Early Bird Prime for February 1, 2026

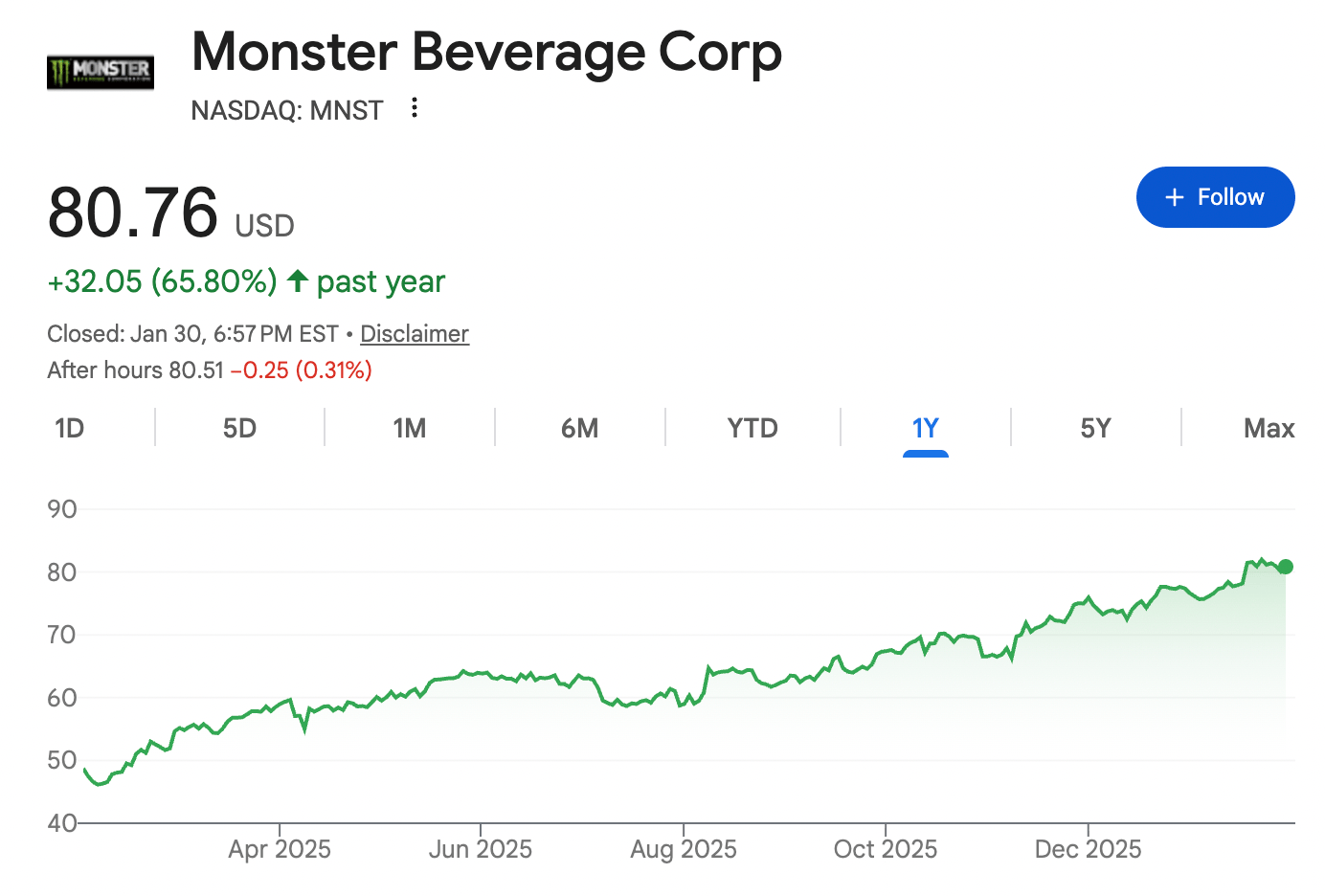

If you’ve been avoiding the caffeine aisle, you might have missed the fact that Monster Beverage's $MNST ( ▼ 0.7% ) stock has been on a tear, up 65.80% in the past year. It also recently hit an all-time high.

The company’s secret sauce? Robust revenue growth fueled by international expansion and some savvy pricing strategies.

Just a few days ago, a Morgan Stanley analyst raised the firm’s price target for Monster Beverage to $96, while reiterating its overweight rating. Apparently, the analyst has been sipping on some industry data that suggests the trends are looking good.

Now, let’s address the elephant in the room: Can Monster’s stock really keep up this growing momentum? With Monster’s stock at a premium, there’s less margin of safety if either category growth or company execution slips.

Speaking of premiums, you’d be paying a pretty penny just to buy the stock now. With Monster’s stock, you’re paying for the privilege of owning a piece of a high-flying company. But remember, what goes up must come down.

Monster is facing ongoing lawsuits and public scrutiny over alleged health risks from long-term energy drink consumption. Some complaints even liken the risk profile to cigarettes, alleging a failure to warn consumers.

Should you buy Monster’s stock right now in 2026 or avoid it? Here’s the answer…

Subscribe to Early Bird Prime to read the rest.

Become a paying subscriber of Early Bird Prime to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Expert analysis on the best stocks.

- Stock price predictions based on machine learning.

- Investing picks and recommendations.

- Advertisement-free.