Today is Tuesday, November 7, 2023.

The Early Bird Index today is 54.27.

New to this newsletter? Sign up here.

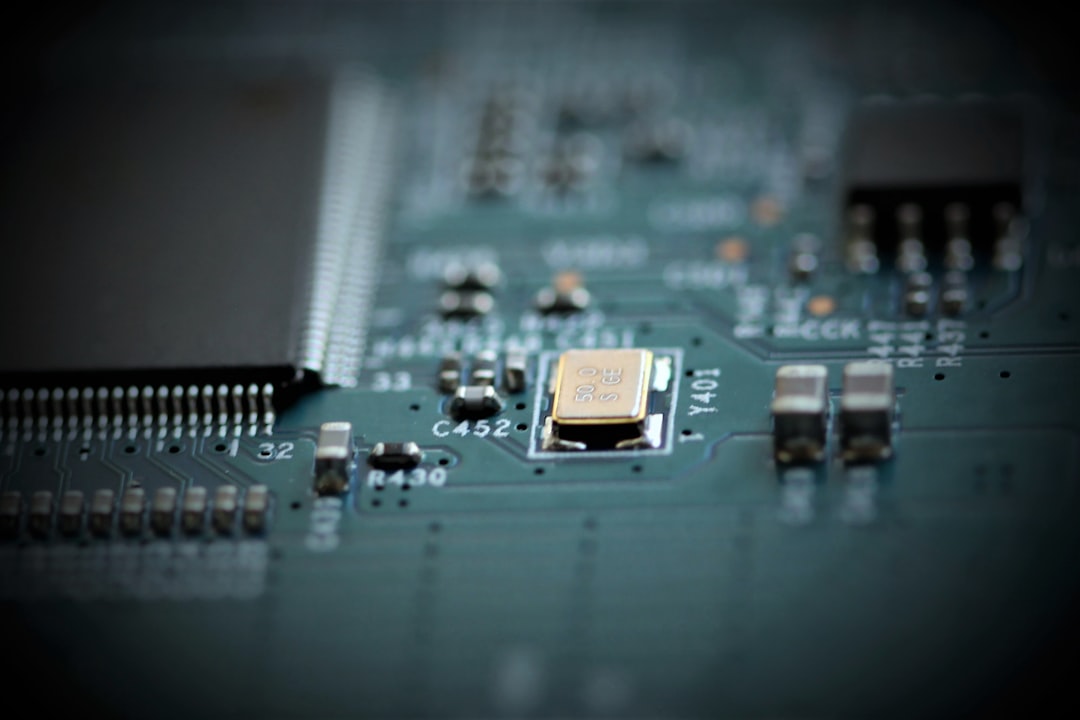

NXP's "Challenging" Market

NXP Semiconductor (Nasdaq: NXPI) ticked up 0.098% in after-hours trading on Monday after the company posted mixed financial results.

Financials: NXP reported earnings of $3.70 per share in the past quarter and revenue of $3.43 billion; both were better than expected.

Details: Revenue declined 0.3% year-over-year. The automotive unit grew but the revenue for the industrial and IoT unit dropped.

Quote: “Revenue for the full year 2023 will be flat versus 2022 in a challenging and cyclical market environment.” - CEO Kurt Sievers.

Final Thoughts: NXP is up 17.9% this year. While the automotive segment is growing, there are concerns about the market environment for semiconductors.

Hal9 (Sponsored)

Chat with your enterprise databases using secure generative AI and empower business users in your team to do their own data analyses in seconds.

