Early Bird Prime for June 16, 2024

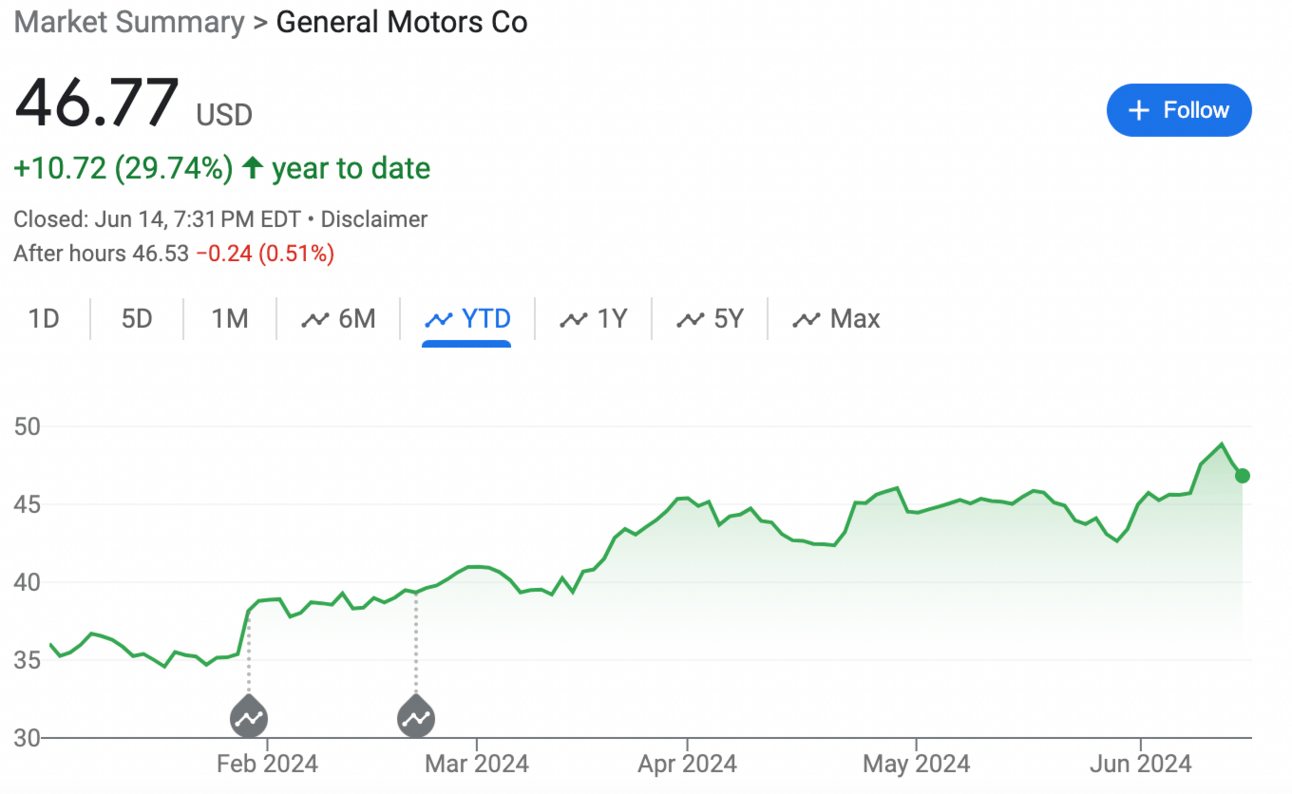

General Motors (NYSE: GM) has been on a wild ride in the stock market. The stock just hit a 52-week high last week, and it’s up 29.74% in 2024.

GM approved a new $6 billion share buyback program this week to add fuel to this stock market joyride. This comes hot on the heels of a previous $10 billion share buyback from November.

But hold your horses, or in this case, your Corvettes. Some analysts are sounding the alarm, arguing that the stock is only up this much because GM is buying back its shares.

The million-dollar question (or should we say the $6 billion question) is: Can the stock continue to grow at a high rate in 2024? Sure, it’s possible, but at some point, the stock could reasonably fall.

GM has pledged to increase production of electric vehicles and hybrids, which sounds fantastic. But with so much competition in the EV and hybrid market, this could be a fool’s errand.

When GM announced the $6 billion stock buyback, CFO Paul Jacobson said the company is “growing and improving the profitability of our EV business and deploying our capital efficiently.”

Keep in mind that GM’s EV business continues to lose money.

Should you buy the stock? Or should you not buy or sell? Well, here’s the answer: