Today is Wednesday, January 28, 2026.

The Early Bird Index today is 85.51.

New to this newsletter? Sign up here

PRESENTED BY CASH APP

3 money habits teens can start building now

With a Cash App Card, teens can take their first steps toward independence with a secure debit card. They’ll learn how to spend, save, and manage money, all with your guidance and oversight to help them get started.

Learn to spend responsibly

A debit card gives them a safe way to practice managing money under your supervision. It gives you the opportunity to teach them how to make smart spending choices.

Start saving for their goals

Setting goals can help them see how saving a little at a time can help them reach their short-term and long-term goals.

Manage their own money

Whether they get paid with direct deposit or use Cash App to get allowance or gifts, they get real experience with money.

Cash App is a financial platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms & Conditions. To view the eligibility requirements for sponsoring a teen, please visit the Sponsored Accounts section of the Cash App Terms of Service.

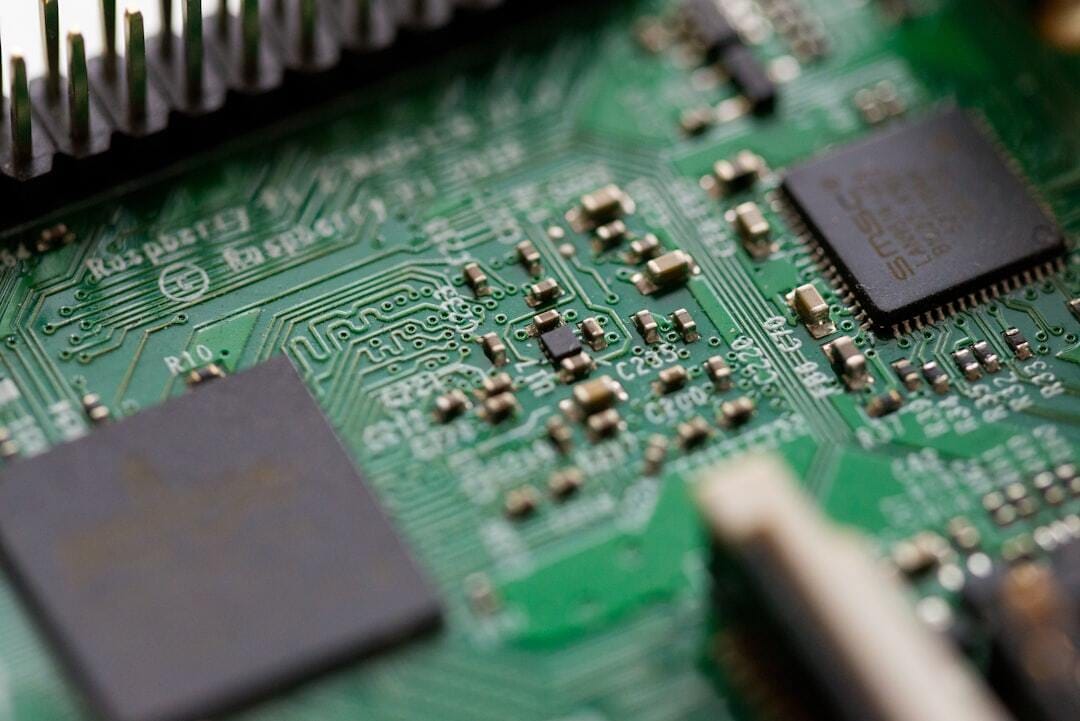

Texas Instruments Survives Losses

Despite posting disappointing financial earnings results on Tuesday, Texas Instruments $TXN ( ▲ 9.94% ) jumped 8.22% in after-hours trading.

Financials: Texas Instruments reported earnings of $1.27 per share in the past quarter and revenue of $4.42 billion. Both were lower than expected.

Powering the Story: The company expects earnings between $1.22 and $1.48 per share in the current quarter and revenue of $4.32 billion to $4.68 billion. Both outlooks were better than expected.

Early Bird’s Nest Egg Gains: Texas Instruments expects the current quarter (Q1 2026) to look better mainly because order trends, backlog, and intra‑quarter demand patterns have improved.

Final Thoughts: Even before these results, the stock had jumped 11% in the past month.