Notables

Notable Earnings Today: Bumble (Nasdaq: BMBL), Uber Technologies (NYSE: UBER), Rivian Automotive (Nasdaq: RIVN), eBay (Nasdaq: EBAY), Robinhood Markets (Nasdaq: HOOD), Celsius Holdings (Nasdaq: CELH), Devon Energy (NYSE: DVN), Datadog (Nasdaq: DDOG), Upstart (Nasdaq: UPST), D.R. Horton (NYSE: DHI), Occidental Petroleum (NYSE: OXY), Gilead Sciences (Nasdaq: GILD), GlobalFoundries (Nasdaq: GFS), ContextLogic (Nasdaq: WISH), Toast (NYSE: TOST), Zimmer Biomet (NYSE: ZBH), Lucid Group (Nasdaq: LCID), Mosaic (NYSE: MOS), H&R Block (NYSE: HRB), ACM Research (Nasdaq: ACMR), Planet Fitness (NYSE: PLNT), The Lion Electric Company (NYSE: LEV), Axon (Nasdaq: AXON), Vertex Energy (Nasdaq: VTNR), Dutch Bros (NYSE: BROS), Emerson (NYSE: EMR), Melco Resorts & Entertainment (Nasdaq: MLCO), AdaptHealth (Nasdaq: AHCO), Air Products (NYSE: APD), Akamai Technologies (Nasdaq: AKAM), Amplitude (Nasdaq: AMPL), Andersons (Nasdaq: ANDE), Angi (Nasdaq: ANGI), Array Technologies (Nasdaq: ARRY), Ballard Power (Nasdaq: BLDP), bluebird bio (Nasdaq: BLUE), Brighthouse Financial (Nasdaq: BHF), Brinks (NYSE: BCO), CarGurus (Nasdaq: CARG), CAVA Group (NYSE: CAVA), Choice Hotels (NYSE: CHH), Civitas Resources (NYSE: CIVI), CNH Industrial (NYSE: CNHI), Corsair Gaming (Nasdaq: CRSR), Coupang (NYSE: CPNG), Darling Ingredients (NYSE: DAR), DaVita (NYSE: DVA), Delek US Holdings (NYSE: DK), Extra Space Storage (NYSE: EXR), Fidelity National Information Services (NYSE: FIS), Fidelity National Financial (NYSE: FNF), Flywire (Nasdaq: FLW), Globus Medical (NYSE: GMED), Gogo (Nasdaq: GOGO), GoPro (Nasdaq: GPRO), Grocery Outlet (Nasdaq: GO), GXO Logistics (NYSE: GXO), Hain Celestial (Nasdaq: HAIN), IAC (Nasdaq: IAC), International Money Express (Nasdaq: IMXI), International Seaways (NYSE: INSW), James River Group (Nasdaq: JRVR), Klaviyo (NYSE: KVYO), KKR (NYSE: KKR), Kyndryl (NYSE: KD), Mannkind (Nasdaq: MNKD), Novanta (Nasdaq: NOVT), OraSure (Nasdaq: OSUR), Primerica (NYSE: PRI), Progyny (Nasdaq: PGNY), Rackspace Technology (Nasdaq: RXT), RXO (NYSE: RXO), Sleep Number (Nasdaq: SNBR), Squarespace (NYSE: SQSP), Upwork (Nasdaq: UPWK), Viatris (Nasdaq: VTRS), W&T Offshore (NYSE: WTI), Waters (NYSE: WAT).

Notable IPOs Today: Linde plc Ordinary Shares (Nasdaq: LIN).

Notable Equity Crowdfunding Campaigns Ending Today: Thrive and Grow Farms (Wefunder), Coral Spirits (StartEngine), Needworking, Inc. (Netcapital), Sun & Swell (Wefunder).

Notable Economic Events Today: Trade Balance / Exports / Imports (8:30 a.m. ET), EIA Short-Term Energy Outlook (12:00 p.m. ET), API Weekly Crude Oil Stock (4:30 p.m. ET).

TripAdvisor's Tours Business

TripAdvisor (Nasdaq: TRIP) jumped 12.35% in after-hours trading on Monday after the travel platform posted better-than-expected financial results.

Final Thoughts: Viator, TripAdvisor’s tours and attractions business, jumped 41%. Even though Tripadvisor’s stock is down this year, these results could turn the stock around.

Hims & Hers Health Announces $50 Million Stock Buyback

Although Hims & Hers Health (NYSE: HIMS) missed on its financial earnings, the company announced a $50 million stock buyback. The stock jumped 6.53% in Monday’s after-hours trading.

Final Thoughts: This is good news for the telehealth stock, which is currently flat for the year.

Trends to Watch

Altcoin Season: XRP, LINK, DOGE Lead Altcoin Gains as Bitcoin Sits at $35K (CoinDesk)

Cooling Off: Solana price corrects as recent SOL rally factors come under question (Cointelegraph)

Big Miss: Diamondback Energy Posts Decline in 3Q Revenue, Net Income (MarketWatch)

Self-Funding: With the Closing of the Funding Round Near, StartEngine Tops $20 Million in Investments (Crowdfund Insider)

WeDone: WeWork Files for Bankruptcy (Wall Street Journal)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.