Together With

Gif by snl on Giphy

Today is Friday, June 14, 2024.

The Early Bird Index today is 74.77.

New to this newsletter? Sign up here

PRESENTED BY MEGACHARTS

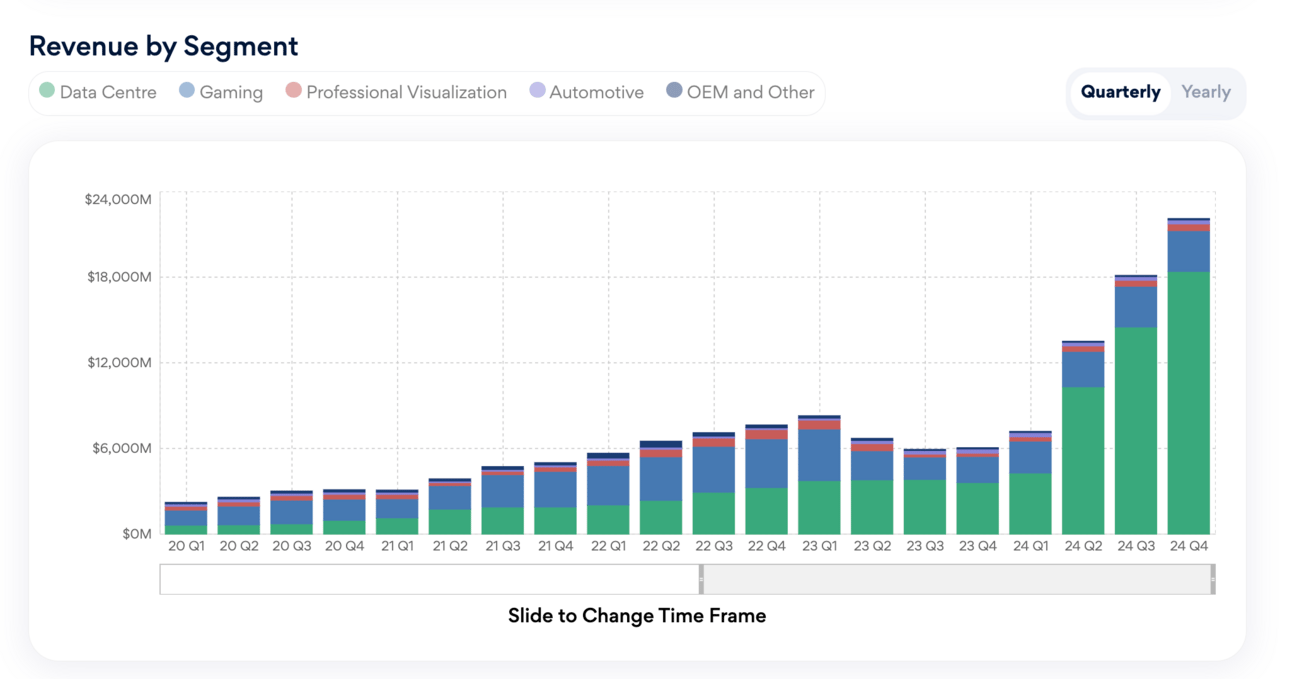

Nvidia’s Incredible 3,000% Growth, Explained

Shares of Nvidia (Nasdaq: NVDA) are up over 3,000% in the last 5 years. But beyond the chart, what metrics specific to Nvidia can investors view to truly understand what’s behind this company’s incredible growth?

By Segment: Data Centre, Gaming, Professional Visualization, Automotive, OEM and Other.

By Geography: U.S, Taiwan, China, Other Countries.

By R&D: R&D Expenses and R&D Spending as a Percentage of Revenue.

Final Thoughts: The research platform MegaCharts has free charts with all this data for Nvidia. Check out MegaCharts today and become the smartest investor out of your friend group.

Elon Musk’s $56 Billion Payday

Elon Musk became $56 billion richer Thursday after Tesla (Nasdaq: TSLA) shareholders approved the CEO’s enormous pay package.

Details: The approval occurred at a shareholder meeting where multiple proposals were voted on, including a decision to move the company from Delaware to Texas.

Background: Musk is getting the extra pay, even though Tesla is struggling to sell cars due to lower demand for electric vehicles.

Stock Price: Tesla is down 26% this year, although the stock is up 2% in the last 30 days.

Final Thoughts: It’s odd that Musk would get the $56 billion pay package given the state of the company’s stock. Some investors were opposed to the package.

Notables

Notable Earnings Today: N/A.

Notable IPOs Today: Sound Point Meridian Capital, Inc. (NYSE: SPMC), Telix Pharmaceuticals Limited American Depositary Shares (Nasdaq: TLX), Tempus AI, Inc. Class A Common Stock (Nasdaq: TEM), Flag Ship Acquisition Corp. Unit (Nasdaq: FSHPU).

Notable Equity Crowdfunding Campaigns Ending Today: RealWorld (Netcapital), ScanHash (Netcapital), Cust Corp. (Netcapital), El Gaucho Grill (Honeycomb), NetWire (Netcapital), Members Mobile (Netcapital), Cupcrew (Netcapital).

Notable Economic Events Today: Import Price Index (8:30 a.m. ET), Export Price Index (8:30 a.m. ET), Michigan Consumer Expectations / Sentiment (10:00 a.m. ET).

Adobe Brushes Off AI Concerns

Adobe (Nasdaq: ADBE) climbed 14.76% in after-hours trading on Thursday after posting strong financial results, including record revenue.

Financials: Adobe reported earnings of $4.48 per share in the past quarter and revenue of $5.31 billion; both were better than expected.

Details: Digital media segment revenue shot up 11%. Creative revenue grew 10%. Digital experience segment revenue increased by 9%.

Outlook: The company also raised its full-year guidance. It now expects revenue between $21.40 billion to $21.50 billion. It also expects earnings per share between $18.00 to $18.20.

Background: Adobe has faced a lot of criticism in the past year for lagging behind other technology companies when it comes to artificial intelligence. Thursday’s results proved that the company can still exceed expectations without AI.

Stock Price: Adobe was down 20.92% this year before these results.

Final Thoughts: Be patient about Adobe’s AI aspirations. The company will slowly integrate AI in the future. For now, it’s still a vibrant subscription software company.

Spot Ethereum ETFs Could Come Soon

We could finally see spot Ethereum ETFs (exchange-traded funds) by the end of the summer, U.S. SEC Chair Gary Gensler said during a senate budget hearing on Thursday.

Background: Similar to spot Bitcoin ETFs, spot Ethereum ETFs would allow traditional investors to get direct exposure to Ethereum.

Price: Ethereum is up 48% this year.

Final Thoughts: Hopefully, there will be more clarity about the approval of spot Ethereum ETFs soon.

Trends to Watch

Hacked: Holograph fell 80% in 9 hours after exploiter mints 1B additional HLG (Cointelegraph)

Slow Housing Market: RH shares fall after furniture retailer reports bigger-than-expected loss (MarketWatch)

Meme Stock Craze: Roaring Kitty’s GameStop stake grows to 9 million shares after selling his big options position (CNBC)

Decentralized Physical Infrastructure Networks: Franklin Templeton points to these two Solana projects as early ‘DePIN’ winners (DLNews)

Happy Travels: Boeing’s Plane Turmoil May Make Summer Travel Worse (Bloomberg)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Pick winning stocks: Upgrade to Early Bird Prime

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.