Today is Thursday, November 14, 2024.

The Early Bird Index today is 80.94.

New to this newsletter? Sign up here

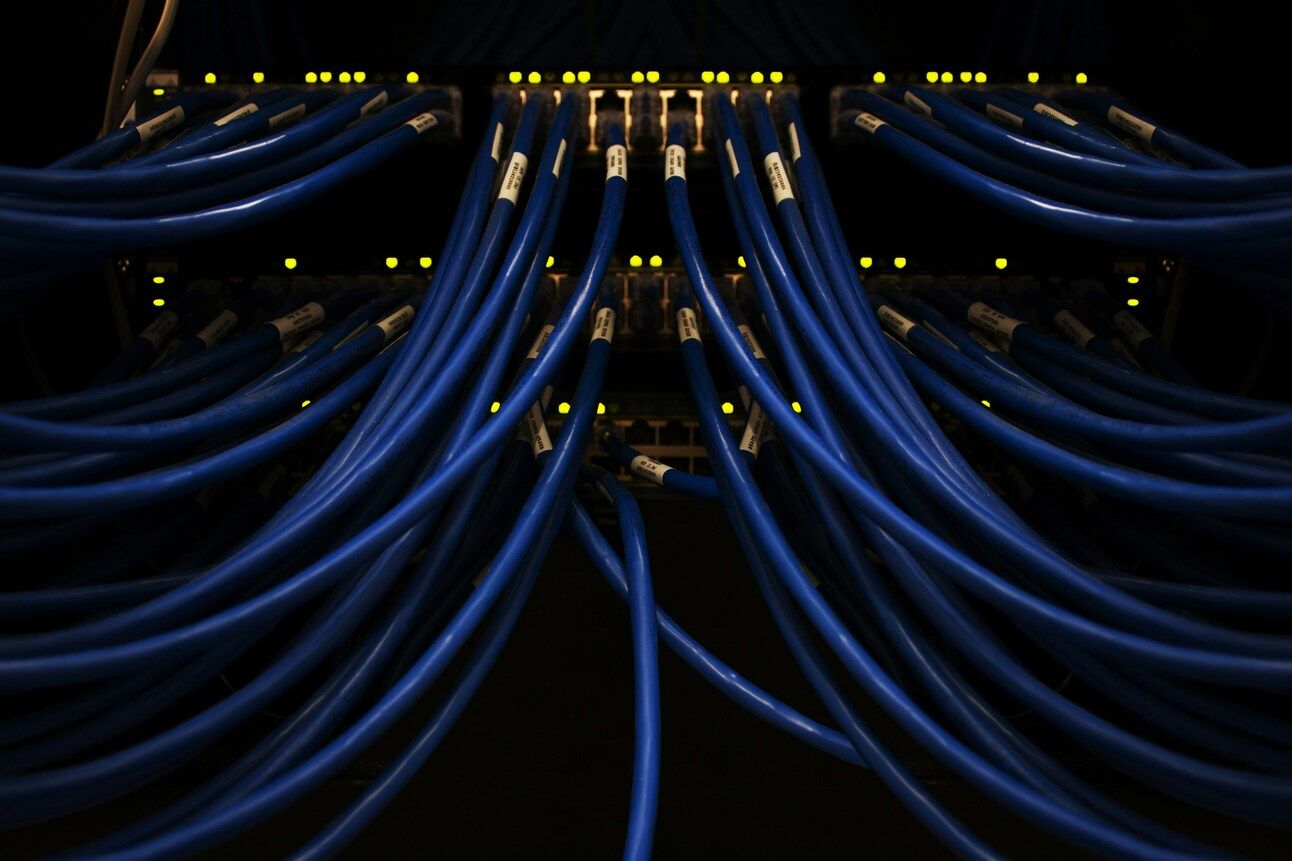

Cisco's Revenue Drops (Again) 📉

It didn’t matter that Cisco Systems (Nasdaq: CSCO) posted better-than-expected financial earnings results on Wednesday because the stock still decreased 2.92% in after-hours trading.

Financials: Cisco reported earnings of 91 cents per share in the past quarter and revenue of $13.8 billion; both were better than expected.

Powering the Story: Revenue also decreased 6% year-over-year, marking the fourth straight quarter of revenue declines.

Early Bird’s Nest Egg Gains: Sales for Cisco's traditional networking business have been declining sharply due to increased cloud migrations, which reduces the demand for on-premises networking hardware. Cisco is actively transitioning towards a recurring revenue model, but that change will take time.

