Source: Joby Aviation

Today is Wednesday, October 8, 2025.

The Early Bird Index today is 92.13.

New to this newsletter? Sign up here

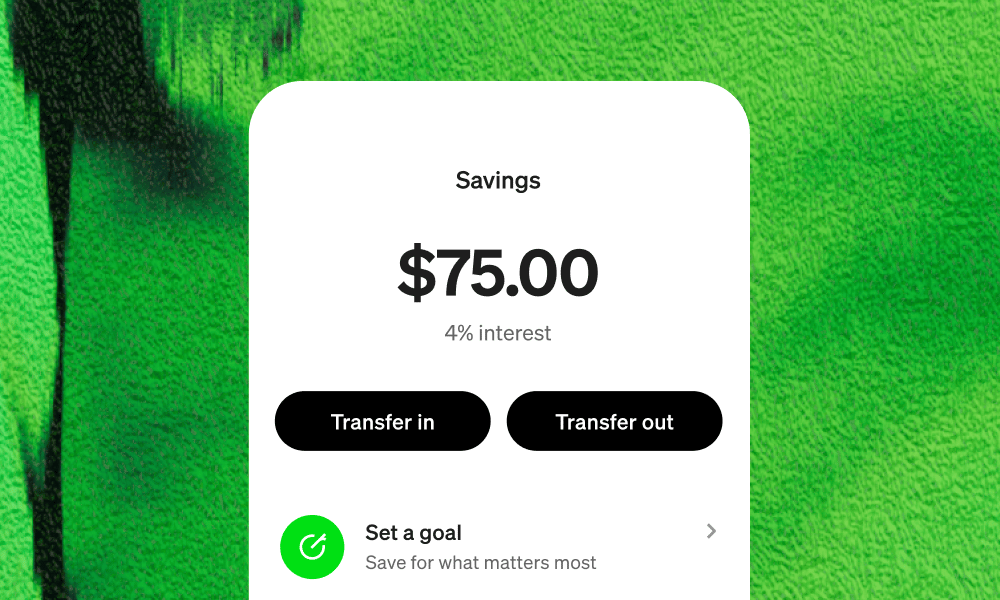

PRESENTED BY CASH APP

Set it, forget it, and save for your goals

Make saving automatic with Cash App. Round up your spare change from every purchase, earn up to 4% interest, and transfer money between your balances whenever you want—all with no hidden fees or minimum balance requirements.*

Saving is easier with Cash App

Use Cash App Card, the debit card for everyday spending, to turn your spare change into savings with Round Ups

Avoid monthly and hidden fees

Make unlimited transfers between your Cash and savings balances

Keep your money safe with 24/7 fraud monitoring and built-in security features

Cash App is a financial services platform, not a bank. Banking services provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms and Conditions. Round Ups and savings provided by Cash App.

Joby Aviation's Dilution Fears

Investors of Joby Aviation $JOBY ( ▼ 3.71% ) know the stock is doing great this year, but a new offering on Tuesday sent shares down 8.78% in after-hours trading.

Details: Joby announced Tuesday that it plans to offer $500 million in its common stock. The new offering will fund the air taxi developer’s certification and manufacturing efforts as it prepares for commercial operations in the future.

Powering the Story: Investors didn’t like the new stock offering due to concerns that it might dilute current shares.

Stock Price: Joby was having an incredible year. The stock was up 133%.

Early Bird’s Nest Egg Gains: Joby Aviation's strong regulatory progress, strategic acquisitions and partnerships, global flight demonstrations, and investor backing have made it one of the top-flight high-growth stocks in 2025, driving its substantial stock appreciation this year.

Final Thoughts: Even in the past month, Joby’s stock was up 40%.

Notables

Notable Earnings Today: AZZ (NYSE: AZZ), Bassett Furniture Industries (Nasdaq: BSET), Resources Connection (Nasdaq: RGP), Richardson Electronics (Nasdaq: RELL).

Notable IPOs Today: POMDOCTOR LIMITED American Depositary Shares (Nasdaq: POM), Talon Capital Corp. Class A Ordinary Shares (Nasdaq: TLNC), Turn Therapeutics Inc. Common Stock (Nasdaq: TTRX).

Notable Equity Crowdfunding Campaigns Ending Today: Jay The Cheesecake Queen (Honeycomb).

Notable Economic Events Today: Construction Spending (10:00 a.m. ET), Crude Oil Inventories (10:30 a.m. ET), FOMC Meeting Minutes (2:00 p.m. ET).

Avalanche's Sentiment Shifts

Tuesday was a setback for cryptocurrency prices. In particular, the price of Avalanche $AVAX.X ( ▲ 1.76% ) fell about 7%.

Powering the Story: Avalanche's drop on Tuesday coincided with a general downturn across the crypto sector. The decline points to a shift in risk sentiment and profit-taking after recent rallies.

Price: Avalanche’s price is up about 4% in the past 12 months. It lags behind most other mainstream cryptos.

Yes, But: Avalanche’s fundamentals remain positive. There is increasing network activity and transaction volumes.

Final Thoughts: Avalanche will also go through an ecosystem upgrade in the future, which could boost the price.

Penguin Solutions Posts Disappointing Revenue

Penguin Solutions $PENG ( ▲ 1.65% ), which provides computing and AI infrastructure, fell 11.67% in after-hours trading on Tuesday after posting mixed financial earnings results.

Financials: Penguin Solutions reported earnings of 43 cents per share in the past quarter, which were better than expected. However, revenue was $337.9 million, which was lower than expected.

Final Thoughts: The stock had been up 39% this year.

Trends to Watch

Golden Times: Gold surges past record $4,000 an ounce as uncertainty fuels rally (BBC)

Investors Are Still Concerned: Tesla offers cheaper versions of 2 electric vehicles in bid to win back market share in tough year (Associated Press)

Dot-Com Era Rewind: Billionaire tech investor Orlando Bravo says ‘valuations in AI are at a bubble’ (CNBC)

Tech Partnership: IBM Stock Hits Record High on Anthropic Deal. It’s Not OpenAI, but It Will Do. (Barron’s)

Bitcoin Pullback: Bitcoin Dips to $122K as Crypto Rally Gets Overheated. What Next? (CoinDesk)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Pick winning stocks: Upgrade to Early Bird Prime.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations, and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.