Early Bird Prime for January 26, 2025

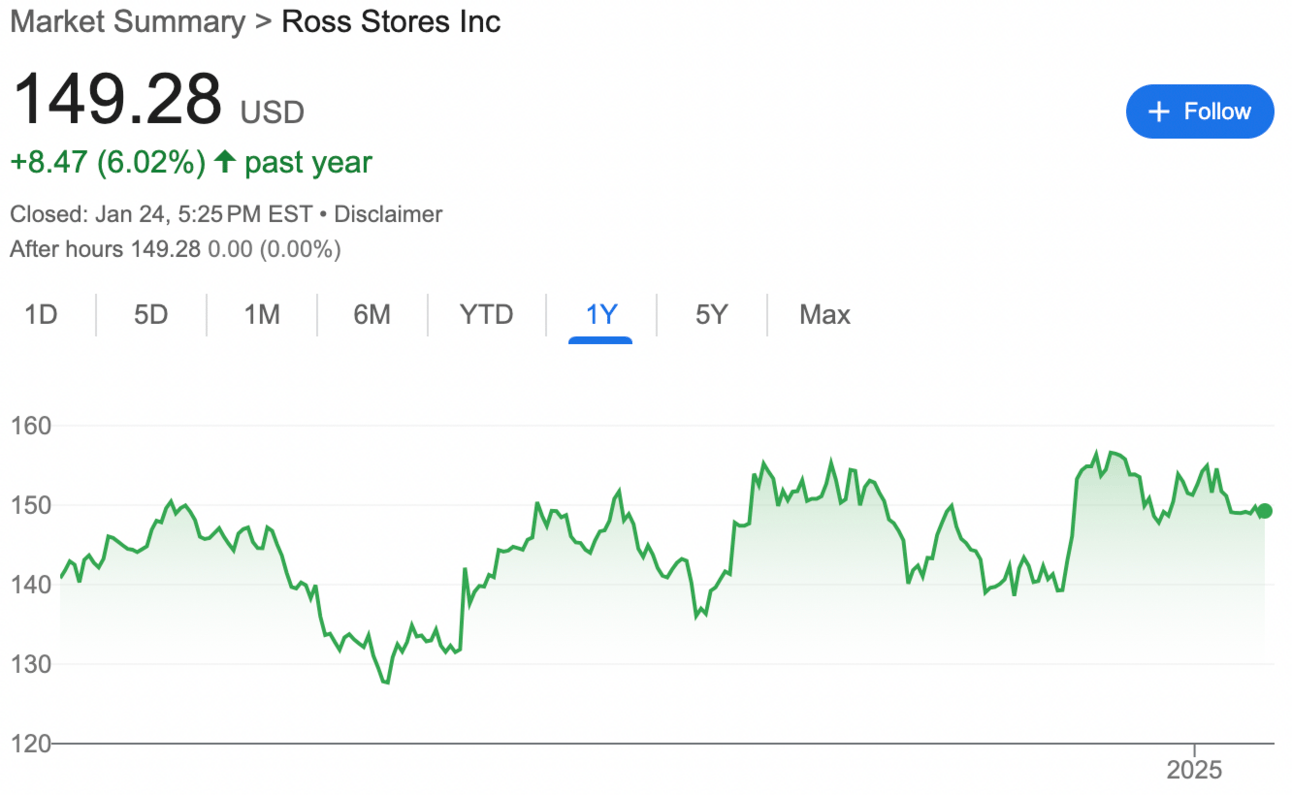

Known for its discounts, Ross Stores (Nasdaq: ROST) has been the go-to for savvy shoppers looking to stretch their dollars. But what about its stock? Over the past 12 months, Ross Stores' stock has risen by 6.02%. Not too shabby, but it is lagging behind the broader market's performance.

Last month, Ross Stores' stock hit an all-time high, which is great news for current investors. But can this discount retailer continue to climb the stock market ladder, or is it about to fall?

Ross Stores is banking on a slowdown in consumer spending, so it hopes that shoppers will flock to its stores rather than splurge at premium retailers.

However, not everyone is convinced that Ross Stores is a golden stock. Last week, Morgan Stanley downgraded the stock to Equal Weight from Overweight, with a price target of $140, down from $164. According to their analyst, profit growth in 2025 might be elusive.

With the stock still hovering near its all-time high, investors are left scratching their heads, wondering if Ross Stores can continue its upward trajectory or if it’s about to take a nosedive. The stock is at a tipping point.

Should you invest in Ross Stores now in 2025 or should you avoid this stock? Here’s the answer:

Subscribe to Early Bird Prime to read the rest.

Become a paying subscriber of Early Bird Prime to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Expert analysis on the best stocks.

- Stock price predictions based on machine learning.

- Investing picks and recommendations.

- Advertisement-free.