Today is Tuesday, March 18, 2025.

The Early Bird Index today is 70.05

New to this newsletter? Sign up here

Alphabet's Biggest Acquisition

Google parent Alphabet $GOOGL ( ▼ 1.77% ) wants to reinforce the cybersecurity abilities of its cloud platform and it is reportedly looking to make an acquisition.

Details: The Wall Street Journal reported Monday afternoon that Alphabet is in advanced talks to acquire the cybersecurity startup Wiz in a deal that could potentially come together soon. The company did not respond to the report.

The deal would be worth around $30 billion, which would be Alphabet’s largest acquisition ever.

Background: Alphabet reportedly engaged Wiz in talks last year for an acquisition. Since then, the company has experienced slower growth in its cloud business. The stock is down over 12% in 2025.

Early Bird’s Nest Egg Gains: If Alphabet acquired Wiz, it would have significant implications for both Alphabet and its cloud business.

Google’s cloud platform would gain advanced cloud security capabilities, allowing it to offer more robust and comprehensive security solutions to its customers.

The deal would allow the company to become a growing force in cybersecurity.

Final Thoughts: Alphabet’s stock was basically flat in after-hours trading, but the report caused a few cybersecurity stocks to dip.

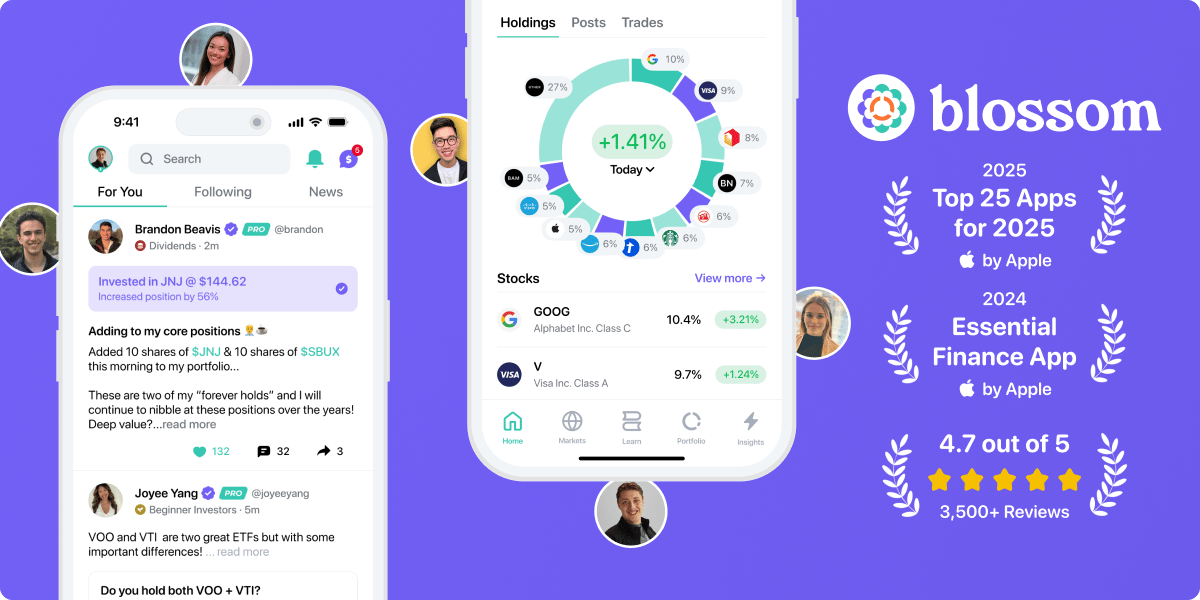

📈 If you love investing, you’ll love Blossom - a social network where over 250,000 investors are sharing their portfolios and ideas, backed-up by what they’re actually investing in.

⭐️ With a 4.7 rating in the App Store, Blossom is jam-packed with tools to help you become a better investor.

Notables

Notable Earnings Today: Tencent Music (NYSE: TME), Maravai LifeSciences (Nasdaq: MRVI), HUYA (NYSE: HUYA), ZTO Express (NYSE: ZTO), KE Holdings (NYSE: BEKE), XPeng (NYSE: XPEV), Acurx Pharmaceuticals (Nasdaq: ACXP), Absci (Nasdaq: ABSI), Bitcoin Depot (Nasdaq: BTM), Elbit Systems (Nasdaq: ESLT), Eton Pharmaceuticals (Nasdaq: ETON), INOVIO (Nasdaq: IVO), MiNK Therapeutics(Nasdaq: INKT), OmniAb (Nasdaq: OABI), SNDL (Nasdaq: SNDL), StoneCo (Nasdaq: STNE), Surf Air Mobility (NYSE: SRFM), Waldencast (Nasdaq: WALD).

Notable IPOs Today: Quartzsea Acquisition Corporation Units (Nasdaq: QSEAU).

Notable Equity Crowdfunding Campaigns Ending Today: Aerovec (StartEngine), Bracketology (Wefunder), The Axe Parlor (Honeycomb).

Notable Economic Events Today: Building Permits (8:30 a.m. ET), Housing Starts (8:30 a.m. ET), Import Price Index (8:30 a.m. ET), Industrial Production (9:15 a.m. ET), API Weekly Crude Oil Stock (4:30 p.m. ET).

Bakkt's Bank of America Deal

The cryptocurrency platform Bakkt Holdings $BKKT ( ▼ 6.84% ) plunged 32.58% in after-hours trading on Monday after announcing that it lost two partnership deals.

Powering the Story: Bakkt announced that Bank of America $BAC ( ▼ 1.81% ) would not renew its agreement with the company. Bank of America represented 16% to 17% of the company’s loyalty services revenue.

The trading platform Webull also ended its agreement with Bakkt. Webull represented about 74% of the company’s crypto services revenue.

Final Thoughts: Baakt, which was previously down 49% in 2025, also rescheduled its upcoming earnings call because of the end of the lucrative partnerships.

Chainlink’s Monday Uptick

Amid positive market sentiment and increased on-chain activity, the price of the cryptocurrency Chainlink $LINK.X ( ▼ 3.33% ) jumped about 2% on Monday.

Final Thoughts: Chainlink is still down about 26% in the last 30 days.

Trends to Watch

Debt Diet: WeightWatchers, Lenders Start Private Talks to Address Debt (Bloomberg)

Waiting: Bitcoin Edges Higher to $84K as Analyst Warns of Another Leg Down for Crypto (CoinDesk)

But Not Forever Solvent: Fast-fashion staple Forever 21 files for bankruptcy again (Washington Post)

Big Tuesday: Nvidia's AI Event Kicks Off Tuesday With Jensen Huang Keynote. Here Are 5 Things to Expect. (Barron’s)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.