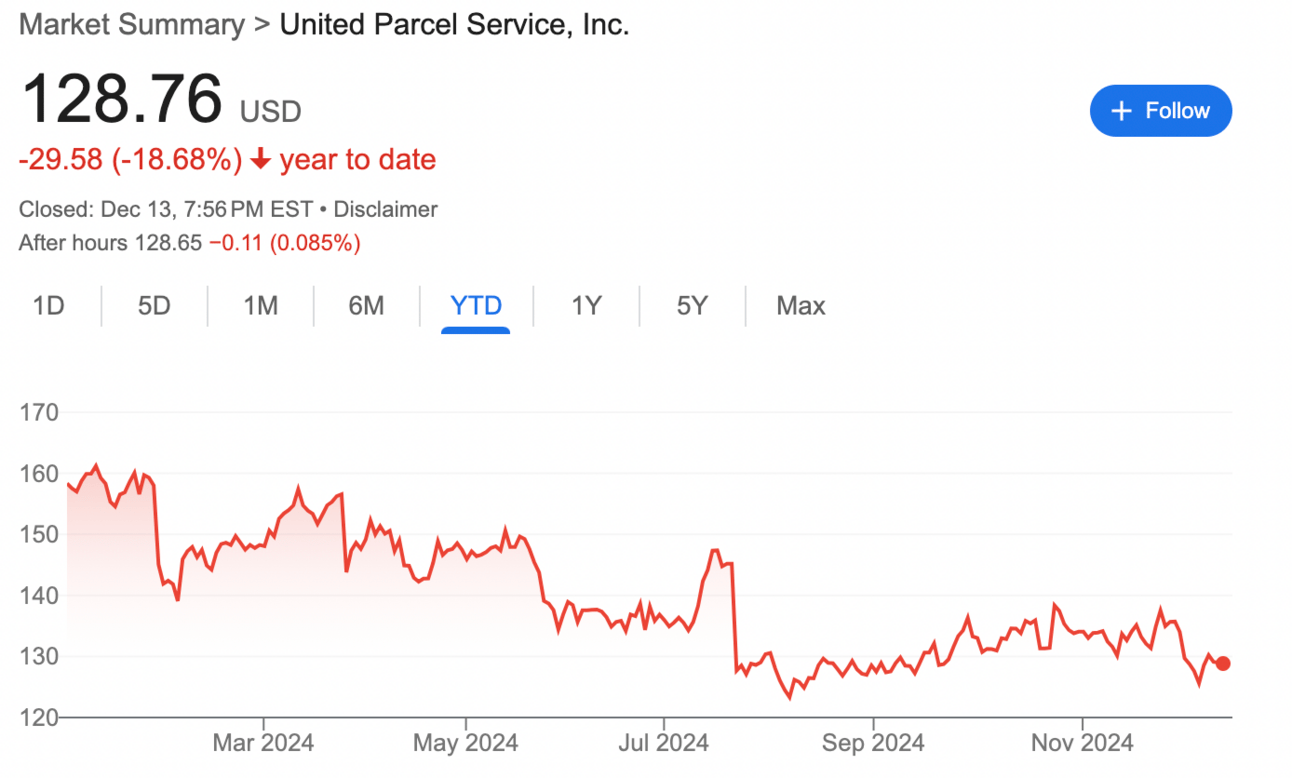

Let's face it, United Parcel Service (NYSE: UPS) has had a year that could make even the most optimistic investor want to hide under a pile of packing peanuts. The stock has taken a nosedive, down 18.68% this year alone, with a 2.93% dip in just the last 30 days.

Since its peak in 2022, UPS has plummeted over 39%. It's like watching a slow-motion train wreck, except the train is brown and full of packages.

Investors are left scratching their heads, wondering if the company can grow in a post-pandemic world. Labor negotiations in 2023 have left UPS with higher costs, and the industry is facing overcapacity.

But before you run for the hills, consider this: This week, BMO Capital Markets upgraded UPS stock to "outperform" from "marketperform." BMO cites better market conditions, moderating cost pressures, and a good valuation. They also predict higher operating margins.

And there's more good news. UPS's most recent financial results finally showed revenue growth. After a challenging 18-month period, UPS is back on the growth track and expanding.

Should you invest in UPS stock now or should you avoid it? Here’s exactly what you should do:

Subscribe to Early Bird Prime to read the rest.

Become a paying subscriber of Early Bird Prime to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Expert analysis on the best stocks.

- Stock price predictions based on machine learning.

- Investing picks and recommendations.

- Advertisement-free.