Early Bird Prime for December 7, 2025

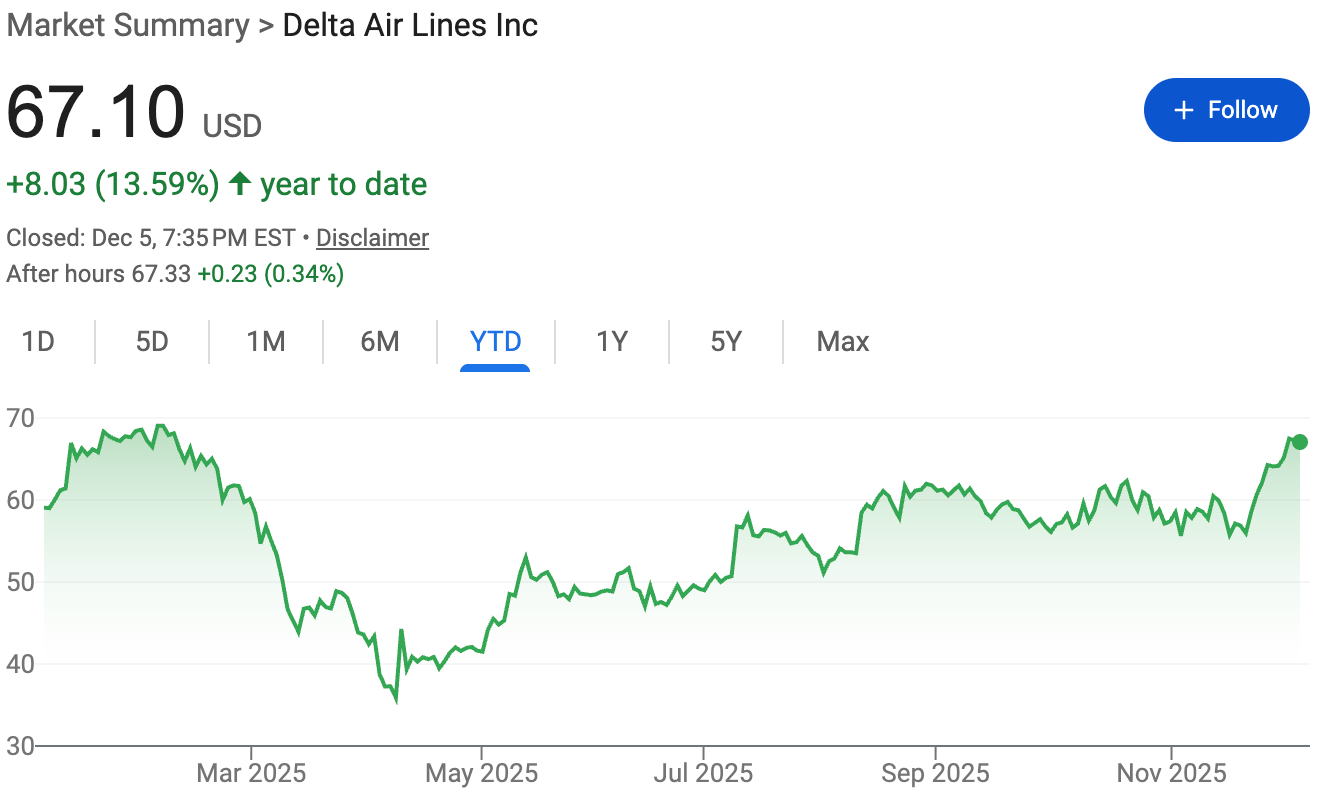

Delta Air Lines $DAL ( ▲ 2.97% ) is the high-flying stock that's been giving investors a reason to smile, or at least a reason to check their portfolios more frequently. Up a respectable 13.59% this year, Delta's stock has been climbing like a plane on takeoff, with most of the boost coming in the past few weeks. It's now flirting with its all-time high.

Just a few days ago, a Citi analyst declared that the U.S. airline sector is entering a "Supermajors Super-Cycle." Sounds fancy, right? According to this analyst, 2026 will be a golden era for large carriers, and they have even initiated a buy rating for Delta.

But there are challenges with Delta. The recent U.S. government shutdown forced Delta to slash flights, leaving it with a financial hangover. The company lost money, but Delta anticipates an eventual recovery.

Of course, there's the looming specter of a global slowdown or recession in 2026. If that happens, discretionary travel could take a nosedive, and Delta's premium and corporate demand might be grounded.

Delta also faces fierce competition from U.S. legacy carriers, low-cost carriers, and international airlines. This intense competition limits Delta's pricing power in many markets, making it harder to charge premium prices for those extra legroom seats.

Should you buy Delta’s stock right now in 2025, or should you avoid it? Here’s the complete answer:

Subscribe to Early Bird Prime to read the rest.

Become a paying subscriber of Early Bird Prime to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Expert analysis on the best stocks.

- Stock price predictions based on machine learning.

- Investing picks and recommendations.

- Advertisement-free.