Today is Tuesday, July 22, 2025.

The Early Bird Index today is 90.59

New to this newsletter? Sign up here

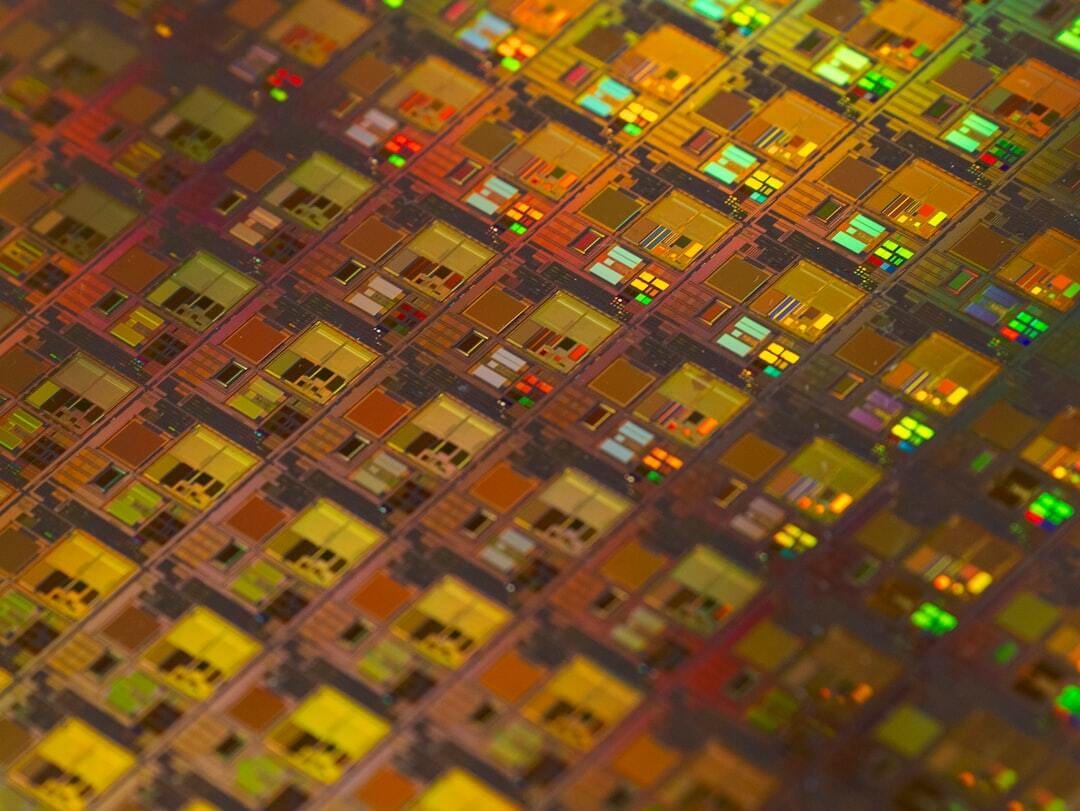

NXP's Flat Automotive Revenue 🚗

Despite posting better-than-expected financial earnings results on Monday, NXP Semiconductors $NXPI ( ▲ 0.07% ) fell 5.51% in after-hours trading.

Financials: NXP reported earnings of $2.72 per share and revenue of $2.93 billion in the past quarter. Both were better than expected.

Powering the Story: Revenue, while better than anticipated, was still down 6% year-over-year. Sales for the automotive unit, which accounts for over half of NXP’s business, were flat year-over-year.

Early Bird’s Nest Egg Gains: 2025 has been a challenging year for automotive-focused semiconductor manufacturers, as inventory corrections, capacity shortages for non-leading-edge chips, price pressure, and trade disruptions all converged, while other sectors consumed industry attention and investment.

The second half of 2025 is seeing improvement, but automakers and their suppliers are now adjusting to a changed competitive landscape, with supply chains and profitability still at risk.

