Early Bird Prime for September 22, 2024

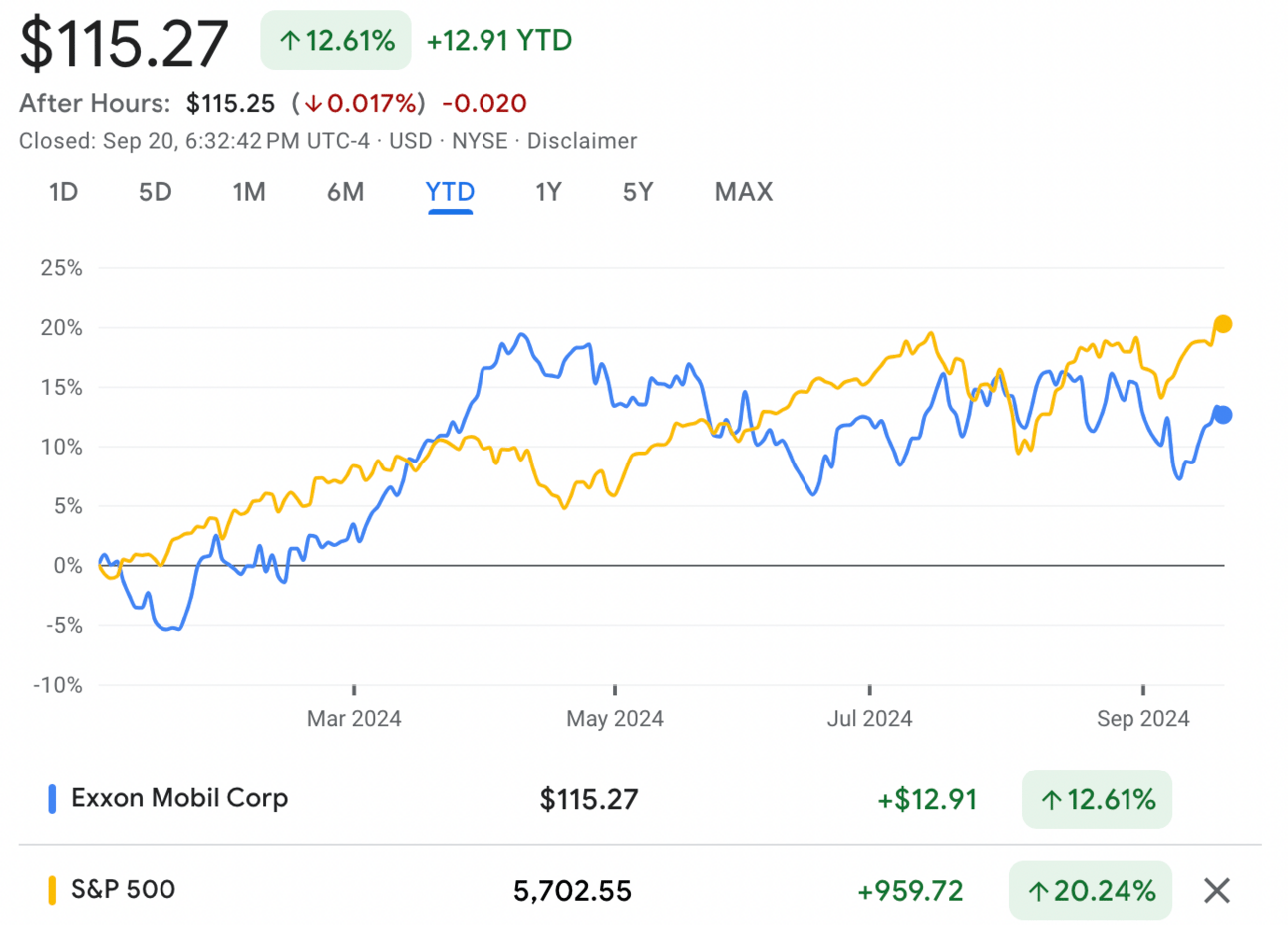

Exxon Mobil (NYSE: XOM) is the granddaddy of oil stocks. This year, Exxon is up a respectable 12.61%. Not too shabby, right? Well, hold your horses, because the S&P 500 is out here flexing with a 20% gain.

It turns out that the oil market is in a questionable place. Concerns about a potential economic slowdown are swirling around, and oil demand and supply are playing a game of hide and seek. Lower oil prices make Exxon look like it’s been left out in the cold.

Before you start writing Exxon’s eulogy, let’s not forget that this stock is steady. With 42 years of dividend increases, Exxon is like a reliable friend.

And just last week, the investment analysts at Mizuho praised Exxon, raising its price target from $128.00 to $130.00. It shows that there’s still some confidence in Exxon’s ability to keep the lights on and the dividends flowing.

But here’s the kicker: Exxon hit an all-time high a few months ago. It’s like reaching the top of Mount Everest and realizing there’s nowhere else to go but down. So, the big question is, should you buy this stock now or avoid it? Well, here’s the answer: