Photo by Alexander Shatov / Unsplash

Today is Wednesday, February 1, 2023.

New to this newsletter? Sign up here.

Snapchat Can't See the Future

The lack of a clear outlook within its financial results sent shares of Snapchat parent Snap (NYSE: SNAP) down 14.97% in after-hours trading on Tuesday.

Financials: Snap reported earnings of 14 cents per share in the quarter, which was better than expected. But revenue only hit $1.3 billion, which was below estimates.

What Happened: The company achieved a 17% increase in daily active users. And the total time spent watching Spotlight content jumped by 100%.

But: Snap said it was unable to provide any guidance for revenue or earnings in the current quarter due to uncertainties and “significant headwinds.” To make matters worse, quarter-to-date revenue has already declined by 7%.

Stock Price: Snap’s stock is down 65% in the last 12 months. The disappointing earnings sent shares of other social platforms down in after-hours trading on Tuesday, including a 2.55% drop for Pinterest (NYSE: PINS).

Final Thoughts: It’s clearly a bad time to invest in Snap, but the concern is that other online advertisers could be in store for some dark times.

Notables

Notable Earnings Today: Meta Platforms (Nasdaq: META), Waste Management (NYSE: WM), Altria (NYSE: MO), Align Technology (Nasdaq: ALGN), T-Mobile (Nasdaq: TMUS), McKesson (NYSE: MCK), Peloton Interactive (Nasdaq: PTON), Aflac (NYSE: AFL), Boston Scientific (NYSE: BSX), Hologic (Nasdaq: HOLX), Enterprise Products Partners (NYSE: EPD), e.l.f. Beauty (NYSE: ELF), Humana (NYSE: HUM), Corteva (NYSE: CTVA), Thermo Fisher Scientific (NYSE: TMO), SiTime (Nasdaq: SITM), GSK (NYSE: GSK), Allstate (NYSE: ALL), AmerisourceBergen (NYSE: ABC), MetLife (NYSE: MET), Allegiant Travel (Nasdaq: ALGT), Brinker (NYSE: EAT), C.H. Robinson Worldwide (Nasdaq: CHRW), DXC Technology (NYSE: DXC), Evercore (NYSE: EVR), Fortive (NYSEL FTV), Kulicke & Soffa (Nasdaq: KLIC), Meritage Homes (NYSE: MTH), MGIC Investment (NYSE: MTG), NETGEAR (Nasdaq: NTGR), Novartis (NYSE: NVS), Old Dominion (Nasdaq: ODFL), Otis Worldwide (NYSE: OTIS), Qorvo, (Nasdaq: QRVO), Rayonier (NYSE: RYN), Scotts Miracle-Gro (NYSE: SMG).

Notable IPOs Today: Cetus Capital Acquisition Corp. Unit (Nasdaq: CETUU).

Notable Equity Crowdfunding Campaigns Ending Today: N/A.

Notable Economic Events Today: ADP Nonfarm Employment Change (8:15 a.m. ET), Manufacturing PMI (9:45 a.m. ET), ISM Manufacturing PMI (10:00 a.m. ET), JOLTs Job Openings (10:00 a.m. ET), ISM Manufacturing Employment (10:00 a.m. ET), Crude Oil Inventories (10:30 a.m. ET), FOMC Statement and Fed Interest Rate Decision (2:00 p.m. ET).