Notables

Notable Earnings Today: Meta Platforms (Nasdaq: META), Microsoft (Nasdaq: MSFT), Tesla (Nasdaq: TSLA), GE Vernova (NYSE: GEV), ASML (Nasdaq: ASML), AT&T (NYSE: T), Starbucks (Nasdaq: SBUX), International Business Machines (NYSE: IBM), Amphenol (NYSE: APH), Lam Research (Nasdaq: LRCX), Levi Strauss (NYSE: LEVI), ServiceNow (NYSE: NOW), Corning (NYSE: GLW), Las Vegas Sands (NYSE: LVS), Scotts Miracle-Gro (NYSE: SMG), General Dynamics (NYSE: GD), Waste Management (NYSE: WM), Progressive (NYSE: PGR), Automatic Data (Nasdaq: ADP), Whirlpool (NYSE: WHR), Lending Club (NYSE: LC), V.F. Corp (NYSE: VFC), Extreme Networks (Nasdaq: EXTR), Ethan Allen (NYSE: ETD), Badger Meter (NYSE: BMI), Brinker (NYSE: EAT), Calix Networks (NYSE: CALX), Canadian Pacific Kansas City (NYSE: CP), Century Communities (NYSE: CCS), Danaher (NYSE: DHR), Deluxe (NYSE: DLX), Elevance Health (NYSE: ELV), Equity Lifestyle Properties (NYSE: ELS), Fair Isaac (NYSE: FICO), Landstar System (Nasdaq: LSTR), Lennox International (NYSE: LII), Liberty Energy (NYSE: LBRT), Monro Muffler (Nasdaq: MNRO), MSCI (NYSE: MSCI), Murphy Oil (NYSE: MUR), Navient (Nasdaq: NAVI), New Oriental Education & Technology (NYSE: EDU), Otis Worldwide (NYSE: OTIS), Raymond James (NYSE: RJF), SEI Investments (Nasdaq: SEIC), SL Green Realty (NYSE: SLG), Tetra Tech (Nasdaq: TTEK), Teva Pharmaceutical (NYSE: TEVA), UBS (NYSE: UBS), United Rentals (NYSE: URI).

Notable IPOs Today: QT Imaging Holdings, Inc. Common Stock (Nasdaq: QTI), Public Policy Holding Company, Inc. Common Stock (Nasdaq: PPHC), ArrowMark Financial Corp. Right (Nasdaq: BANXR), Bleichroeder Acquisition Corp. II Class A Ordinary Shares (Nasdaq: BBCQ), KRAKacquisition Corp Unit (Nasdaq: KRAQU), Space Asset Acquisition Corp. Units (Nasdaq: SAAQU).

Notable Equity Crowdfunding Campaigns Ending Today: Epilog (StartEngine), Innovega (StartEngine), Kit & Kin (Crowdcube).

Notable Economic Events Today: Crude Oil Inventories (10:30 a.m. ET), Fed Interest Rate Decision (2:00 p.m. ET), FOMC Statement (2:00 p.m. ET).

F5 Networks' Product Revenue

The security tech company F5 Networks $FFIV ( ▲ 8.09% ) jumped 10.42% in after-hours trading on Tuesday after posting strong financial earnings results.

Financials: F5 Networks reported earnings of $4.45 per share in the past quarter and revenue of $822 million. Both were better than expected. Product revenue surged by 11%.

Final Thoughts: It’s a recovery for F5 Networks, as the stock has only been up about 2% in the past year.

Hyperliquid’s Commodity Surge

The price of the cryptocurrency Hyperliquid $HYPE ( ▲ 8.27% ) surged 27% on Tuesday amid increased demand for its new commodity perpetuals.

Final Thoughts: In the past week, Hyperliquid is up 50%.

Trends to Watch

What Brown Can’t Do For You: UPS to cut additional 30,000 jobs in Amazon unwind, turnaround plan (CNBC)

Potential Next Fed Chair: Inside the world of Rick Rieder, the $2.3 trillion insomniac who might soon run the Fed (Fortune)

Delivering Change: Amazon to close Amazon Go and Amazon Fresh to concentrate on Whole Foods and grocery delivery (Associated Press)

Up and Down: Bitcoin climbs above $89,000 as U.S. dollar tumbles on President Trump's remarks (CoinDesk)

Taking Off: Boeing’s Stepped-Up Plane Deliveries Lift Sales (Wall Street Journal)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Pick winning stocks: Upgrade to Early Bird Prime.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations, and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.