Today is Friday, January 26, 2024.

The Early Bird Index today is 63.59.

New to this newsletter? Sign up here

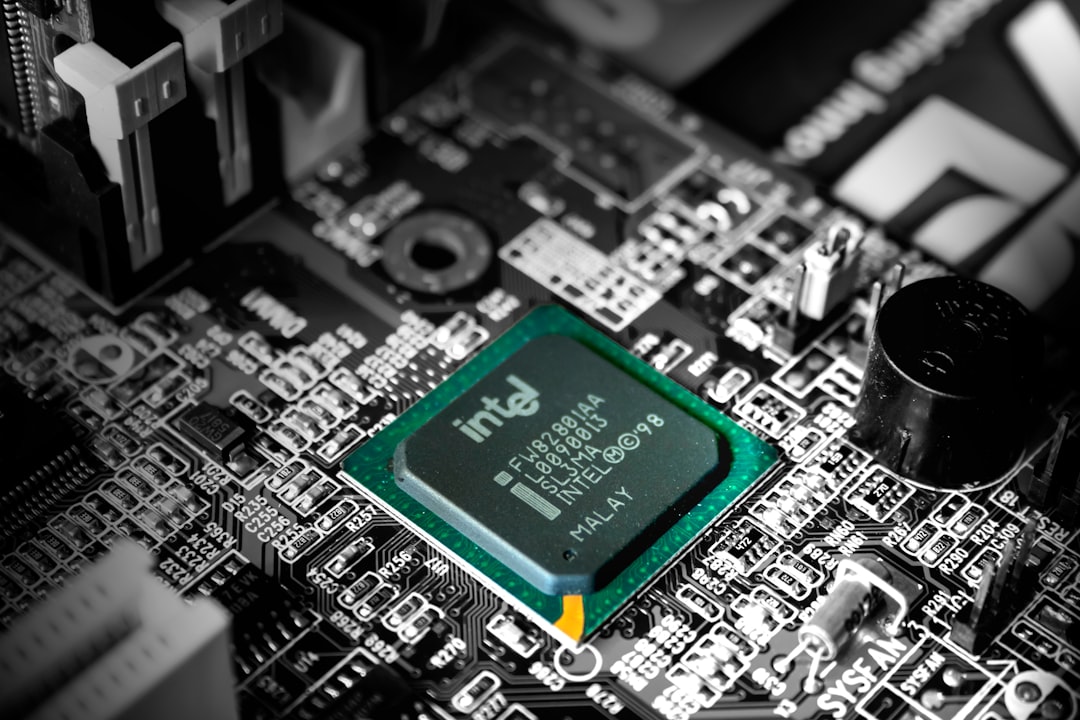

Intel's Outlook Falls Short

Despite posting good financial results on Thursday, Intel (Nasdaq: INTC) fell 10.90% in after-hours trading due to its future outlook.

Financials: Intel reported earnings of 54 cents per share in the past quarter and revenue of $15.4 billion; both were better than expected.

Details: Revenue grew by 10% in the past quarter. The gross margin also ticked up during the period.

Powering the Story: Intel’s outlook rattled investors. The company only expects revenue in the current quarter to be between $12.2 billion to $13.2 billion, way lower than expected.

Stock Price: Intel’s stock benefited from the 2023 tech boom and is up 64% in the last 12 months.

Final Thoughts: Intel’s growth may have just hit a wall. There’s a bigger concern that this could spell trouble for other semiconductor stocks as well.

Alts.co (Sponsored)

Alts.co is the world's largest community of alternative investors. If it's unique or outside the mainstream, we love it. We have 50,000+ subscribers, and getting new ones is like a knife through butter.

Notables

Notable Earnings Today: American Express (NYSE: AXP), Booz Allen Hamilton (NYSE: BAH), Colgate-Palmolive (NYSE: CL), First Hawaiian (Nasdaq: FHB), Autoliv (NYSE: ALV), Badger Meter (NYSE: BMI), Norfolk Southern (NYSE: NSC), Gentex (Nasdaq: GNTX), Stellar Bank (NYSE: STEL), Southside Banc (Nasdaq: SBSI), Moog (NYSE: MOG.A), First Citizens BancShares (Nasdaq: FCNCA), South Plains Financial (Nasdaq: SPFI).

Notable IPOs Today: ArriVent BioPharma, Inc. Common Stock (Nasdaq: AVBP), Haoxi Health Technology Limited Class A Ordinary Shares (Nasdaq: HAO), Psyence Biomedical Ltd. Common Shares (Nasdaq: PBM), BrightSpring Health Services, Inc. Common Stock (Nasdaq: BTSG).

Notable Equity Crowdfunding Campaigns Ending Today: GAMA MORINGA BRANDS (Mainvest), Kon Tiki Room (Mainvest), Bagel Kitchen (Mainvest), Something Sweet Bake Shoppe (Mainvest).

Notable Economic Events Today: Core PCE Price Index / PCE Price Index (8:30 a.m. ET), Personal Spending (8:30 a.m. ET), Pending Home Sales (10:00 a.m. ET).

Visa’s "Resilient" Consumers Ignored

Visa (NYSE: V) posted good financial results on Thursday, but the stock still fell by 2.79% in after-hours trading.

Financials: Visa reported earnings of $2.41 per share in the past quarter and revenue of $8.6 billion; both were better than expected.

Details: CEO Ryan McInerney said that “consumer spending remained resilient” during the quarter.

Yes, But: Concerns about payment volume slowing down in January caused the stock to drop.

Final Thoughts: Visa, up 21% in the last 12 months, experiences a reality check with payment volume declining in January.

Levi Strauss Plans Layoffs

Levi Strauss (NYSE: LEVI) slipped 1.59% in after-hours trading on Thursday after releasing financial results.

Financials: Levi Strauss reported earnings of 44 cents per share in the past quarter, which was better than expected. Revenue reached only $1.6 billion, which was lower than expected.

Powering the Story: The company announced it will cut 10% to 15% of its workforce.

Final Thoughts: Levi Strauss had a bad 2023, so it makes sense that job cuts are coming.

Trends to Watch

More Customers: T-Mobile Earnings Miss, But Subscriber Adds Top AT&T, Verizon (Investor’s Business Daily)

Changing Roles: JPMorgan shuffles top bosses as Wall Street focuses on Dimon succession (Reuters)

Good Question: ETH ETFs Are Inevitable — But When? (CoinDesk)

No Bull: Bitcoin price battle for $40K continues — Here’s what BTC bulls must do (Cointelegraph)

A Gaping Hole: The 737 Max grounding will cost Alaska Airlines $150 million (CNN)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.