Final Thoughts: Although 2025 has been tough, NXP’s stock is still positive for the year.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

Notables

Notable Earnings Today: Coca-Cola (NYSE: KO), Lockheed Martin (NYSE: LMT), Intuitive Surgical (Nasdaq: ISRG), Texas Instruments (Nasdaq: TXN), General Motors (NYSE: GM), Capital One Financial (NYSE: COF), Cal-Maine Foods (Nasdaq: CALM), SAP SE (NYSE: SAP), Philip Morris International (NYSE: PM), Enphase Energy (Nasdaq: ENPH), Northrop Grumman (NYSE: NOC), Sherwin-Williams (NYSE: SHW), D.R. Horton (NYSE: DHI), Chubb (NYSE: CB), Equifax (NYSE: EFX), Invesco (NYSE: IVZ), Synchrony Financial (NYSE: SYF), Tenet Healthcare (NYSE: THC), Matador Resources (NYSE: MTDR), Quest Diagnostics (NYSE: DGX), RTX (NYSE: RTX), Danaher (NYSE: DHR), Halliburton (NYSE: HAL), Range Resources (NYSE: RRC), KeyCorp (NYSE: KEY), CoStar Group (Nasdaq: CSGP), EQT Corp. (EQT), Avery Dennison (NYSE: AVY), Badger Meter (NYSE: BMI), Baker Hughes (Nasdaq: BKR), Cathay General Bancorp (Nasdaq: CATY), Community Financial System (NYSE: CBU), East West Bancorp (Nasdaq: EWBC), First Bancorp (NYSE: FBP), Genuine Parts (NYSE: GPC), Hope Bancorp (Nasdaq: HOPE), Interpublic (NYSE: IPG), IQVIA (NYSE: IQV), Karooooo (Nasdaq: KARO), Manhattan Associates (Nasdaq: MANH), National Bank (NYSE: NBHC), MSCI (NYSE: MSCI), Old National Bancorp (Nasdaq: ONB), PACCAR (Nasdaq: PCAR), PennyMac (NYSE: PFSI), Pentair (NYSE: PNR), PulteGroup (NYSE: PHM), Renasant (NYSE: RNST), Valmont Industries (NYSE: VMI), Vicor (Nasdaq: VICR).

Notable IPOs Today: N/A.

Notable Equity Crowdfunding Campaigns Ending Today: Asylum Brewing (SMBX), Crimson Horticultural Rarities (SMBX), Doc2Doc Lending (StartEngine).

Notable Economic Events Today: API Weekly Crude Oil Stock (4:30 p.m. ET).

Solana Jumps After Huge Buy

The price of Solana $SOL.X ( ▲ 1.33% ) jumped about 12% Monday to reach its highest value in five months.

Powering the Story: Solana surged on Monday after DeFi Development Corp. $DFDV ( ▼ 2.23% ), a Solana treasury company, announced that it now holds 999,999 SOL and SOL equivalents on its balance sheet following a recent purchase.

Price: Solana is now up 50% in the last 30 days. Meanwhile, DeFi Development Corp. is up 2,700% (wow!) this year.

Final Thoughts: Crypto stocks have been outperforming the market this year. And altcoins such as Solana are having a good summer.

Grab Holdings Ends Monday Strong

The price of Grab Holdings $GRAB ( ▼ 0.46% ), a mobile super app in Southeast Asia, jumped 7.85% in after-hours trading on Monday, primarily due to investor optimism regarding the company's ongoing expansion and recent positive momentum.

Final Thoughts: Grab is up 12% this year.

Trends to Watch

Railing for a Takeover: Berkshire-owned BNSF taps bankers for its own rail acquisition (Semafor)

Crypto Exposure: Its not just bitcoin. Companies are now adding ethereum to their balance sheets. (Yahoo! Finance)

Coming Soon: Joby Seeking Final-Phase Testing for Five Air Taxis in 2026 (Bloomberg)

Tariff Pain: Jeep maker Stellantis says it will lose $2.7 billion due partly to tariffs (ABC News)

Trust Your Gut: Pepsi is betting a popular health trend can get more people to drink its soda (CNN)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Pick winning stocks: Upgrade to Early Bird Prime.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.