Happy Sunday, Early Birds.

In addition to our normal weekday newsletter (which is still 100% free), we just released a new premium weekly newsletter called Early Bird Prime. It is a deep dive into a specific stock or sector. Early Bird Prime will grow your investing knowledge and confidence to help you make better investing decisions.

Enjoy your complimentary trial of Early Bird Prime for March. Last Sunday, Early Bird Prime warned investors about a beaten-up stock. This week Early Bird Prime is dissecting another highly-debated stock and using machine learning to determine the future price.

If you’re still on the fence about joining Early Bird Prime, we offer a special rate of just $6.74 per month – a generous 25% discount from the regular price. Sign up by March 31 (one week from today) to access the discounted rate.

Thank you for being a part of this exciting journey. Dive in and let us know your thoughts – your feedback is our compass.

Steven

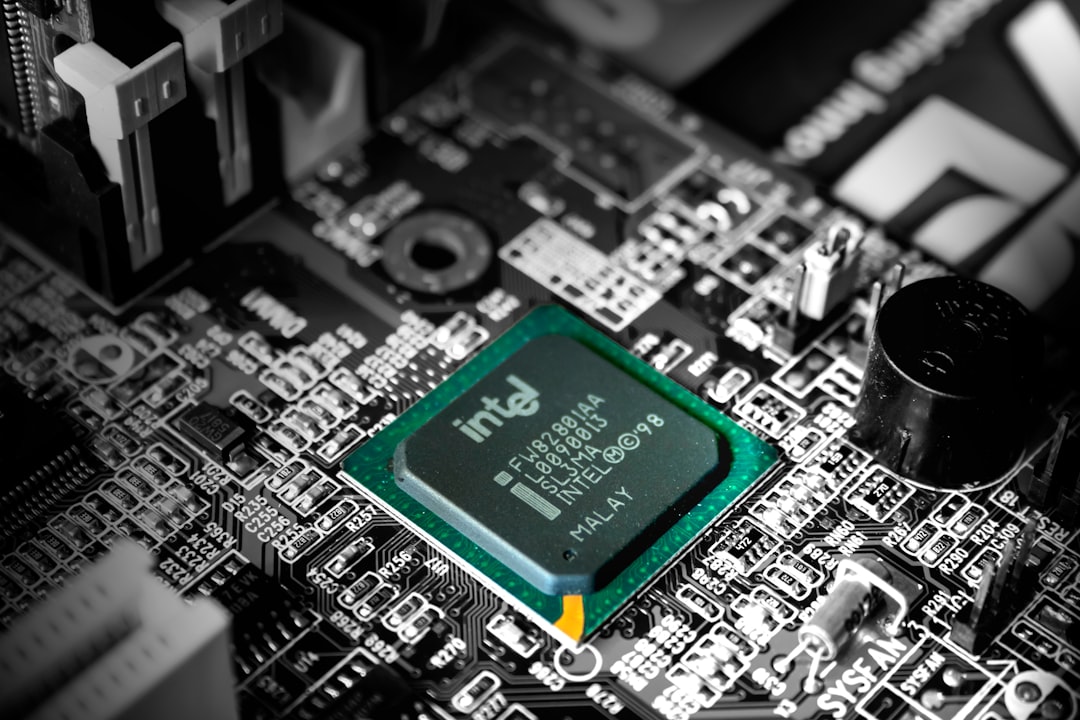

The Next Nvidia: Intel?

If you're considering jumping into the chip trade, the obvious choice is Nvidia (Nasdaq: NVDA), which has skyrocketed 2000% in the last five years thanks to its role in the artificial intelligence boom. But the stock is currently sitting at an all-time high of $942.89, and it seems the time to get in on that action may have passed.

Let's look at Intel (Nasdaq: INTC) as a potential alternative to the soaring Nvidia. Ah, poor Intel. It's been lagging behind Nvidia and other chip stocks, with its stock down 20% in the last five years. The stock is currently trading at $42.57, which is, well, not exactly impressive.

But hold on, because there might be a glimmer of hope on the horizon.