Early Bird Prime for January 25, 2026

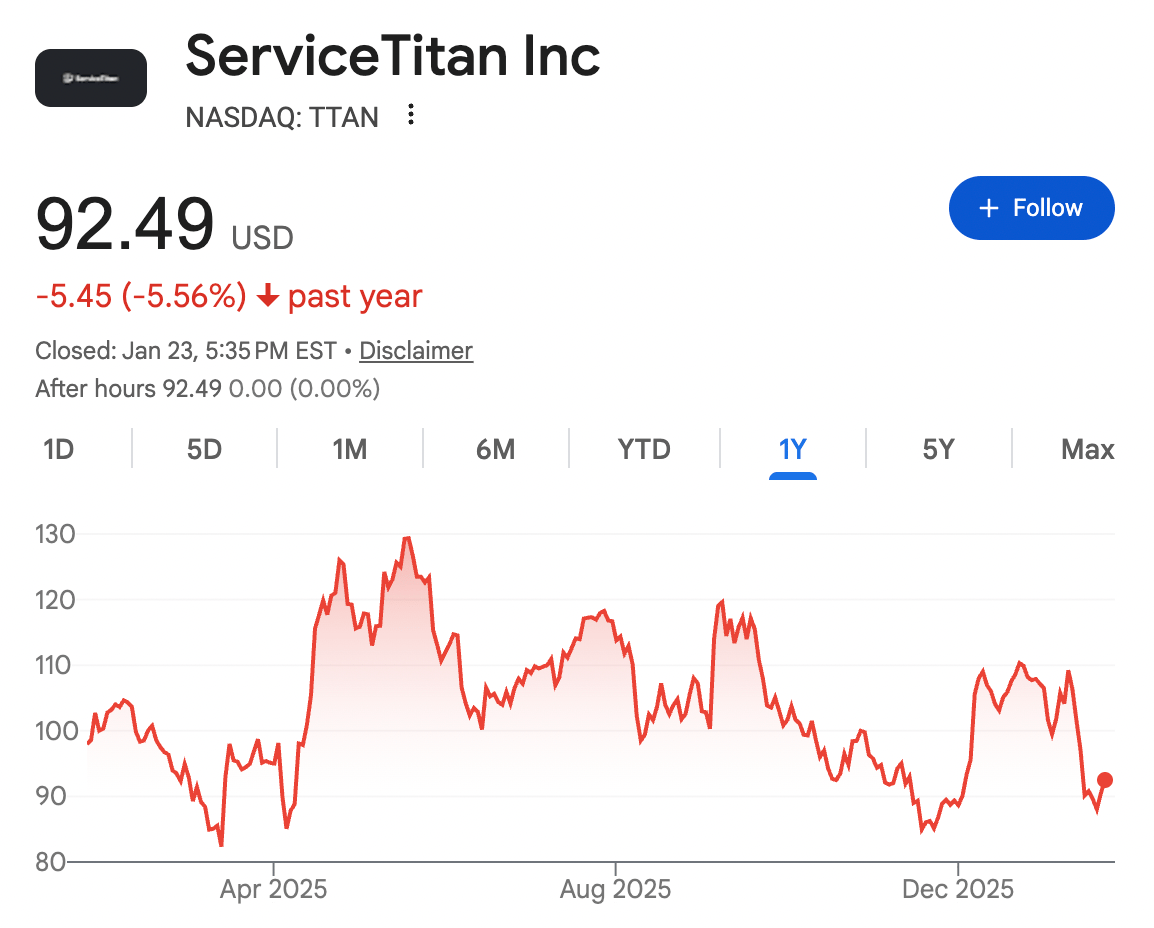

ServiceTitan's $TTAN ( ▲ 2.01% ) stock is at a crossroads in 2026. The stock has taken a bit of a nosedive, down 5.56% over the past year. Some say it's because of valuation concerns, as the company posted operating losses in parts of 2025. Others blame the broader losses in the enterprise software sector.

Just when you thought it was time to jump ship, Morgan Stanley swoops in this week, upgrading ServiceTitan and naming it a top pick. According to them, ServiceTitan is “very well positioned for AI.” Apparently, the company's growth and its focus on home and commercial service businesses make it a compelling pick.

ServiceTitan's customer base is growing fast. With roughly 9,500 active customers, up 18% year over year, the company is showing some serious stickiness. Low churn and continued penetration in a sticky vertical? Sounds like a recipe for success.

Now, let's talk numbers. ServiceTitan boasts a net dollar retention above 110% and a gross dollar retention above 95%. In layman's terms, this means they're pretty good at upselling and cross-selling, and their customers aren't running for the hills.

Should you buy ServiceTitan's stock right now in 2026, or should you avoid it? Here’s the answer…

Subscribe to Early Bird Prime to read the rest.

Become a paying subscriber of Early Bird Prime to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Expert analysis on the best stocks.

- Stock price predictions based on machine learning.

- Investing picks and recommendations.

- Advertisement-free.