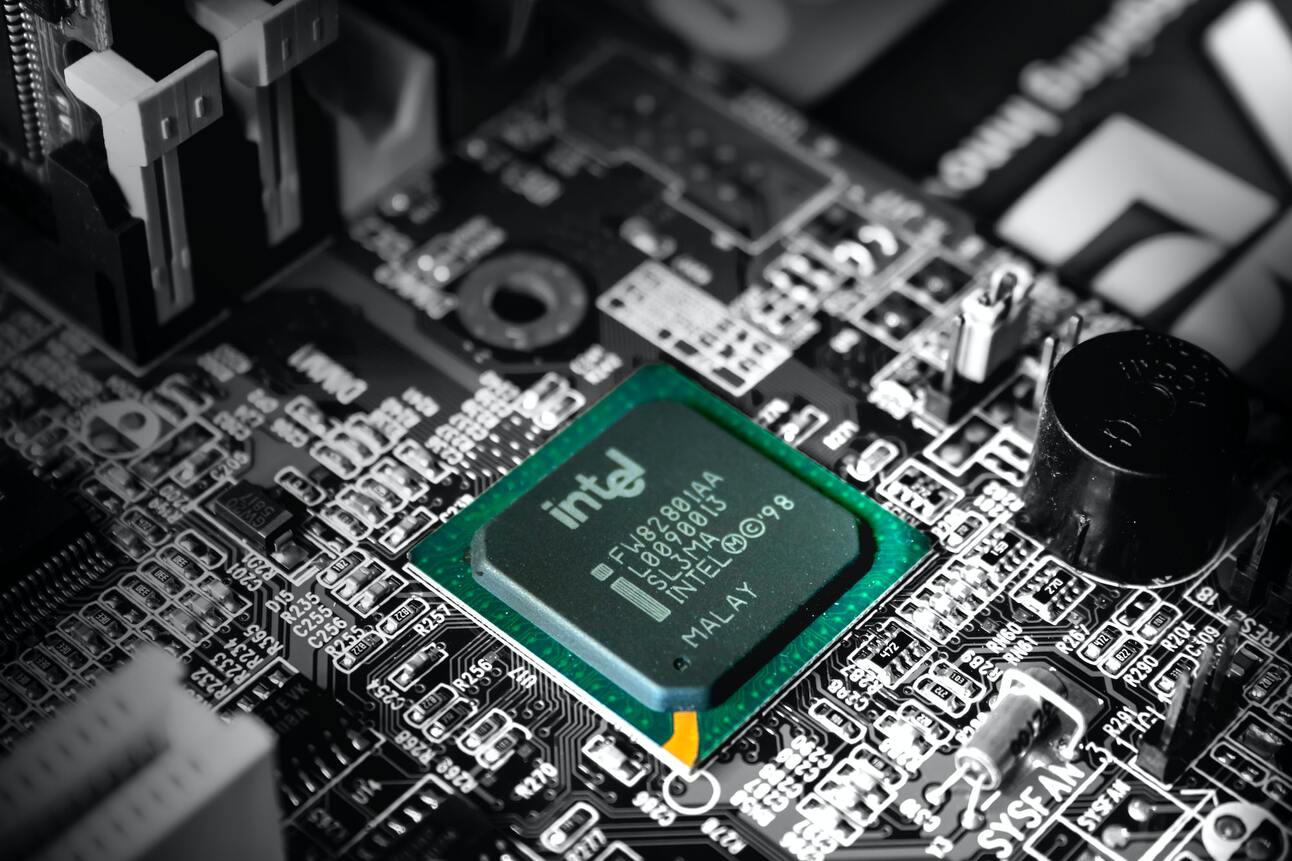

Photo by Slejven Djurakovic / Unsplash

Today is Friday, January 27, 2023.

New to this newsletter? Sign up here.

Intel's Progress is Not Enough

Bad financial results and a poor outlook sunk Intel (Nasdaq: INTC) by 9.74% in after-hours trading on Thursday.

Financials: Intel reported earnings of 10 cents per share and revenue of $14 billion in the quarter; both were below estimates.

