Today is Tuesday, February 6, 2024.

The Early Bird Index today is 65.98.

New to this newsletter? Sign up here

Palantir's "Surging Demand"

Software company Palantir (NYSE: PLTR) surged by 17.28% in after-hours trading on Monday after posting strong financial results.

Financials: Palantir reported earnings of 8 cents per share in the past quarter, which was expected. The revenue reached $608 million, which was better than expected.

Details: U.S. commercial revenue grew 70% in the period as Palantir recorded its fifth straight quarter of profitability.

Quote: “Our results reflect both the strength of our software and the surging demand that we are seeing across industries and sectors for artificial intelligence platforms.” - CEO Alex Karp.

Final Thoughts: Palantir’s stock price has more than doubled in the last 12 months. While the company’s future guidance was mixed, investors are excited about AI-related growth.

Sponsored

Sunday Money

Get 10 quick gems on Money, Investing, and Entrepreneurship every Sunday, and a Midweek Money Minute every Wednesday

Notables

Notable Earnings Today: Eli Lilly (NYSE: LLY), Snap (NYSE: SNAP), Spotify Technology (NYSE: SPOT), Chipotle Mexican Grill (NYSE: CMG), Gilead Sciences (Nasdaq: GILD), Enphase Energy (Nasdaq: ENPH), Ford Motor (NYSE: F), Hertz Global (Nasdaq: HTZ), e.l.f. Beauty (NYSE: ELF), Prudential (NYSE: PRU), Yum China (NYSE: YUMC), Western Union (NYSE: WU), Energizer (NYSE: ENR), MicroStrategy (Nasdaq: MSTR), H & R Block (NYSE: HRB), Fortinet (Nasdaq: FTNT), DuPont (NYSE: DD), Spirit Aerosystems (NYSE: SPR), V.F. Corp (NYSE: VFC), Amgen (Nasdaq: AMGN), Cummins (NYSE: CMI), Edwards Lifesciences (EW), Fiserv (NYSE: FI), Check Point Software Technologies (Nasdaq: CHKP), Advanced Energy (Nasdaq: AEIS), AGCO Corp (NYSE: AGCO), AllianceBernstein (NYSE: AB), Amdocs (Nasdaq: DOX), American Financial Group (NYSE: AFG), Ametek (NYSE: AME), Aramark (NYSE: ARMK), Arrowhead Pharmaceuticals (Nasdaq: ARWR), Assurant (NYSE: AIZ), Atmos Energy (NYSE: ATO), Autohome (NYSE: ATHM), Carlisle Companies (NYSE: CSL), Centene (NYSE: CNC), Cincinnati Financial (Nasdaq: CINF), Cirrus Logic (Nasdaq: CRUS), Cognizant Technology Solutions (Nasdaq: CTSH), DHT (NYSE: DHT), Diodes (Nasdaq: DIOD), Douglas Emmett (NYSE: DEI), Equitable Holdings (NYSE: EQH), Exelixis (Nasdaq: EXEL), FirstService (Nasdaq: FSV), Freshworks (Nasdaq: FRSH), Frontier Group Holdings (Nasdaq: ULCC), Gartner (NYSE: IT), GE HealthCare (Nasdaq: GEHC), Himax Technologies (Nasdaq: HIMX), Jacobs Engineering (NYSE: J), KKR (NYSE: KKR), Kyndryl (NYSE: KD), Lear (NYSE: LEA), Linde (Nasdaq: LIN), Lumen Technologies (NYSE: LUMN), MSG Sports (NYSE: MSGS), Nabors Industries (NYSE: NBR), O-I Glass (NYSE: OI), Omnicom (NYSE: OMC), Precision Drilling (NYSE: PDS), Sensata Technologies (NYSE: ST), Silicon Motion (NasdaqGS: SIMO), Sonos (Nasdaq: SONO), Tradeweb Markets (Nasdaq: TW), UBS (NYSE: UBS), Valvoline (NYSE: VVV), Werner Enterprises (Nasdaq: WERN), Willis Towers Watson (Nasdaq: WTW), Xylem (NYSE: XYL).

Notable IPOs Today: N/A.