Final Thoughts: It’s a transition period for Cisco with the stock up 17% in 2024 but lagging behind other technology companies.

Invest with the art investment platform with 23 profitable exits.

How has the art investing platform Masterworks been able to realize an individual profit for investors with each of its 23 exits to date?

Here’s an example: an exited Banksy was offered to investors at $1.039 million and internally appraised at the same value after acquisition. As Banksy’s market took off, Masterworks received an offer of $1.5 million from a private collector, resulting in 32% net annualized return for investors in the offering.

Every artwork performs differently — but with 3 illustrative sales (that were held for 1+ year), Masterworks investors realized net annualized returns of 17.6%, 17.8%, and 21.5%.

Masterworks takes care of the heavy lifting: from buying the paintings, to storing them, to selling them for you (no art experience required).

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Notables

Notable Earnings Today: Walt Disney (NYSE: DIS), Applied Materials (Nasdaq: AMAT), Advance Auto Parts (NYSE: AAP), Sally Beauty (NYSE: SBH), JD.com (Nasdaq: JD), AST SpaceMobile (Nasdaq: ASTS), Intuitive Machines (Nasdaq: LUNR), Talen Energy (Nasdaq: TLN), NICE (Nasdaq: NICE), Post (NYSE: POST), Globant (NYSE: GLOB), Bilibili (Nasdaq: BILI), NetEase (Nasdaq: NTES), ESCO Technologies (NYSE: ESE), Inovio Pharmaceuticals (Nasdaq: INO), iPower (Nasdaq: IPW), IZEA Worldwide (Nasdaq: IZEA), Nomad Foods (NYSE: NOMD), Ocular Therapeutics (Nasdaq: OCUL), Origin Materials (Nasdaq: ORGN), Sow Good (Nasdaq: SOWG), ZEEKR Intelligent Technology Holding (NYSE: ZK).

Notable IPOs Today: TSS, Inc. Common Stock (Nasdaq: TSSI), Medicus Pharma Ltd. Common Stock (Nasdaq: MDCX).

Notable Equity Crowdfunding Campaigns Ending Today: N/A.

Notable Economic Events Today: Jobless Claims (8:30 a.m. ET), Core PPI / PPI (8:30 a.m. ET), Crude Oil Inventories (11:00 a.m. ET), Federal Reserve Chair Jerome Powell Speaks (3:00 p.m. ET), Fed's Balance Sheet (4:30 p.m. ET).

Super Micro Delays Filing

Super Micro Computer (Nasdaq: SMCI) fell 6.25% in after-hours trading on Wednesday after disclosing that it won’t file its financial report because it needs more time to find a new auditor.

Background: It’s been an awful year for Super Micro. The tech company has faced accounting accusations. Also, its previous auditor resigned.

Final Thoughts: The stock is down 57% in the last 30 days. It could get delisted from the market.

Shiba Inu Recovers After Market Correction

The price of the cryptocurrency Shiba Inu fell 6% at one point on Wednesday before recovering and ending the day with a 3% increase.

Price: Over the past 30 days, Shiba Inu is up over 30%.

Powering the Story: Shiba Inu, a so-called meme coin, experienced a price correction. Given the recent price surge, some investors may be taking profits, leading to increased selling pressure.

Final Thoughts: Overall, most major crypto prices turned positive on Wednesday.

Trends to Watch

The Rally Continues: Amazon Stock Hits New High As Tech Giant Launches Temu Competitor (Investor’s Business Daily)

Chip Comeback: Nvidia earnings are a test for chip stocks as software has stolen the limelight (MarketWatch)

Potential Staking Opportunity: How a new SEC chair can boost Ether price and ETF inflows (Cointelegraph)

Not Lovin’ It: E. coli cases climb to 104 in McDonald’s outbreak tied to slivered onions (Associated Press)

Fed Agenda: Inflation Stays Firm, but Not Enough to Derail December Fed Cut (Wall Street Journal)

Thank you for reading!

Forward to a friend and tell them to sign up here.

Pick winning stocks: Upgrade to Early Bird Prime

Be social: Like our Facebook page and follow us on Twitter.

Want more investing tips? Listen to the podcast.

Show your support: Buy Me a Coffee.

Questions or comments? Hit reply to reach out.

The contents of Early Bird are intended for informational and entertainment purposes only. They do not constitute trade or investment recommendations and they are not financial or legal advice. Readers are encouraged to consult licensed professionals for personalized guidance regarding their financial or legal situations.