Details: The company said that it has made “good progress on its strategic transformation” in the quarter, including its strategy of cost reduction.

But: Intel’s outlook for the current quarter is a loss of 15 cents per share and revenue between $10.5 billion to $11.5 billion; both were below estimates. The company is also not issuing guidance for the full year, which is a problem.

Stock Price: Shares of Intel are down 37% in the last 12 months, but are up 16% in the last 30 days.

Final Thoughts: It’s been a tough year for semiconductor stocks. Intel’s disappointing results and poor outlook won’t please investors.

Notables

Notable Earnings Today: Chevron (NYSE: CVX), American Express (NYSE: AXP), HCA Healthcare (NYSE: HCA), Colgate-Palmolive (NYSE: CL), Booz Allen Hamilton (NYSE: BAH), Autoliv (NYSE: ALV), Charter Communications (Nasdaq: CHTR), Roper Technologies (NYSE: ROP), Badger Meter (NYSE: BMI), Gentex (Nasdaq: GNTX).

Notable IPOs Today: MorningStar Partners, L.P. (NYSE: TXO), Brera Holdings PLC (Nasdaq: BREA), Elate Group, Inc. (Nasdaq: ELGP), Bullfrog AI Holdings, Inc. Common Stock (Nasdaq: BFRG).

Notable Equity Crowdfunding Campaigns Ending Today: Neurotez (Netcapital), Ship It Pro (StartEngine), Instafloss (Republic), Sparket (StartEngine), Teak New York (Mainvest), PowerBuy (Netcapital), Lean Kitchen-Research Triangle Park (Mainvest), Shark Wheel (StartEngine), Asaak (Republic), Nuttin Ordinary by Clean Simple Foods (StartEngine).

Notable Economic Events Today: Core PCE Price Index (8:30 a.m. ET), PCE Price index (8:30 a.m. ET), Personal Spending (8:30 a.m. ET), Pending Home Sales (10:00 a.m. ET), Michigan Consumer Expectations / Sentiment (10:00 a.m. ET).

Visa’s Cross-Border Travel Recovery

Photo by CardMapr.nl / Unsplash

Strong financial results for Visa (NYSE: V) sent shares up 1.11% in after-hours trading on Thursday.

Financials: Visa reported earnings of $2.18 per share and revenue of $7.9 billion in the quarter; both were better than expected.

Closer Look: Revenues grew 12% thanks to what the company called “a continued cross-border travel recovery.” Payment volume also grew by 7%.

Final Thoughts: There are concerns about Visa, including its upcoming CEO change and potential issues with consumer demand in 2023, but these results represent a step in the right direction.

Hasbro Cuts 15% of Staff, Posts Poor Results

Shares of Hasbro (Nasdaq: HAS) dropped 7.49% in after-hours trading on Thursday after the company announced plans to lay off 15% of its global workforce.

Financials: In preliminary fourth-quarter results released by Hasbro on Thursday, revenue dropped 17% year-over-year.

Final Thoughts: Hasbro expects these cost reductions to help the company get closer to profitability. The stock is down 27% in the last 12 months.

Connect to clean energy in two mins (Sponsored)

Whether you rent or own your home, Arcadia can help you power it with 100% clean energy for just $5/month — no installations, long-term commitments, or changes to your current electricity provider.

When you enter your zip code and utility company, Arcadia can check if there is a community solar farm near you. Connect to it for no extra cost and receive guaranteed monthly savings on your power bill.

Sign up to become an Arcadia member today, and get a welcome gift of $10 toward your power bill. Get Your $10!

Trends to Watch

Indifferent: Bitcoin Trades Flat as GDP, Employment Data Signal Mild Growth (CoinDesk)

The End is Near: Bed Bath & Beyond Says Banks Have Cut Off Its Credit Lines (The Wall Street Journal)

Mixed Reaction: Data shows pro Bitcoin traders want to feel bullish, but the rally to $23K wasn’t enough (Cointelegraph)

Grounded: Southwest Says Holiday Meltdown Will Cost It More Than $1 Billion (The New York Times)

Withdrawn: U.S. FDA pulls authorization for AstraZeneca's COVID-19 treatment Evusheld (Reuters)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.