Photo by Jason Leung / Unsplash

Today is Friday, July 7, 2023.

The Early Bird Index today is 56.98.

New to this newsletter? Sign up here.

Levi Strauss Sees Wholesale Drop

A poor financial outlook caused shares of Levi Strauss (NYSE: LEVI) to drop by 6.32% in after-hours trading on Thursday.

Financials: Levi Strauss reported earnings of 4 cents per share in the past quarter, which was better than expected. Revenue reached $1.34 billion, which was expected.

Growth: Net revenues for direct-to-consumer grew 13% during the past quarter, and e-commerce sales jumped by 20%.

But: Overall net revenues declined by 9% in the quarter. The company blamed its U.S. wholesale business, which CEO Chip Bergh said “remains pressured.”

Outlook: As a result of these pressures in the U.S. wholesale business, Levi Strauss lowered its full-year outlook. The company now expects revenue to grow between 1.5% to 2.5% instead of between 1.5% to 3%. Levi Strauss also lowered its projected earnings per share from $1.30 to $1.40 down to the range of $1.10 to $1.20.

Stock Price: Shares of Levi Strauss are down 8% this year, including a 1% decline in the last 30 days.

Final Thoughts: Investors were not pleased that Levi Strauss lowered its guidance for the year. Some retail stocks are struggling as consumer spending is under pressure in 2023.

Notables

Notable Earnings Today: Immunoprecise Antibodies (Nasdaq: IPA).

Notable IPOs Today: Exchange Traded Concepts Trust (NYSE Arca: MSUQ), Pineapple Financial Inc. (NYSE American: PAPL).

Notable Equity Crowdfunding Campaigns Ending Today: Imagin8 Play Cafe (Mainvest), Biggerstaff Brewing (Honeycomb), Lil Boite Patisserie (Honeycomb), Brueprint Tap Rooms (Mainvest), Lei'd Cookies (Honeycomb), Art of Kava (Honeycomb).

Notable Economic Events Today: Unemployment Rate (8:30 a.m. ET), Nonfarm Payrolls (8:30 a.m. ET), Average Hourly Earnings (8:30 a.m. ET), Labor Force Participation Rate (8:30 a.m. ET).

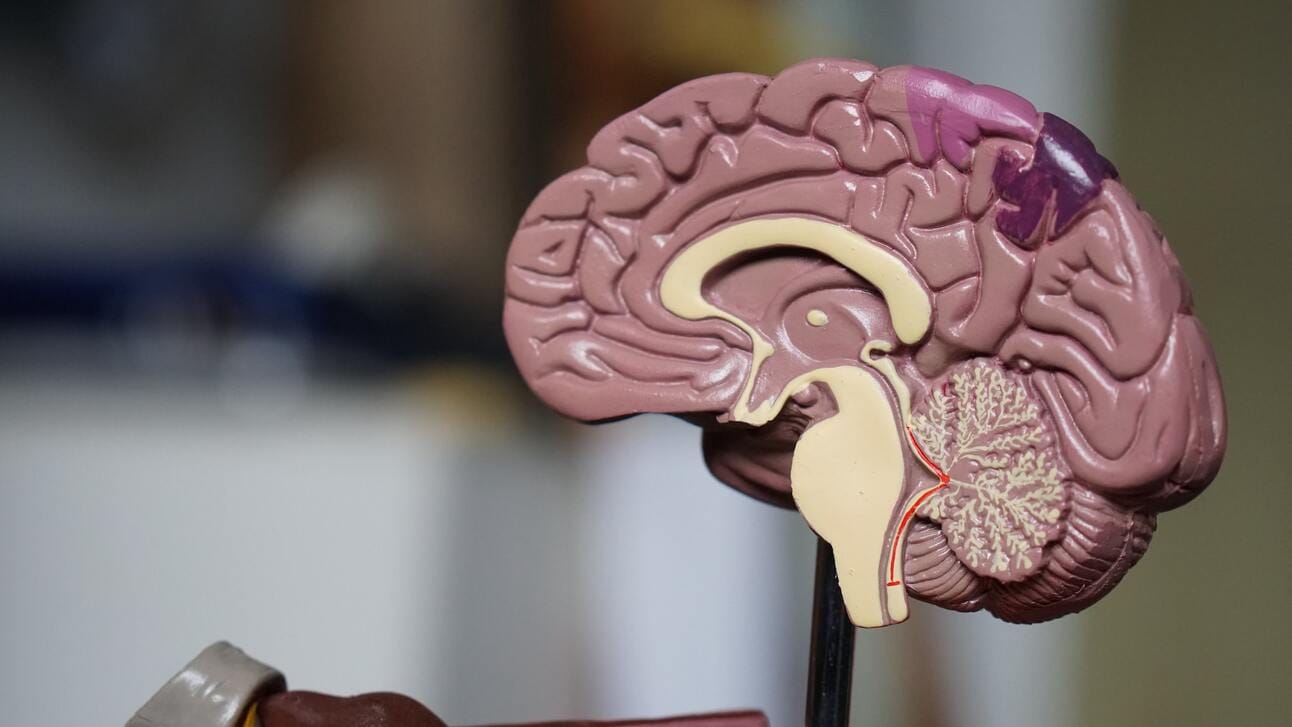

Biogen Alzheimer's Drug Gets FDA Approval

Photo by Robina Weermeijer / Unsplash

The Alzheimer's drug from Biogen (Nasdaq: BIIB) and Eisai (OTCMKTS: ESAIY) known as Leqembi received traditional approval from the U.S. Food and Drug Administration (FDA) on Thursday.

Details: Leqembi is the first drug of its kind to get this approval, which was shown to slow down the progression of Alzheimer's disease. The drug was first approved under a preliminary accelerated approval pathway in January. Medicare coverage for the drug is now available.

Stock Price: Biogen’s stock is up 4% this year, which is better than other health stocks, but is down 6% in the last 30 days.

Final Thoughts: When news of the FDA approval broke in after-hours on Thursday, trading for Biogen was halted. Trading will resume on Friday, and Biogen could be set up for a nice day.

Solana Gets Coca-Cola Bump

While most cryptocurrency prices didn’t go anywhere on Thursday, Solana jumped by 4%.

Details: The business of Coca-Cola (NYSE: KO) in Serbia introduced a new partnership with the Solana platform SolSea on Wednesday. Both parties are working on a non-fungible token (NFT) offering at a music event, according to Blockworks.

Definition: An NFT is a unique digital token on the blockchain. It represents ownership.

Final Thoughts: Solana’s price is about even in the last 30 days, but it is surging by 11% in the last week.

Join 10,000+ Readers Across IB, PE, and VC (Sponsored)

World's most interesting finance newsletter, getting you caught up with what went down each week across private equity, investment banking, and the public markets. Subscribe Here

Trends to Watch

Costly: AbbVie trims full-year profit forecast on higher R&D expenses (Reuters)

Gassed: Costco Same-Store Sales Dipped Again. Blame Gas Prices. (Barron’s)

Twitter Killer: More than 30 million people signed up for Meta's new Threads app (Engadget)

Bad Summer: UPS drivers move closer to a strike after negotiations break down at 4 a.m. amid finger-pointing fracas (Fortune)

Hype Machine: Will 2023 Be the Year of the Bitcoin ETF? (CoinDesk)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.