Photo by Clay Banks / Unsplash

Today is Wednesday, August 25, 2021.

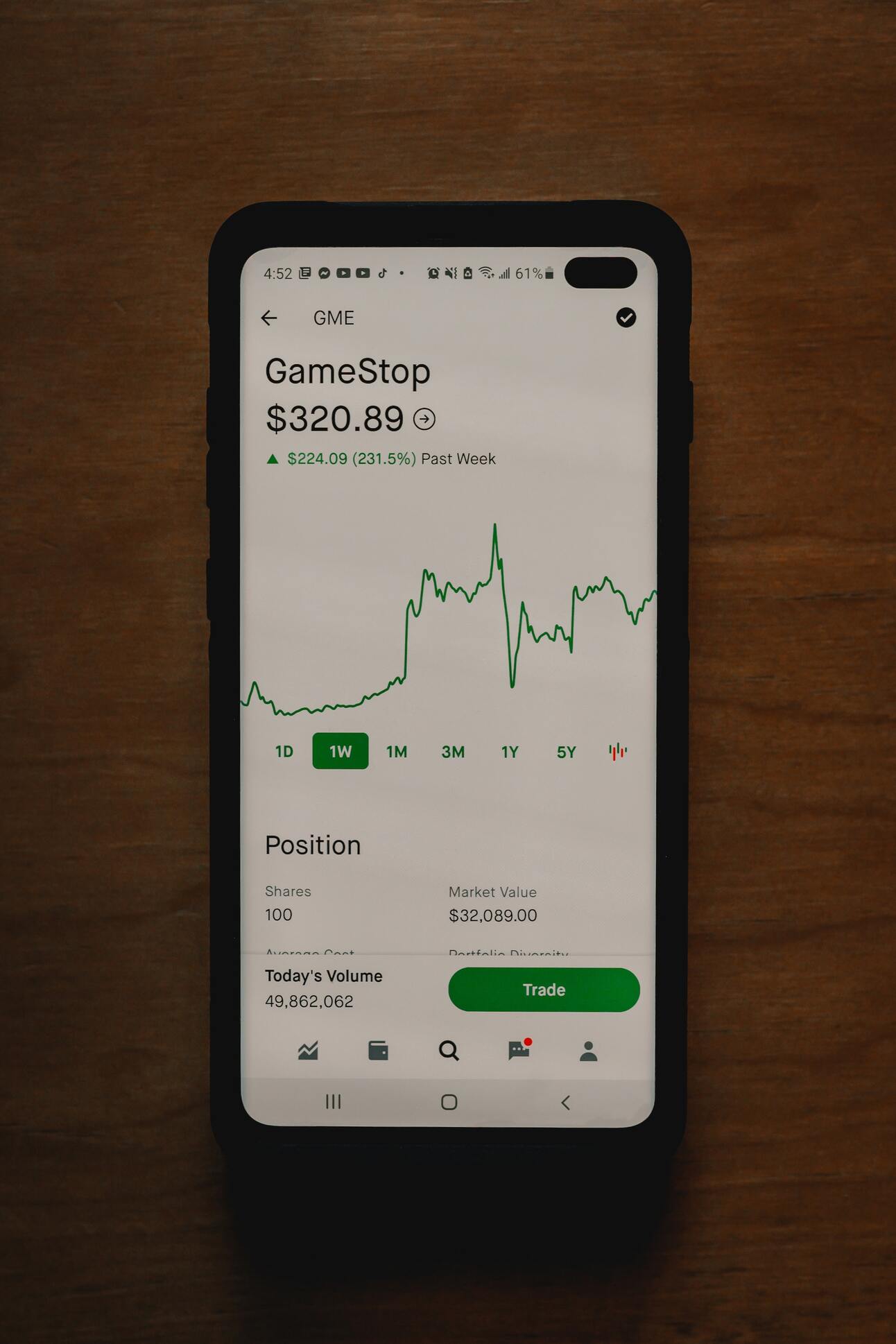

Meme Stocks Pick Up Right Where They Left Off

The WallStreetBets phenomenon returned Tuesday after shares of AMC Entertainment (NYSE: AMC) and GameStop (NYSE: GME) jumped 20% and 27%, respectively.

