Today is Thursday, December 8, 2022.

New to this newsletter? Sign up here.

Early Bird Referral Program

1 Referral

Exclusive Community

3 Referrals

Investing Guide With 12 Stock Picks

7 Referrals

Pick a Stock Topic for a Newsletter

12 Referrals

Coffee Mug

20 Referrals

T-Shirt

40 Referrals

$100 Amazon Gift Card

Powered by Viral Loops

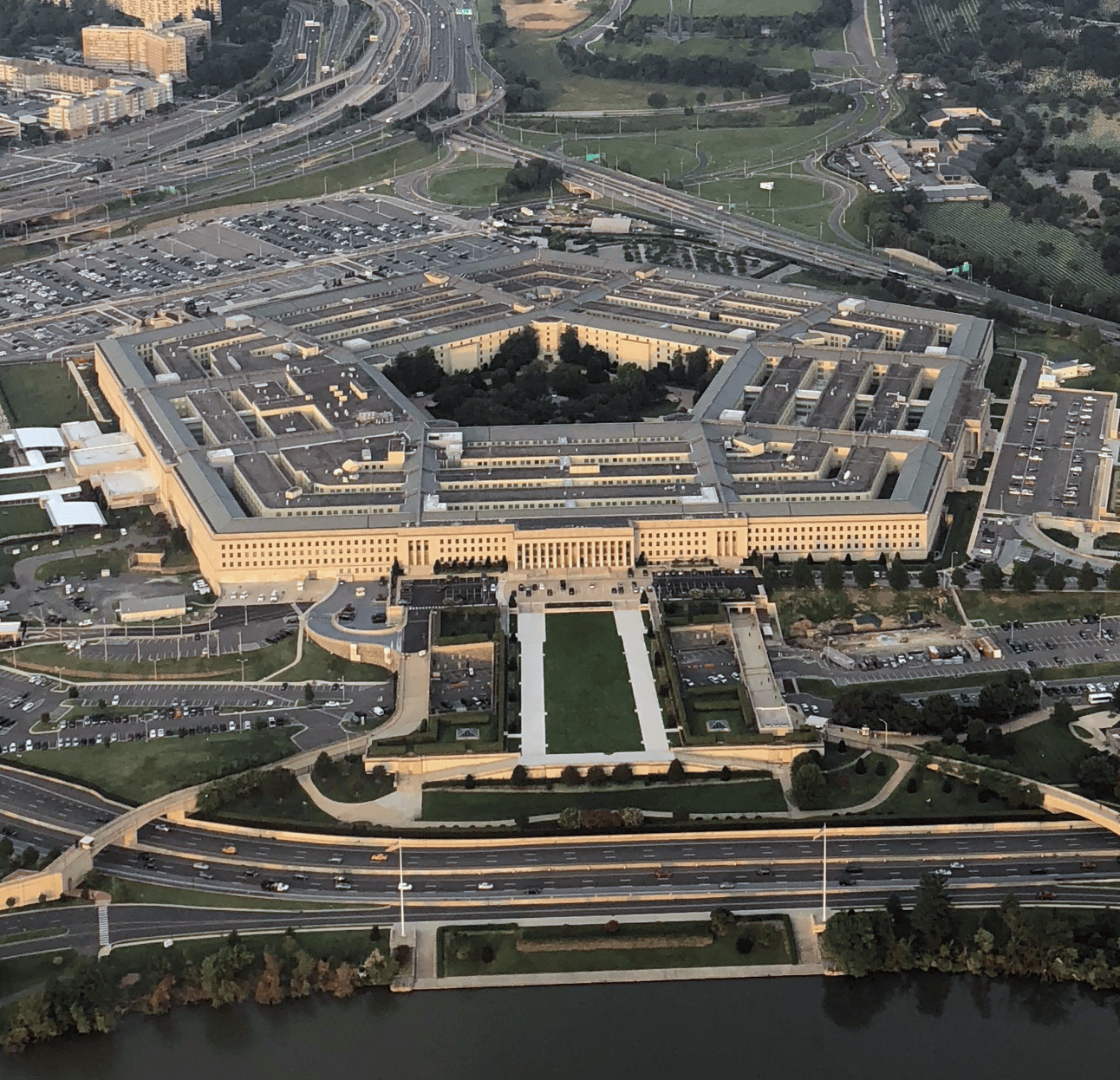

Google, Amazon, Microsoft, Oracle

The $9 billion contract for the Pentagon’s cloud computing network will be split among four leading technology players.

