Early Bird Prime for July 21, 2024

CrowdStrike (Nasdaq: CRWD) became famous on Friday for all the wrong reasons.

On Friday, CrowdStrike sent out an update to their software that had an error in it, causing a global outage impacting airlines, banks, hospitals, broadcasters, and other businesses.

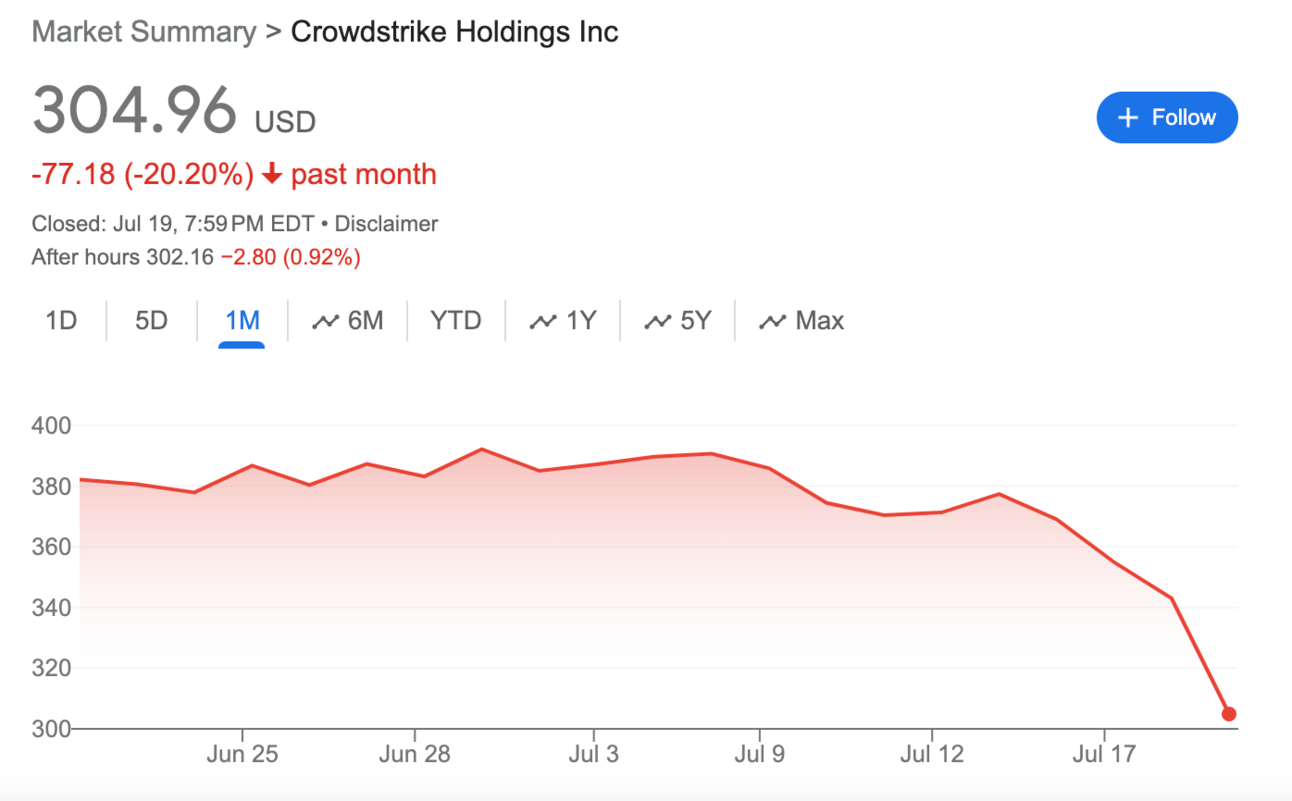

The stock market, being the drama queen that it is, reacted with all the subtlety of a soap opera villain. CrowdStrike’s stock fell 11.10% on Friday. Wedbush's Dan Ives called it a “black eye moment” for the company, saying CrowdStrike’s brand damage could last for a while.

That wasn’t the only problem that CrowdStrike’s stock faced recently.

On Thursday, the day before the outage, Redburn-Atlantic decided to rain on CrowdStrike’s parade by changing its rating on the cybersecurity firm's stock from Buy to Sell. The firm also adjusted the price target to $275 from the previous $380. In early July, Piper Sandler also downgraded CrowdStrike.

CrowdStrike is now down 20.20% in the last 30 days. It’s a sad time for investors in the company.

But other investors see this as an opportunity to buy the dip. Because, hey, who doesn’t love a good bargain?

On Friday, after the outage, Rosenblatt analysts said the dip “presents a compelling buying opportunity for CrowdStrike investors.”

CrowdStrike is a leading name in cybersecurity. Is this a great opportunity to buy the stock now that the price is down, or is this stock one you should avoid like a suspicious email from a Nigerian prince? Or if you already have the stock, should you sell now and cut your losses? Well, here’s the answer…