Today is Wednesday, October 4, 2023.

The Early Bird Index today is 51.73.

New to this newsletter? Sign up here.

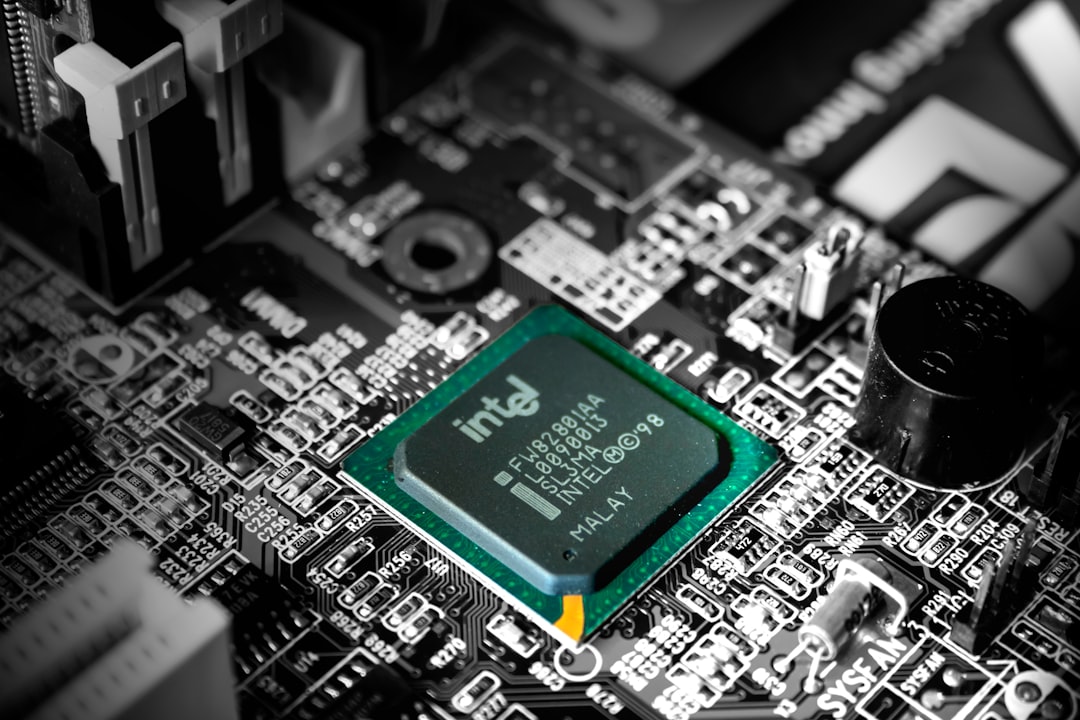

Intel Spins Off Unit With Potential IPO

Intel (Nasdaq: INTC) jumped 2.33% in after-hours trading on Tuesday after the technology company announced that it would spin off one of its units.

Details: The plan is to spin off Intel’s programmable solutions group (PSG) into a standalone business. Intel says that this will give PSG autonomy and flexibility to fully accelerate its growth and compete in the industry.

Big Picture: The new unit won’t become a standalone operation until January 1.

Powering the Story: Within the next two to three years, Intel plans to conduct an initial public offering (IPO) for PSG. The company may also consider private investments in PSG.

Also: Sandra Rivera, executive vice president at Intel, will become CEO of PSG.

Stock Price: Intel is up 33% this year, but down about 2% in the last 30 days. The stock is still down from its 2021 peak.

Final Thoughts: Investors are pleased with this announcement because it allows Intel to focus on growing its core business while maintaining a majority stake in the spinoff. The company’s most recent financial results were also strong.

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Notables

Notable Earnings Today: Tilray (Nasdaq: TLRY), Resources Connection (Nasdaq: RGP), Helen of Troy (Nasdaq: HELE), Accolade (Nasdaq: ACCD), RPM (NYSE: RPM), Acuity Brands (NYSE: AYI), AngioDynamics (Nasdaq: ANGO).

Notable IPOs Today: SWK Holdings Corporation 9.00% Senior Notes due 2027 (Nasdaq: SWKHL), Calamos ETF Trust (NYSE Arca: CVRT).

Notable Equity Crowdfunding Campaigns Ending Today: Keep It Frank (SMBX), NextPower360 (Netcapital)

Notable Economic Events Today: ADP Nonfarm Employment Change (8:15 a.m. ET), S&P Global Services PMI (9:45 a.m. ET), S&P Global Composite PMI (9:45 a.m. ET), ISM Non-Manufacturing PMI / Prices (10:00 a.m. ET), Factory Orders (10:00 a.m. ET), Crude Oil Inventories (10:30 a.m. ET).

Molson Coors Goes Beyond Beer

Shares of Molson Coors (NYSE: TAP) ticked up 1.58% in after-hours trading on Tuesday after the brewing company revealed its future plans.

Details: Molson Coors said that it plans to expand its “beyond beer portfolio” into other spirits and nonalcoholic beverages. There are also plans to grow its core power brand revenue.

Powering the Story: The company also said that it will conduct a $2 billion stock buyback over the next five years. This could raise the stock price.

Stock Price: Molson Coors is up 25% in 2023, but shares are about flat over the last 30 days.

Final Thoughts: Beer companies are considered to be “recession-proof,” which is what attracts investors to these types of stocks. But Molson Coors recently reported lower-than-expected sales. Hopefully, these “beyond beer” plans can grow sales.

Cal-Maine Foods Reports Lower Egg Prices

Cal-Maine Foods (Nasdaq: CALM) plunged by 12% in after-hours trading on Tuesday after the egg producer posted disappointing financial results.

Financials: Cal-Maine reported earnings of two cents per share in the past quarter and revenue of $459.3 million; both were below estimates.

Powering the Story: The reason that the company had a weaker quarter was because egg prices declined from previous inflationary highs.

Final Thoughts: Cal-Maine, down 14% this year, will have a tough time recovering thanks to the lower prices.

Trends to Watch

Stability: UAE dirham stablecoin DRAM launches on Uniswap, PancakeSwap (Cointelegraph)

Driving up: US new vehicle sales jump in third quarter as UAW strike casts shadow (Reuters)

Strong Travel Demand: United Airlines buys 110 additional Boeing, Airbus jets into the 2030s with delivery slots scarce (CNBC)

Zooming: Zoom Docs launches in 2024 with built-in AI collaboration features (The Verge)

Bad Outlook: Bond Selloff Threatens Hopes for Economy’s Soft Landing (The Wall Street Journal)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.