Today is Wednesday, January 24, 2024.

The Early Bird Index today is 63.90.

New to this newsletter? Sign up here

Netflix Throws Shade

Netflix (Nasdaq: NFLX) surged 8.66% in after-hours trading on Tuesday after the streaming giant posted financial results with strong subscriber growth.

Financials: Netflix reported earnings of $2.11 per share in the past quarter, which was lower than expected. But revenue reached $8.83 billion, which was better than anticipated.

Details: The company added 13 million paid subscribers in the quarter, up 4% for its strongest gain since the pandemic.

Quote: “As our competitors adjust to these changes, it’s logical to expect further consolidation, particularly among companies with large and declining linear networks. We’re not interested in acquiring linear assets. Nor do we believe that further M&A among traditional entertainment companies will materially change the competitive environment given all the consolidation that has already happened over the last decade.” - Netflix’s letter to shareholders.

Outlook: The company expects revenue to grow 16% in the current quarter, with some seasonality limiting subscriber growth.

Final Thoughts: Netflix, clearly the current king of streaming, called out its competitors with that comment about consolidation. The stock is up 35% in the past 12 months.

Sponsored

Simplify Wall Street

Logic-Driven Investment Alerts for Independent Investors.

Notables

Notable Earnings Today: Tesla (Nasdaq: TSLA), AT&T (NYSE: T), ASML (Nasdaq: ASML), International Business Machines (NYSE: IBM), Abbott Labs (NYSE: ABT), ServiceNow (NYSE: NOW), Amphenol (NYSE: APH), Lam Research (LRCX), Freeport-McMoRan (NYSE: FCX), United Rentals (NYSE: URI), Kimberly-Clark (KMB), Seagate Technology (Nasdaq: STX), Elevance Health (NYSE: ELV), SAP (NYSE: SAP), Crown Castle (NYSE: CCI), Textron (NYSE: TXT), Packaging Corp (NYSE: PKG), W.R. Berkley (NYSE: WRB), Las Vegas Sands (NYSE: LVS), Ameriprise Financial (NYSE: AMP), Cohen & Steers (NYSE: CNS ), Columbia Banking (Nasdaq: COLB), CSX (Nasdaq: CSX), Ethan Allen (NYSE: ETD), General Dynamics (NYSE: GD), Knight-Swift (NYSE: KNX), Monro Muffler (Nasdaq: MNRO), Plexus (Nasdaq: PLXS), Raymond James (NYSE: RJF),ResMed (NYSE: RMD), Sallie Mae (Nasdaq: SLM), SL Green Realty (NYSE: SLG), TE Connectivity (NYSE: TEL), Teledyne Tech (NYSE: TDY).

Notable IPOs Today: Core Scientific, Inc. Common Stock (Nasdaq: CORZ), J-Long Group Limited Ordinary Shares (Nasdaq: JL), SU Group Holdings Limited Ordinary Shares (Nasdaq: SUGP).

Notable Equity Crowdfunding Campaigns Ending Today: Woods Beer & Wine (Wefunder), Zeehaus (Wefunder).

Notable Economic Events Today: S&P Global Services PMI (9:45 a.m. ET), S&P Global US Manufacturing PMI (9:45 a.m. ET), S&P Global Composite PMI (9:45 a.m. ET), Crude Oil Inventories (10:30 a.m. ET).

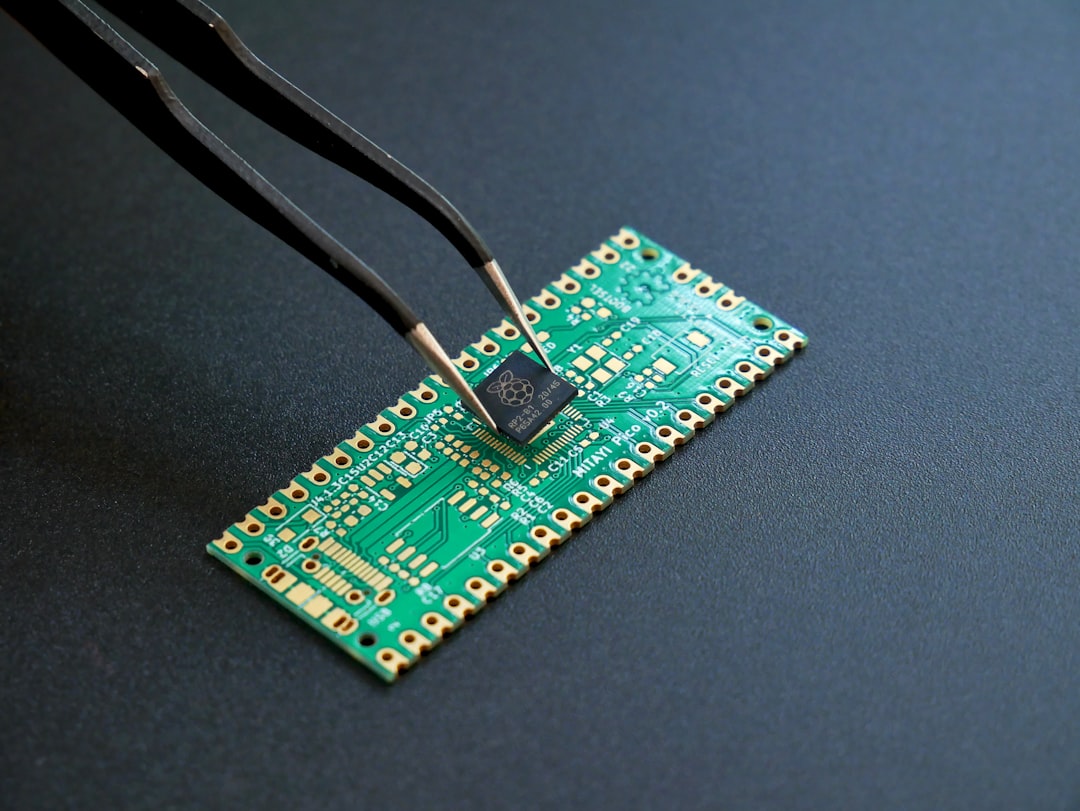

Texas Instruments Sees "Weakness"

Texas Instruments (Nasdaq: TXN) fell by 4.55% in after-hours trading on Tuesday after disclosing weaker financial results.

Financials: Texas Instruments reported earnings of $1.49 per share in the past quarter, which was better than expected. However, the revenue of $4.08 billion was lower than expected.

Powering the Story: The company said it “experienced increasing weakness across industrial and a sequential decline in automotive” during the quarter.

Final Thoughts: Texas Instruments is down about 1% in the last 12 months. These results show problems for the company and the larger semiconductor industry.

BlackBerry Drives Fear With Offering

BlackBerry (NYSE: BB) plunged 11.83% in after-hours trading on Tuesday after announcing a plan to offer $160 million in convertible senior notes.

Final Thoughts: BlackBerry needs cash. The stock is down 16% in the last 12 months.

Trends to Watch

Way Not Fair: Wayfair Layoffs Focused on Remote Workers (Wall Street Journal)

Pivoting: Apple Dials Back Car’s Self-Driving Features and Delays Launch to 2028 (Bloomberg)

Abnormal Price Fluctuation: Crypto Exchange OKX's Token Suffers 50% Flash Crash Amid Liquidation Cascade (CoinDesk)

Investors Are Pleased: Intuitive Surgical 4Q Revenue Rises on Procedure Growth (MarketWatch)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.