Details: Google’s parent Alphabet (Nasdaq: GOOGL), Amazon (Nasdaq: AMZN), Microsoft (Nasdaq: MSFT), and Oracle (NYSE: ORCL) were the four companies awarded the contract, according to The Associated Press. It is for the Joint Warfighting Cloud Capability (JWCC) for the Department of Defense.

Background: The announcement of a joint award between four companies comes after a year of accusations that the previously-announced contract was decided on political grounds. Sharing the contract seems to solve this problem.

Why This Matters: It’s a coveted contract from the military. In addition to the revenue, it’s a signal that these companies are four of the leading cloud providers.

Stock Price: The news had little impact on the prices of the stocks for all four companies.

Final Thoughts: It’s been a bad year for big tech companies, but hopefully this announcement helps turn things around.

Notables

Notable Earnings Today: Broadcom (Nasdaq: AVGO), Express (NYSE: EXPR), Costco Wholesale (Nasdaq: COST), Ciena (NYSE: CIEN), Lululemon Athletica (Nasdaq: LULU), Hello Group (Nasdaq: MOMO), DocuSign (Nasdaq: DOCU), GMS (NYSE: GMS), Chewy (NYSE: CHWY), RH (NYSE: RH), Hovnanian Enterprises (NYSE: HOB), Domo (Nasdaq: DOMO), Manchester United (NYSE: MANU), CooperCompanies (NYSE: COO), Vail Resorts (NYSE: MTN), National Beverage (Nasdaq: FIZZ).

Notable IPOs Today: SONDORS Inc. Common Stock (Nasdaq: SODR), EF Hutton Acquisition Corporation I Common Stock (Nasdaq: EFHT), TenX Keane Acquisition Ordinary Share (Nasdaq: TENK).

Notable Equity Crowdfunding Campaigns Ending Today: N/A.

Notable Economic Events Today: Jobless Claims (8:30 a.m. ET).

GameStop May Look At Acquisitions

Photo by Michael Förtsch / Unsplash

Despite negative financial earnings results, shares of GameStop (NYSE: GME) grew 3.95% in after-hours trading on Wednesday.

Financials: GameStop reported a loss of 31 cents per share and revenue of $1.186 billion; both were below estimates.

Bad Business: Sales are down from last year. Meanwhile, overall general and administrative expenses were slightly up. GameStop announced more layoffs this week.

Buying: During the earnings call, GameStop CEO Matthew Furlong said the company would take a look at acquisitions as a way to grow the business.

Stock Price: Shares of GameStop are down 41% this year, including an 11% decline in the last 30 days.

Final Thoughts: These negative financial results reflect poorly on GameStop. However, sales attributed to new relationships and collectibles are up, which will give GameStop loyalists reasons to still believe in the stock.

Binance US Abolishes Ethereum Trading Fees

The cryptocurrency exchange Binance US announced Wednesday that it was eliminating fees for those who buy or trade Ethereum - with no trading volume requirements.

Final Thoughts: Despite this positive news, the price of Ethereum dropped 2% on Wednesday due to market pressures.

Trends to Watch

You Get a Pay Raise, And You Get a Pay Raise: Exxon’s US Workers Get Inflation-Busting Pay Hike as Profit Hits Record (Bloomberg)

Another Acquisition: IBM acquires software company Octo from Arlington Partners to expand federal government services (MarketWatch)

Car Wreck: Carvana shares tank as bankruptcy concerns grow for used car retailer (CNBC)

Not Buying This: Daily stock buying by retail traders is near its lowest point all year as caution builds ahead of the final Fed meeting of 2022 (Markets Insider)

You’ll Never Get Me Copper: Bitcoin’s High Correlation to Copper Does Not Bode Well for Short-Term Investors (CoinDesk)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Questions or comments? Hit reply to reach out.