Notable Equity Crowdfunding Campaigns Ending Today: Kids & Coffee (MainVest), Voise (Netcapital).

Notable Economic Events Today: EIA Short-Term Energy Outlook (12:00 p.m. ET), API Weekly Crude Oil Stock (4:30 p.m. ET).

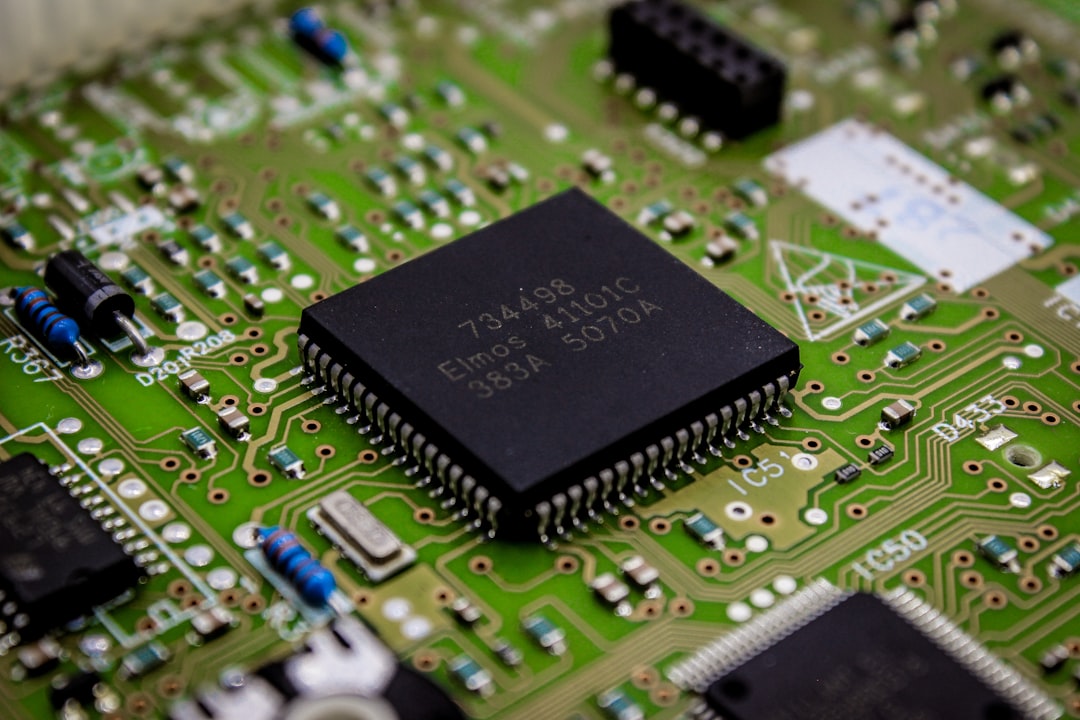

NXP Continues Strong Growth

Chipmaker NXP Semiconductors (Nasdaq: NXPI) jumped 3.63% in after-hours trading on Monday after posting better-than-expected earnings of $3.71 per share in the past quarter, higher revenue at $3.42 billion, and a good financial outlook.

Final Thoughts: NXP, up 17% in the last 12 months, continues to grow its mobile and industrial businesses.

Simon Property’s Higher Dividend

Simon Property Group (NYSE: SPG) ticked up by 1.62% in after-hours trading on Monday after posting good financial results and raising its dividend by 8.3%.

Final Thoughts: Despite problems with the real estate market, Simon Property Group has managed to stay above water in the past year. However, the company’s 2024 outlook is troubling.

Trends to Watch

Crypto on Monday: Bitcoin Slips Towards $42K as Interest Rates Soar; Chainlink's LINK Defies Crypto Slump (CoinDesk)

No March Rate Cut: Stocks Fall After Powell Says Caution Is Needed on Rate Cuts (Wall Street Journal)

Mixed Results: Chegg 4Q Profit Surges Despite Revenue Decline (MarketWatch)

No Takeoff: Virgin Galactic grounded after a small part fell off vehicle during latest space tourism flight (CNN)

Oh, Snap: Snapchat’s parent lays off 10% of workforce in order to ‘reduce hierarchy,’ says company (TechCrunch)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.