Meme Stocks Unite: And these weren’t the only meme stocks to soar Tuesday, as shares of Robinhood (Nasdaq: Hood) increased 9%.

What Gives: On the surface, nothing. There was no initial reason or news behind the sudden uptick in shares of AMC and GameStop.

Possible Explanation: Reuters reported Tuesday that the increase in share prices resulted in losses of close to $1 billion to investors who tried to short these stocks. These are usually institutional investors who bet against the price of these companies.

Final Thoughts: Tuesday’s action was reminiscent of the retail trading frenzy that occurred earlier this year.

Notables

Notable Earnings Today: Autodesk (Nasdaq: ADSK), Dick’s Sporting Goods (NYSE: DKS), Salesforce.com (NYSE: CRM), Box (NYSE: BOX), Williams Sonoma (NYSE: WSM).

Notable IPOs Today: n/a

Notable Equity Crowdfunding Campaigns Ending Today: Petzbe (StartEngine), NoBaked Cookie Dough (StartEngine), McKnight’s Sliders & Dogs (MainVest).

Notable Economic Events Today: Durable Goods Orders (8:30 a.m.), Crude Oil Inventories (10:30 a.m.).

Nordstrom Sinks As Earnings Disappoint

Despite posting good earnings and raising its future outlook Tuesday, shares of Nordstrom (NYSE: JWN) fell 8% in after-hours trading.

The Good: Nordstrom’s $0.49 earnings per share beat the projected estimate of $0.27. Revenue came in at $3.66 billion, which was better than the expected $3.36 billion. Net sales grew 101% from the same quarter in 2020.

The Bad: However, net sales fell 6% from the same period in 2019, suggesting that sales were still below pre-pandemic levels.

Observation: Because of the pandemic, Nordstrom pushed its big annual anniversary sale to the third quarter, which may have impacted second-quarter earnings.

Final Thoughts: Macy’s (NYSE: M) and other competitors pushed the bar higher with even better earnings earlier this month.

When SPACs Meet Crypto

One of the most interesting investment trends is the convergence of two recent phenomenons: Cryptocurrency and special-purpose acquisition companies (or SPACs), which are shell companies that acquire a private company to take it public.

Bigger Picture: SPACs generally focus on companies that fit recent economic trends, which includes the very hot crypto industry.

Recent Trends: This summer, there have been a few crypto companies that announced SPAC mergers to go public, including Core Scientific Holding Co. and Power & Digital Infrastructure Acquisition Corp. (Nasdaq: XPDI), Circle and Concord Acquisition Corp. (NYSE: CND), and Bullish and Far Peak Acquisition (NYSE: FPAC).

Buyer Beware: While some SPAC stocks do well, the crypto space currently has a few troubling trends. VPC Impact Acquisition Holdings (Nasdaq: VIH), which announced plans to merge with crypto company Bakkt, has seen its price go down 3% for the year. Ribbit LEAP (NYSE: LEAP), which may aim to merge with a company in the crypto space, has not merged with any company since its SPAC announcement last year. The stock is down 12%.

Final Thoughts: Investing in a crypto SPAC is far from perfect.

Trends to Watch

Bright Future: Citigroup Gearing Up to Trade CME Bitcoin Futures (CoinDesk)

2021 Vision: Eyeglass retailer Warby Parker in IPO filing reveals rising sales—but also widening losses (CNBC)

Setback: Theravance (TBPH) Suffers 2nd Study Failure in Two Months (Nasdaq)

Make It Account: Financial Software Firm Intuit Trounces Quarterly Targets, Gives Robust Outlook (Investor’s Business Daily)

Car Sick: NIO now requires a test before using assisted driving following fatal crash (Electrek)

Thank you for reading! Please share this with a friend.