AMD Saved by Data Center Business

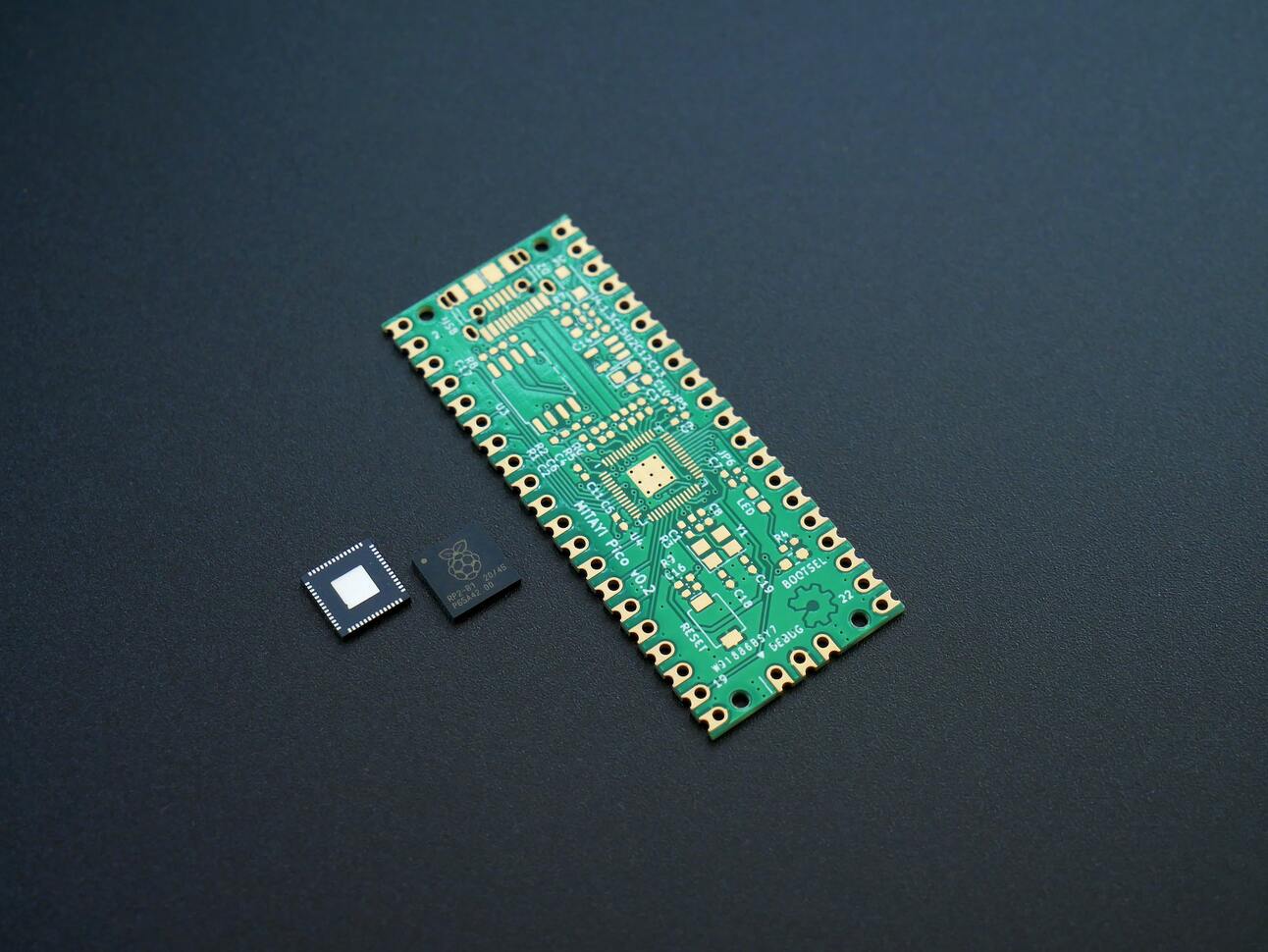

Photo by Vishnu Mohanan / Unsplash

Advanced Micro Devices (Nasdaq: AMD) did just enough with its financials earnings to jump by 1.41% in after-hours trading on Tuesday.

Financials: AMD reported earnings of 69 cents per share and revenue of $5.6 billion in the quarter; both were better than expected.

Details: While business units such as its clients' segment saw revenue drop 51% due to a weak PC market, data center revenue jumped by 42% due to strong sales.

But: The company expects revenue to decline by 10% year-over-year in the current quarter.

Final Thoughts: The results were not perfect, but AMD is in better shape than other semiconductor firms.

Electronic Arts Delays Star Wars Game

Video game developer Electronic Arts (Nasdaq: EA) announced that it was delaying the release of Star Wars Jedi: Survivor from March to April, sending shares down by 10.55% in after-hours trading on Tuesday.

Final Thoughts: The delay had an impact on EA’s first-quarter revenue guidance.

Nova Bank (Sponsored)

Novo is the powerfully simple small business banking platform that's resetting expectations of small business banking. Complete with integrations to tools small business owners are already using like Stripe, Shopify, Square, and Quickbooks Online.

Trends to Watch

Haircut: Intel Cuts Pay Across Company to Preserve Cash for Investment (Bloomberg)

Westless: Western Digital stock drops as outlook disappoints (MarketWatch)

To the Moon: Dogecoin soars as Elon Musk reportedly works on Twitter payments plan (Markets Insider)

Artificial Intelligence Beats Natural Stupidity: Move Over, ChatGPT. AI-Powered ETF Outperforms This Year (ETF.com)

Strong January: Bitcoin, Ether Price Surge a Reversal From Darkest Days of 2022 (CoinDesk)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.