Early Bird Prime for August 3, 2025

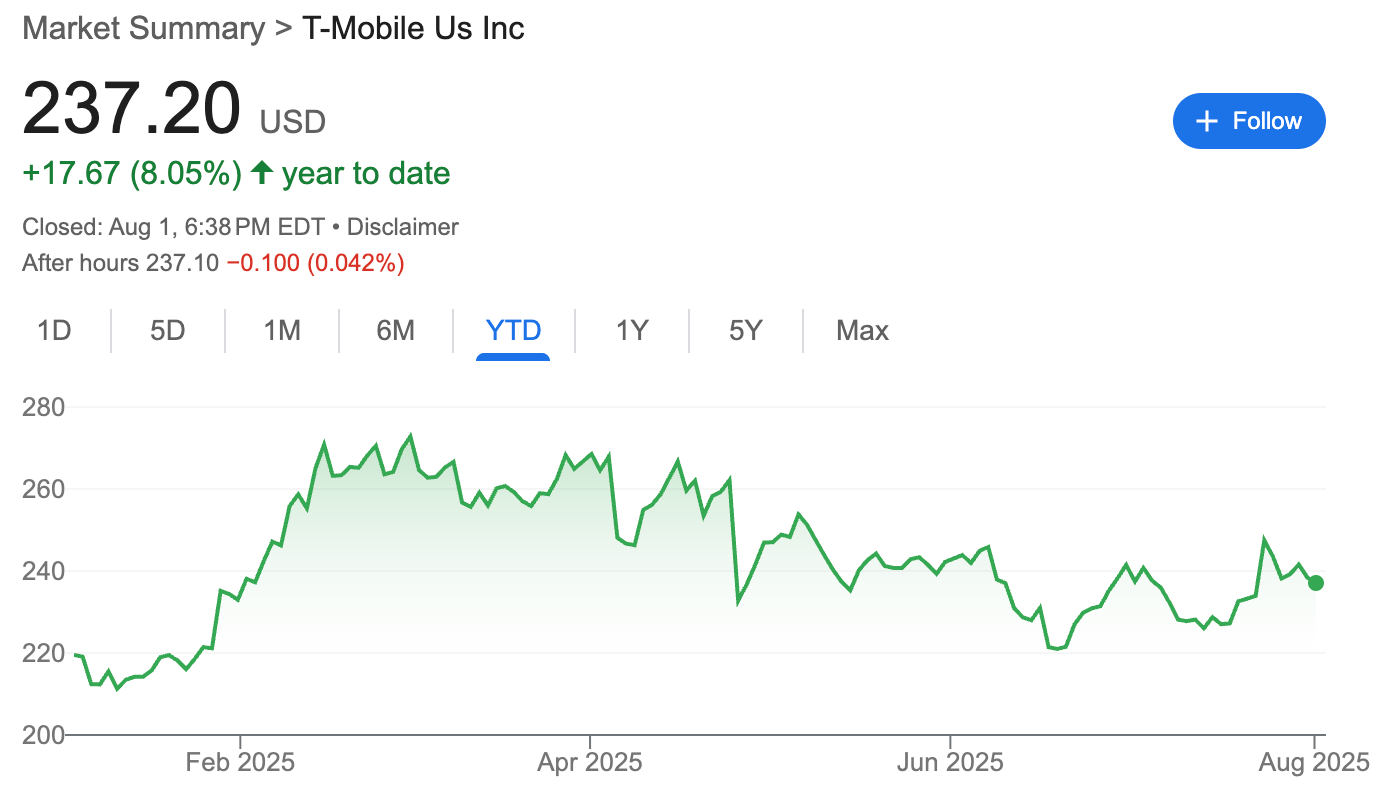

T-Mobile $TMUS ( ▲ 0.07% ), the magenta marvel of the telecom world, is up 8.05% this year, which is slightly better than the overall market. But the last six months have been a bit of a rollercoaster, with the stock taking a slight dip. Blame it on the weaker-than-expected subscriber growth in Q1, which thankfully improved in Q2.

Now, for the recent news: T-Mobile has just closed its acquisition of UScellular’s wireless operations. This move could lead to T-Mobile experiencing more growth and a larger share of the telecom market.

T-Mobile has been on a shopping spree, snapping up everything from Mint Mobile to fiber internet assets. And like any shopaholic, it's racked up a hefty credit card bill. This debt could limit T-Mobile's ability to grow in the future.

Remember when T-Mobile was the cool kid on the block with its 5G network? Well, the competition has arrived. AT&T $T ( ▲ 0.36% ) and Verizon $VZ ( ▲ 1.25% ) are catching up, flexing their muscles in network quality and spectrum deployment. This means T-Mobile's once-unbeatable advantage is starting to look more like a participation trophy. With rivals closing in, T-Mobile's future growth and margins might be shaky.

So, should you buy T-Mobile’s stock in 2025 or avoid it? Here’s the answer:

Subscribe to Early Bird Prime to read the rest.

Become a paying subscriber of Early Bird Prime to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Expert analysis on the best stocks.

- Stock price predictions based on machine learning.

- Investing picks and recommendations.

- Advertisement-free.