Early Bird Prime for June 9, 2024

Salesforce (NYSE: CRM), the software behemoth that has been a favorite of Wall Street for years, is currently experiencing a bit of a rough patch in the stock market in 2024.

The company, a consistent performer, suddenly stumbled recently and reported its first revenue miss since 2006. Revenue only reached $9.13 billion in the past quarter, which was lower than expected.

Adding salt to the wound, Salesforce projected sales to grow in the single digits for the current quarter. This is a company that usually flexes its muscles with double-digit growth.

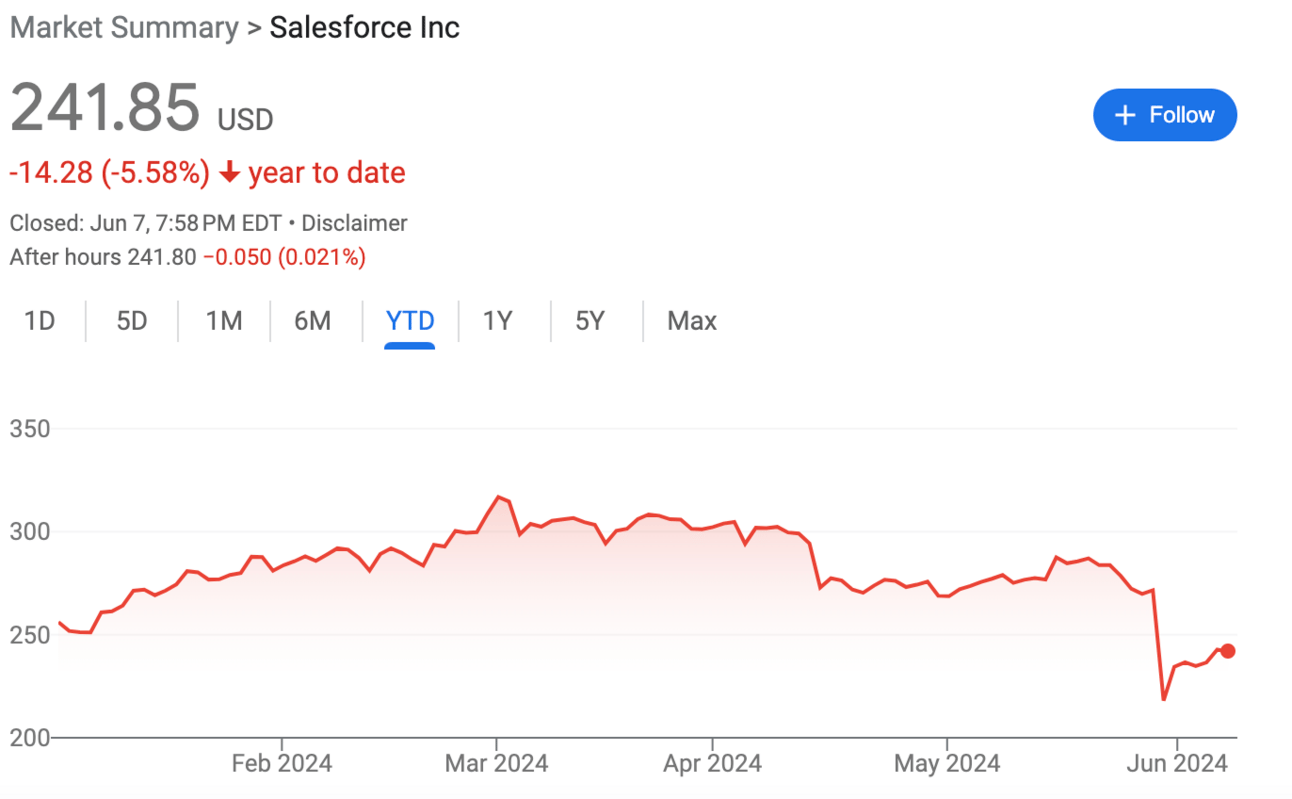

Naturally, this news made many investors panic, and they started selling the stock faster than you can say "Marc Benioff." As a result, Salesforce’s stock is down 12.11% in the last 30 days and has dipped 5.58% this year.

Salesforce is also losing its market share, especially to the big AI players. The company has lagged in AI adoption, and in a world where AI is the new black, that’s a big deal. Investors are worried that Salesforce might be left in the dust while the AI juggernauts zoom ahead.

However, not everyone is ready to throw in the towel. Some bullish investors see the recent selloff as a massive overreaction. They argue that Salesforce is still a huge and powerful company, and AI is still in its early innings.

A few days ago, Salesforce announced plans to open its first AI center in London.

The company’s recent performance has been less than stellar, but it’s still a giant in the software industry.

Is this a good time to buy Salesforce while it’s down, or is this a classic case of catching a falling knife? Well, here’s the answer: