Today is Tuesday, February 3, 2026.

The Early Bird Index today is 83.50.

New to this newsletter? Sign up here

PRESENTED BY CASH APP

What if saving felt as easy as your morning routine?

With Cash App, it can.

Round up your spare change from your coffee runs, save part of every paycheck with direct deposit, and make your savings work for you with up to 3.5% interest. Plus, there are no monthly or hidden fees, or minimum balances.

Save and transfer money whenever you want, and know your money is safe with 24/7 fraud monitoring and proactive security features.

Reach your goals faster with a better way to save that fits into your everyday life.

Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms & Conditions. Eligibility restrictions apply to some benefits. See Terms and Conditions for more information.

Palantir's Surging U.S. Sales 📈

Palantir Technologies $PLTR ( ▲ 6.85% ) jumped 6.95% in after-hours trading on Monday after reporting strong financial results that included a 93% surge in U.S. revenue.

Financials: Palantir reported earnings of 25 cents per share in the past quarter and revenue of $1.4 billion. Both were better than expected.

Early Bird’s Nest Egg Gains: Management and analysts tie the outperformance in the U.S. to strong uptake of Palantir’s AI-driven products.

The U.S. commercial customer base is rapidly expanding, with U.S. commercial revenue up 137%. The U.S. commercial remaining deal value is up 145%.

Final Thoughts: It’s another big quarter for Palantir, which hit an all-time high stock price in late 2025.

Notables

Notable Earnings Today: PayPal (Nasdaq: PYPL), Advanced Micro Devices (Nasdaq: AMD), PepsiCo (Nasdaq: PEP), Super Micro Computer (Nasdaq: SMCI), Chipotle Mexican Grill (NYSE: CMG), Merck (NYSE: MRK), Pfizer (NYSE: PFE), Skyworks (Nasdaq: SWKS), Suncor Energy (NYSE: SU), Take-Two Interactive Software (Nasdaq: TTWO), Match Group (Nasdaq: MTCH), Enphase Energy (Nasdaq: ENPH), Clorox (NYSE: CLX), Mondelez International (Nasdaq: MDLZ), Lumen Technologies (NYSE: LUMN), Amgen (Nasdaq: AMGN), Lumentum (Nasdaq: LITE), ADM (NYSE: ADM), Electronic Arts (Nasdaq: EA), Gartner (NYSE: IT), Prudential (NYSE: PRU), Chubb (NYSE: CB), Madison Square Garden Ent. (NYSE: MSGE), Marathon Petroleum (NYSE: MPC), Galaxy Digital (Nasdaq: GLXY), Eaton (NYSE: ETN), MPLX LP (NYSE: MPLX), Amdocs (Nasdaq: DOX), Hubbell (NYSE: HUBB), Amcor (NYSE: AMCR), ATI Inc. (NYSE: ATI), Atkore International (NYSE: ATKR), Broadridge Financial (NYSE: BR), Capri Holdings (NYSE: CPRI), Cirrus Logic (Nasdaq: CRUS) Corteva (NYSE: CTVA), Emerson (NYSE: EMR), Enterprise Products (NYSE: EPD), fuboTV (NYSE: FUBO), H & R Block (NYSE: HRB) Hamilton Lane (Nasdaq: HLNE), IAC Inc. (Nasdaq: IAC), Illinois Tool Works (NYSE: ITW), Jacobs Solutions (NYSE: J), Mercury (Nasdaq: MRCY), Pentair (NYSE: PNR), Transdigm Group (NYSE: TDG), Voya Financial (NYSE: VOYA), Weatherford (Nasdaq: WFRD) Willis Towers Watson (Nasdaq: WTW).

Notable IPOs Today: Iris Acquisition Corp II (NYSE: IRAB).

Notable Equity Crowdfunding Campaigns Ending Today: Sl8 (Wefunder), THORPE (Republic), CureValue (Republic), Stemnovate (Crowdcube).

Notable Economic Events Today: API Weekly Crude Oil Stock (4:30 p.m. ET).

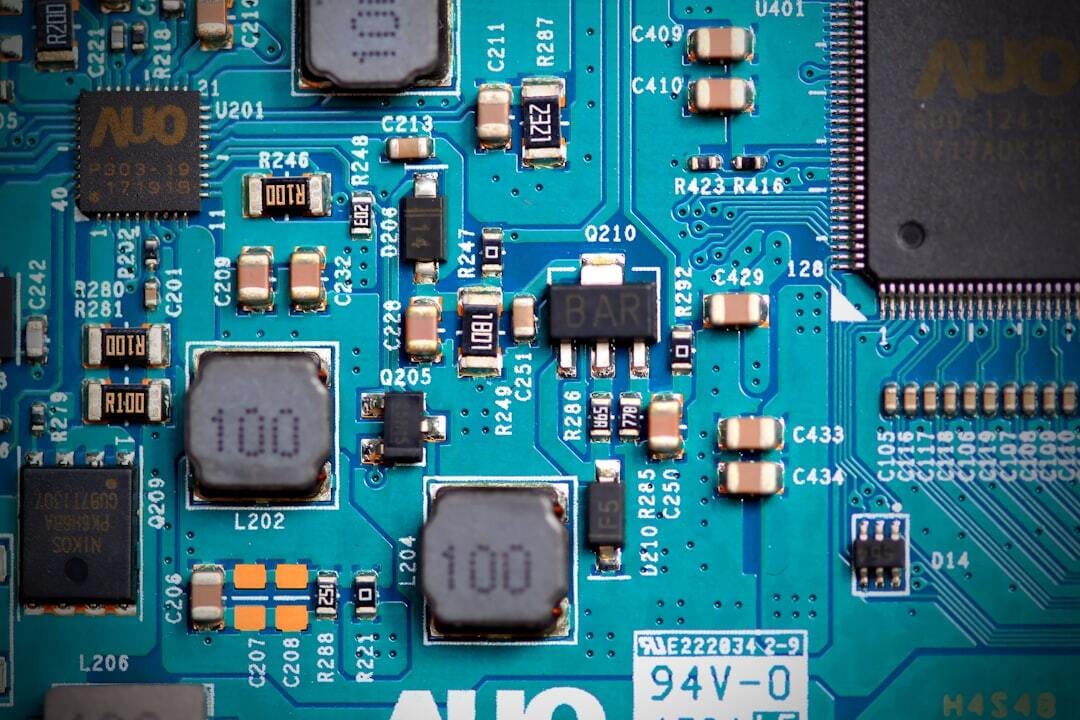

NXP's Communications Unit

Despite posting good financial earnings results on Monday, NXP Semiconductors $NXPI ( ▼ 4.51% ) fell 5.02% in after-hours trading.

Financials: NXP reported earnings of $3.35 per share in the past quarter and revenue of $3.34 billion. Both were better than expected.

Final Thoughts: Investors were not pleased with the 18% decline in revenue in NXP’s small communications infrastructure business. However, the company anticipates overall revenue growth in the current quarter.

Teradyne’s Strong Results

Teradyne $TER ( ▲ 13.35% ), which is an automatic test equipment designer and manufacturer, skyrocketed 19.23% in after-hours trading on Monday after posting strong financial earnings results.

Financials: Teradyne reported earnings of $1.80 per share in the past quarter and revenue of $1.08 billion. Both were better than expected.

Final Thoughts: The stock was already up 124% in the past year.

Trends to Watch

Before the IPO: Elon Musk Merges SpaceX With His A.I. Start-Up xAI (New York Times)

Final Innings: Crypto bear market is nearing end, with $60K as key bitcoin floor, Compass Point analysts say (CoinDesk)

AI Tensions: OpenAI is unsatisfied with some Nvidia chips and looking for alternatives, sources say (Reuters)

Rare Earth Minerals: Trump to Launch $12 Billion Critical Mineral Stockpile to Blunt Reliance on China (Bloomberg)

Optimism: 4 reasons why $75K may have been Bitcoin’s 2026 price bottom (Cointelegraph)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Pick winning stocks: Upgrade to Early Bird Prime.

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show Your Support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations, and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.