Today is Thursday, September 7, 2023.

The Early Bird Index today is 55.83.

New to this newsletter? Sign up here.

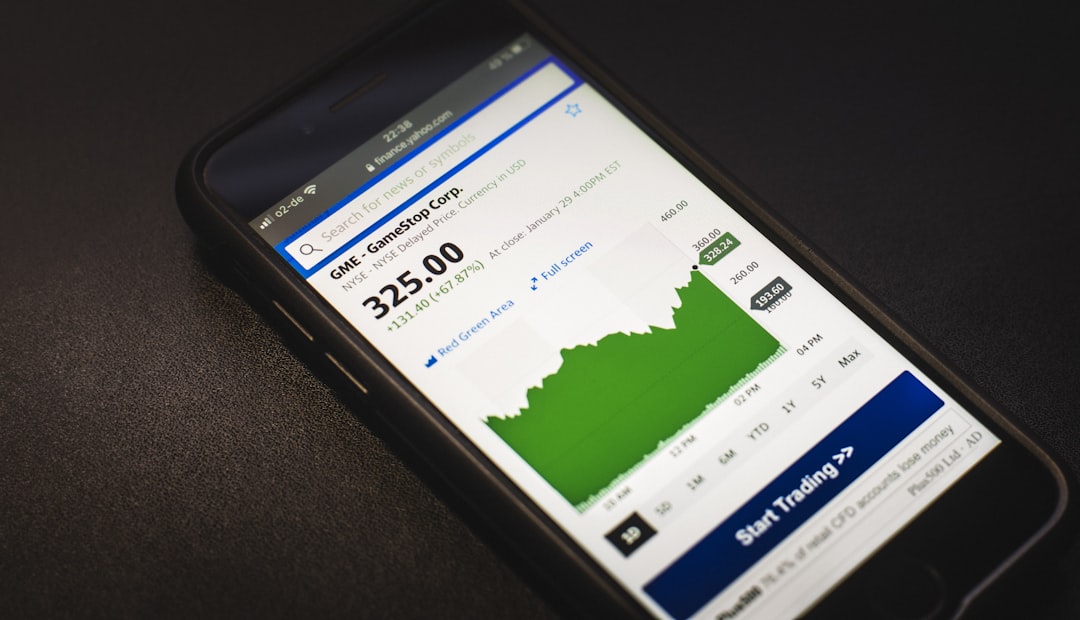

GameStop Grows Despite No CEO

It was game on for GameStop (NYSE: GME) on Wednesday, with the stock jumping 3.57% in after-hours trading after posting good results.

Financials: GameStop reported a loss of 3 cents per share in the past quarter and revenue of $1.16 billion; both were better than expected.

Details: Sales were up in the quarter. The net loss in the quarter was $2.8 million, which is better than the $108.7 million loss in the same period last year.

Background: These are the first financial results since GameStop ousted its CEO in June. The CFO then resigned in July. No replacements have been named yet.

Stock Price: GameStop is up 9% this year, but down 11% in the last 30 days.

Final Thoughts: These results were impressive, but as an investor, it is tough to trust GameStop without knowing when the new CEO will come in.

Notables

Notable Earnings Today: Science Applications (NYSE: SAIC), DocuSign (Nasdaq: DOCU), RH (NYSE: RH), Designer Brands (NYSE: DBI), Planet Labs (NYSE: PL), Smith & Wesson Brands (Nasdaq: SWBI), BRP (Nasdaq: DOOO), ABM Industries (NYSE: ABM), Braze (Nasdaq: BRZE), Korn Ferry (NYSE: KFY), G-III Apparel (Nasdaq: GIII), Smartsheet (NYSE: SMAR), Toro (NYSE: TTC), Semtech (Nasdaq: SMTC), Waterdrop (NYSE: WDH), Zumiez (Nasdaq: ZUMZ), Latronix (Nasdaq: LTRX), Guidewire Software (NYSE: GWRE), Tsakos Energy Navigation (NYSE: TNP).

Notable IPOs Today: Solowin Holdings Ordinary Share (Nasdaq: SWIN), KraneShares Trust (NYSE Arca: KLXY).

Notable Equity Crowdfunding Campaigns Ending Today: Maison Valero (Honeycomb), FH Jerk (Honeycomb), iXperience (StartEngine), Dream City Brewing Company (Mainvest).

Notable Economic Events Today: Jobless Claims (8:30 a.m. ET), Nonfarm Productivity (8:30 a.m. ET), Unit Labor Costs (8:30 a.m. ET), Crude Oil Inventories (11:00 a.m. ET), Fed's Balance Sheet (4:30 p.m. ET).

AI Stock C3.ai Keeps Losing Cash

Despite posting better-than-expected financial results, the artificial intelligence company C3.ai (NYSE: AI) dropped 7.82% in after-hours trading on Wednesday.

Financials: C3.ai reported a loss of 9 cents per share in the past quarter and revenue of $72.4 million; both were better than expected.

Details: Subscription revenue made up 85% of the total revenue. The company also introduced its C3 Generative AI Suite on Wednesday.

Yes, But: C3.ai said that it expects to lose up to $100 million in the fiscal year.

Stock Price: The stock is up 184% this year, but down 14% in the last 30 days.

Final Thoughts: C3.ai is riding the AI wave of success in 2023, but with no profitability this year, investors are correct to be worried.

Blackberry’s Revenue Faces Challenges

Blackberry (NYSE: BB) reported preliminary financial results on Wednesday, causing the stock to drop by 6.32% in after-hours trading. The company only expects revenue in the quarter to be $132 million due to “delays in closing certain large deals.”

Final Thoughts: The stock is up 67% this year, but these preliminary results are troubling.

Get the Best in Bitcoin (Sponsored)

Bitcoin Breakdown boasts the highest signal-to-noise ratio in the newsletter space. It is also carefully curated by an alien from the future. Sign up for free!

Trends to Watch

Packaged Deal: WestRock Shares Jump 12% on Reported Merger Talks With Smurfit Kappa (MarketWatch)

Swiss out of Water: TON Foundation Announces Registration as Swiss Non-Profit (Decrypt)

Fashionable Demand: American Eagle Outfitters lifts revenue forecast on steady demand (Reuters)

House of Cards: Real-Estate Doom Loop Threatens America’s Banks (Wall Street Journal)

Struggling: Bitcoin Set to Form Death Cross as Dollar Index Teases Golden Crossover (CoinDesk)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.