Early Bird Prime for August 24, 2025

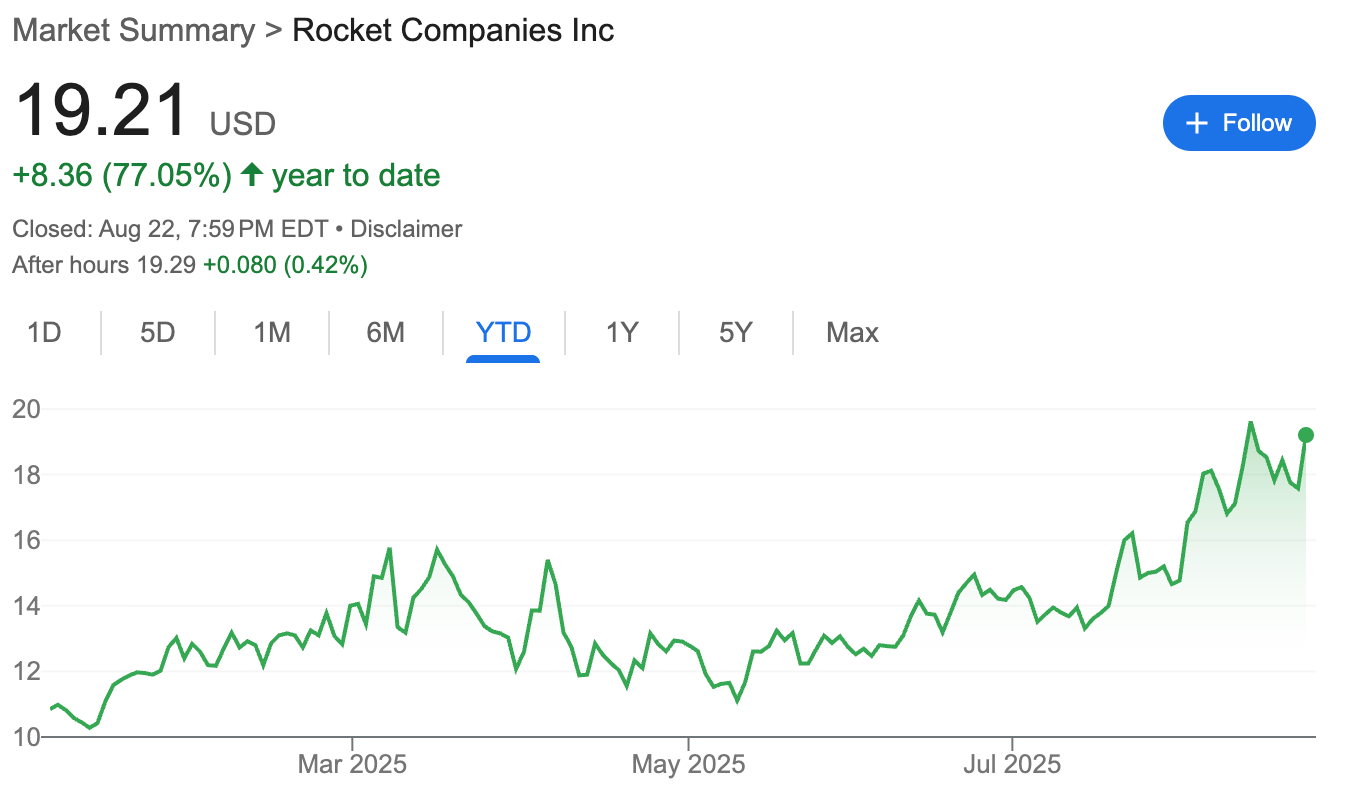

The financial technology business Rocket Companies $RKT ( ▼ 2.02% ), which specializes in homeownership, is up 77.05% this year. The stock has been the darling of Wall Street thanks to stellar results and several strategic acquisitions.

Just last week, the folks over at BTIG decided to sprinkle some optimism on Rocket Companies, initiating coverage with a Buy rating and a $25 price target. They’re feeling all warm and fuzzy about the residential mortgage finance sector, which is great news if you’re a fan of optimism. But remember, optimism doesn’t last forever. The winds of change are always lurking.

Speaking of winds, the U.S. housing market is facing a bit of a chilly breeze. July 2025 saw homes taking longer to sell, and pending home sales dropped 1.1% month-over-month. High prices and economic uncertainty are the culprits, and with mortgage rates still elevated, affordability is an issue.

Now, let’s talk about Rocket’s own little bag of question marks. The company is juggling pending acquisitions of Mr. Cooper and the recent integration of Redfin. Any misstep could hurt the financial performance.

Operating margins are another area where Rocket is feeling the pinch. They’re declining, including a drop in the wholesale margin business.

Should you invest in Rocket’s stock in 2025 or avoid it? Here’s the answer:

Subscribe to Early Bird Prime to read the rest.

Become a paying subscriber of Early Bird Prime to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Expert analysis on the best stocks.

- Stock price predictions based on machine learning.

- Investing picks and recommendations.

- Advertisement-free.